Time to act for the future of ASEAN

|

| PwC Vietnam's general director shared her expert views with the audience at the Vietnam, Business Summit 2018 |

Growth in ASEAN

|

| David Wijeratne |

Last year marked the 50th anniversary of the Association of Southeast Asian Nations (ASEAN), a unique achievement considering the regional conflicts and poverty which characterised the region in the first half of the 20th century.

The ASEAN’s remarkable growth journey to become the world’s sixth-largest economy has been powered by its people, with the establishment of a formidable labour force and the subsequent creation of a wealthier middle class which has driven domestic consumption.

Challenges to ASEAN’s growth

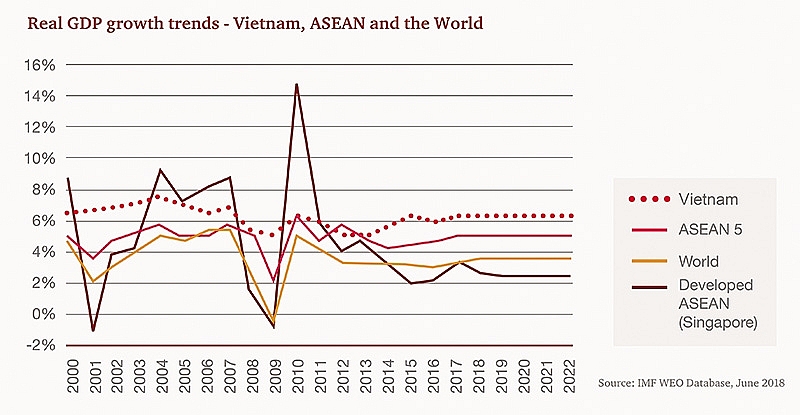

However, against this backdrop, questions have been raised about the sustainability of the ASEAN growth story. Global economic growth has slowed in recent years and this has impacted all markets across the ASEAN. GDP growth in Singapore (or the developed ASEAN) dropped below the global average to 2.0 per cent in 2016 and in the emerging part of the ASEAN (Indonesia, Malaysia, Philippines, Thailand, and Vietnam), growth fell to 4.9 per cent, after a 6.9-per-cent high in 2010. The Fourth Industrial Revolution also threatens employment and disposable incomes in the short term at least, if its adoption is not managed responsibly by both governments and companies. This challenge will be felt throughout the region and countries such as Thailand are acting on it in earnest. Furthermore, an over-dependence on external trade partners, stagnating productivity growth, an ageing population, and a lack of infrastructure are also significant challenges to the ASEAN’s future prosperity.

Time to Act

From a regional perspective, in order to offset the risk emanating from the rising dependence on external partners, intra-ASEAN trade needs to be enhanced by strengthening regional co-operation, especially by reducing non-tariff trade barriers which reached a high of 5,975 in 2015. A reduction in Technical Barriers to Trade measures would need to be prioritised in order to improve the extent of intra-regional co-operation within the ASEAN going forward, especially norms related to the discriminatory treatment of certain products, discrepancies in standards across markets, and the lack of transparency in assessment procedures.

Whilst regional co-operation is important to the ASEAN’s continued growth, each individual country has its challenges. In this context, we see five categories of markets emerging across the ASEAN based on their current economic position and pace of demographic transition.

The first category is the ageing high-income markets of Singapore and Brunei Darussalam, where the growing fiscal burden of an ageing population is accompanied by a reduction in working-age population.

ICT adoption and skill development, especially within small and medium-sized enterprises (SMEs), will be central to improving productivity.

Our second category is the ageing middle-income markets of Malaysia and Thailand. Here, enabling structural shifts towards higher value-added activities in production will be key to remaining competitive amidst a rapidly disappearing labour cost advantage.

Vietnam stands on its own as an ageing low-income market, facing higher socio-economic growth pressures associated with population ageing at lower income levels.

Policy interventions, such as addressing talent gaps through inward migration, and long-term reforms targeted at improving labour force participation of women and older age groups, will be key to reducing the impact of ageing across the countries in the three ageing categories. Healthcare infrastructure and skill development will also need to be strengthened, coupled with investments in physical and digital connectivity infrastructure.

