Techcombank celebrates 30-year anniversary

Congratulations on Techcombank's important 30-year milestone. Looking back, how would you characterise the bank's present standing compared to its initial inception?

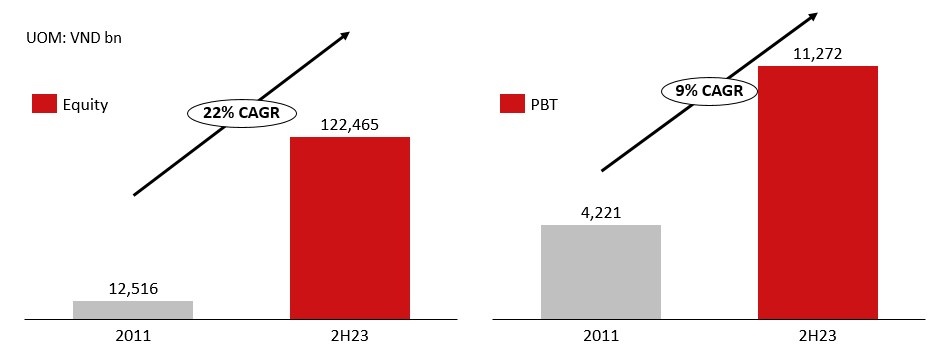

Techcombank was founded with capital of VND20 billion ($850,000), a small operation, but with a forceful entrepreneurial spirit. Through the years, the bank has grown to around $5.3 billion in capital - one of the highest capitalised banks in the country.

What has remained consistent from the very beginning is Techcombank’s spirit and culture. As Vietnam’s economy grew and became more dynamic, Techcombank was a pioneer spearheading its development.

The founding fathers of the bank came from engineering backgrounds and were not traditional bankers. Therefore, as an institution, Techcombank has consistently adopted technology as an enabler and has always done things a bit differently compared to other banks. Looking back, while we are now very different from when we started - much bigger, much stronger, and definitely much more profitable - some of the core elements of technology and entrepreneurship have remained.

|

What have been some of the most significant challenges the bank has encountered on its 30-year journey?

Around 2011 and 2013, the whole industry faced a stern challenge. Techcombank was probably the first to come out of that crisis, having cleaned up our credit book and having a healthy amount of capital. It was a very formative experience, and we now have strong risk management capabilities and are well-capitalised as a result.

We are not the largest private sector bank in the country, and therefore, we need to be a bit more daring and break the mould regularly. If you worked with us, you would see that we are never content, persistently meeting the changing needs of our customers. It's part of our DNA and one of our biggest strengths.

As you approach your fourth year at Techcombank, what do you regard as your most notable achievements?

