The retail market needs to box clever

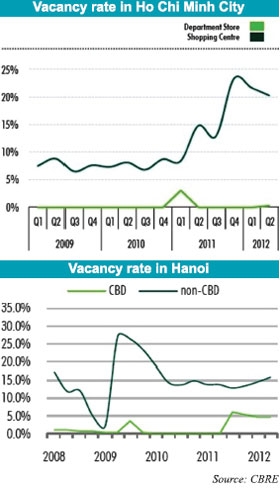

With oversupply dangers and the current gloomy economy, shopping centre developers in Hanoi and Ho Chi Minh City are seeing occupancy and rentals in their developments fall. However, the nightmare has just started, what should they do?

By the end of last year, general retail rentals in Hanoi and Ho Chi Minh City started declining, but some developers failed to see the walls were closing in.

Developers of some new projects such Picomall in Hanoi’s Dong Da district, Savico MegaMall in Hanoi’s Long Bien district, Crescent Mall in Ho Chi Minh City’s District 7 still had confidence to launch their projects.

They believed that the rental decreases would only occur in a short-term and with the prime locations, their properties would be magnets to attract not only tenants, but also shoppers. Before the official launch by the end of last year, the developments had high occupancy rates ranging from 60-80 per cent. However, to date, the rates did not raise more and the developers are struggling to keep their tenants.

In Hanoi, after nearly a year since the opening ceremony, Picomall still has a high vacancy rate and some tenants planned to move out as their business there were not in favourable conditions.

In Ho Chi Minh City, Vincom Center, which launched last April and The Vista have decreased asking rentals to attract more tenants. Crescent Mall is offering a lot of promotion packages while Pico Cong Hoa, which was initially planned to be launched in the second quarter, has delayed its opening ceremony.

According to a CBRE report, the retail market faced challenges. While there were no new shopping centres or department stores, more tenants and brands were closed than opened, and new stores opened were smaller in sizes. The number of new mid-sized shops had seen a drop, and could not be offset by a larger number of small shop openings.

According to a CBRE report, the retail market faced challenges. While there were no new shopping centres or department stores, more tenants and brands were closed than opened, and new stores opened were smaller in sizes. The number of new mid-sized shops had seen a drop, and could not be offset by a larger number of small shop openings.

In terms of shop categories, the report said that textiles, shoes, and electronics seemed to reduce the number of stores and store sizes as consumers lowered budget for these categories most significantly. Categories such as food and beverage and entertainment, on the other hand, seemed to fare relatively well and acted as traffic drivers to shopping centres. However, having these features in-house doesn’t necessarily encourage consumers to spend more.

Property consultants Savills, DTZ and Colliers said that apart from experienced retail developments in the central business districts such Vincom Centre in Hanoi, Diamond Plaza in Ho Chi Minh City, the rents in most of other shopping centres in CBD saw declines of 6-12 per cent year on year.

In non-CBD areas, Hanoi and Ho Chi Minh City retail markets saw a sharp drop in rents of shopping centres, while rents of department stores keep their stability.

At this time, according to Collier’s latest report, in Ho Chi Minh City the average rents for shopping centres, retail podiums and department stores are recorded at $64 per square metre per month while retail spaces in prime locations still command rents over $100 per square metre per month.

In Hanoi, Colliers pointed out that the average rent of shopping centres decreased $1.75 per square metre against the first quarter of 2012 to $68.21 per square metre per month. A downward trend in the average asking rent occurred in either inner districts, the East or the West of Hanoi.

Some new department stores in the West had reduced asking rents, contributing to a 4.24 per cent reduction in average rent of development store, down to $65.83 per square metre per month.

However, there are still no recovery signs. Local residents are continuing to keep their tightening monetary policies due to the challenging general economy and Vietnam has dropped out of the top 30 in the Global Real Estate Development Index produced by A.T.Kearney.

Tran Nhu Trung, deputy director of Savills Hanoi, said that retail developments in Ho Chi Minh City’s Districts 2 and 7 will face a fiercer competition than other areas as nearly 64 per cent of around 1.3 million square metres of new retail space, which started to be poured into market since 2012, would be located there.

Trung forecasted that there would be about 1.9 million square metres from 101 new retail projects put into operation in Hanoi in the next four years. Retail developers in western Hanoi should try their best from this time to find a green light for their projects.

Accepting the bad mood of the market and finding the way to adapt with the changes are the most important works of all retail developers.

Situated on Hanoi’s Tran Duy Hung street, the Grand Plaza was forced to be closed last year after nearly a year of operation, but it has just opened again with a new special strategy, with free rent in two months for every retailer, who would like to locate at the plaza and offers their customers at least 30 per cent of discount. Since the third month of sales, the retailers there have to pay 6 per cent of their turnover for management fees of the plaza and if these retailers want to set up their stores at the plaza for a long time, they can enjoy six months of free rent and other special promotions from the developer.

The strategy is considered controversial and has never happened in Vietnam’s retail market.

Hoang Duc Anh, CEO of the Grand Plaza, said desperate times call for desperate measures.

“With decreased or free rents, retailers can decrease their products’ prices. Customers will come with them and they will come with us,” said Anh.

Located in Ho Chi Minh City’s District 7, Crescent Mall understood that far from the centre of the city was its weakness. Therefore, besides offering customers promotion packages as a series of other shopping malls such Vincom Centre, Zen Plaza, Diamond Plaza or Parkson Paragon, it offered free buses from city centre to the shopping mall.

Bitexco Group is redesigning retail space in Bitexco Financial Tower for its opening this November.

Nishitohge Yasuo, general director of the Aeon Vietnam - which has just been licensed for Celadon Shopping Centre in Ho Chi Minh City’s Tan Phu district and Binh Duong Canary in Binh Duong province, said: “We did a deep study on Vietnam’s retail market so we know that the country currently has many retail developments but most of them focus on high-income people and can’t meet the demand for entertainment of local residents. Hence, Aeon Vietnam’s shopping centres will take advantages of Aeon International retail system and add more entertainment area to meet demand of mid to high-income earners.”

Dang Van Quang, director of Navigat realty consultant company said that the market still is potential so retail developers still gain success if they carefully study what are their own strengths and weaknesses of their projects, choose a suitable direction for long-term developments but not try to take unsustainable short-term benefits.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Mobile Version

Mobile Version