Indonesia and the Philippines make up the younger mid-income markets category, and are at an ‘early-dividend’ stage, as they are projected to record among the largest additions in working-age population in the ASEAN in the coming years. Sustainable long-term growth will depend on their capacity to exploit the demographic dividend to their advantage – by focusing not only on the quantity, but also on the quality of jobs being created, fostering entrepreneurship, and adopting new digital solutions. Our final category is the younger low-income markets of Cambodia, Laos, and Myanmar, with the youngest populations in the region and a workforce which is expected to grow by 14 million by 2050. Job creation needs to take priority and reforms to foreign direct investment levels will be key to realising this objective. Digital adoption will help deliver access to basic services such as healthcare, education, and financial services that will improve social well-being and strengthen the human capital needed for growth.

|

Finding new strategies

The ASEAN Secretariat and individual governments will need the support of the business community to drive the region’s growth. Just as governments will need new reform agendas, companies will also need to adopt more innovative strategies to promote and achieve growth. In our ‘The Future of ASEAN’ report, we identify new strategies for growth across seven sectors.

There are a number of common themes to these new strategies, such as localised production and the development of regional hubs to serve ASEAN consumers, as well as the adoption of digital capabilities to produce and transport goods, and serve and communicate with consumers. Partnerships and alliances together with vertical integration will also play a more significant role, particularly cross-sector and with industry disruptors, as companies try to stay relevant and competitive, and meet consumer expectations in a profitable manner.

Automakers looking to establish a bigger foothold in the region can look to increase localisation more holistically – in sourcing, manufacturing, sales, and research and development. This will offer greater competitiveness, more localised products, and differentiation. Hurdles, such as a lack of scale due to lower demand, can be addressed by entering a region in partnership and through sharing manufacturing platforms.

In financial services, key challenges include limited financial access, a largely cash-based society, and the low usage of value-added services. Banks can look to bridge these gaps by building capabilities in digital financial services, specifically in digital on-boarding driving financial inclusion, introducing QR scanning capabilities to reduce merchant infrastructure gaps, developing automated financial advice applications to expand wealth management towards the emerging middle class, and in developing alternative lending platforms to bridge SME credit gaps.

Consumer goods companies have a significant opportunity to grow across the ASEAN by leveraging digital capabilities to connect directly with consumers to inform and influence purchasing habits, to employ greater efficiencies across their supply chains, and to collaborate with e-commerce and e-payment players. This involves a holistic review of their operating model, not just from a marketing and sales channel perspective.

Medical device companies have an important role in the ASEAN to improve the access, affordability, and quality of healthcare within the region. Instead of using a “hand-me-down” approach, companies should look to build customised and affordable devices for the market. They should get closer to the customer to understand patient needs, have a more local presence, and encourage local innovation. In this regard, medical device companies should look to work with both the public and private sector to provide care through alternative models in lower-cost settings, such as home care, and further embrace technology, such as mobility, Big Data, and artificial intelligence, in their current product portfolio.

The refining sector remains underdeveloped in most markets in the ASEAN, and limited production capacity and utilisation challenges are pushing the need for additional investments for new construction and plant upgrades. Integration of refining units with petrochemical plants is a key strategy that promises significant revenue and cost upside in the ASEAN region.

ASEAN telecommunications companies must pick the growth opportunities where they have a competitive edge and focus their strategy on these. In the consumer segment, telecom companies can monetise the flood of data running through their networks by developing advertising platforms, whereas in the enterprise segment, they have the opportunity to address the gap in the IT-as-a-Service market and build Internet of Things capabilities, which can support an ecosystem of cross-sector businesses to enhance their connectivity to the 630 million consumers across the ASEAN.

And finally, with regards to transportation, airlines and ocean liners operate in vastly different industries, but both face stronger global competition and pressure on pricing, which makes it difficult to capture rising opportunities in the ASEAN. Collaboration across adjacent sectors can play a part in addressing rising competition and operational complexities. By collaborating with railways to extend additional spokes in the network of services, airlines will be able to maintain a share in the growing short- to mid-haul routes, better serve the region despite its air restrictions, and at the same time better utilise their aircraft for more profitable routes. Meanwhile, a collaboration between ocean liners and terminals helps to consolidate their influence and capture opportunities in major economic centres, secure shipping demand and terminal availability with dedicated berths or prioritised ports of call, and streamline land-side efficiency. Analytics are also anticipated to be a critical enabler in transportation, not only in addressing the pressures on pricing, but also in improving operational efficiency.

The ASEAN can be proud of what it has achieved in the past 50 years, but the time of passive growth is over. Global trade and consumer markets are evolving, and the ASEAN and its individual nations need to acknowledge this and proactively develop business environments which are conducive to local production, intra-ASEAN trade, and serving local consumers. This will take time, and so companies looking to grow across the region need to be equally proactive and innovative in developing and executing strategies which will fulfil the potential of the region.

By David Wijeratne ,Growth Markets Centre leader, PwC

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version