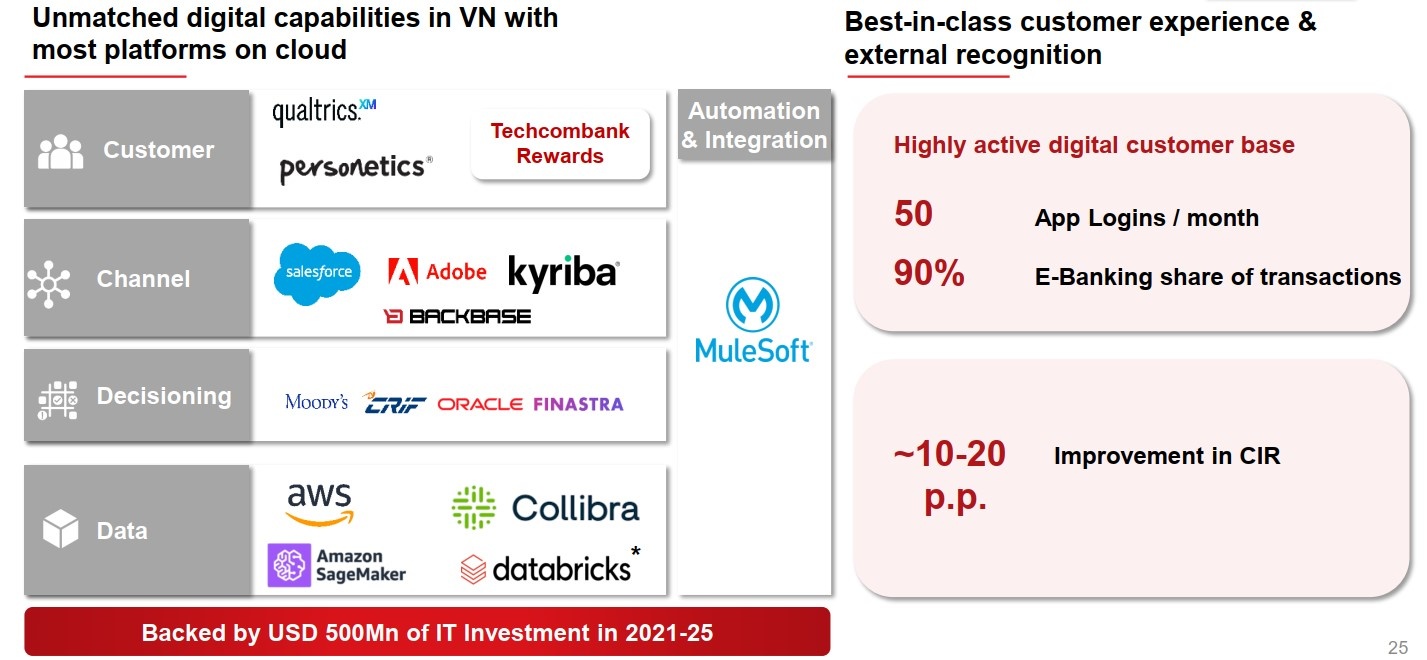

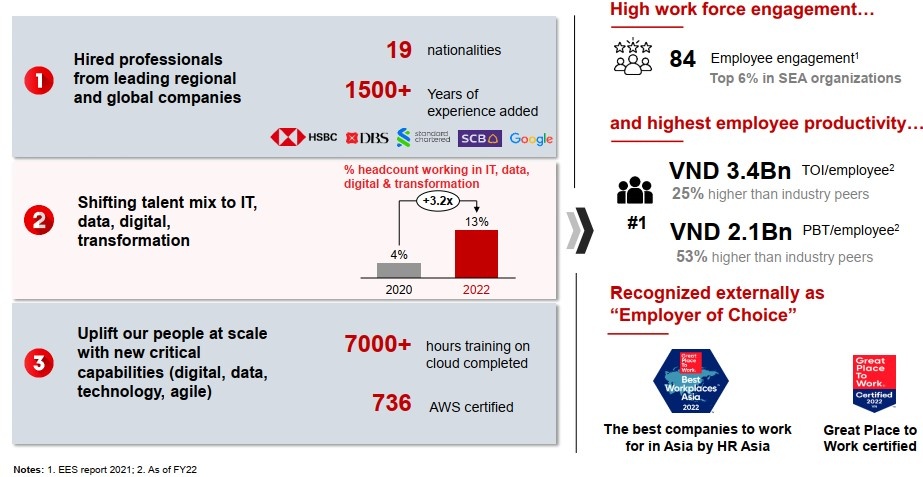

I would say one of the achievements which we accelerated over the last three years is our digital transformation. Numerous investments were made to transform the bank and its capabilities. At the same time, our customer growth has accelerated. Our aspiration is not just to be one of the largest private banks, but to shape the transformation of the Vietnamese banking industry and also to be one of the top banks in the region. To achieve this, we needed a different technology platform and to transform into an even more digitally enabled bank, with a focus on talent, data, and technology.

|

Would you mind telling us about the distinctive architecture and design of Techcombank's new office buildings in Hanoi and Ho Chi Minh City?

While the buildings are beautiful from the outside, we put great effort into the interior. For many people, work is not just about money, but also the environment they work in. We gave this job to Fosters and Partners - one of the world's most renowned architectural firms who built the Apple headquarters in California, and the spectacular buildings you see now are the result.

|

Our headquarters in Hanoi were designed with a fusion between the old and the new, with some elements inspired by the Old Quarter. We put a lot of thought into the architectural design, and it carries the message we want to convey. It's important for us to be, on the one hand, a Vietnamese bank that has inherited Vietnamese cultural values, but on the other hand, breaking through and doing something new and innovative.

These buildings were very much about customer centricity, innovation, and collaboration, with all the working spaces built to accommodate agile ways of working. And while these buildings feature a great deal of digital enablement and digital tools, they are also built with a focus on sustainability and energy efficiency.

|

As outlined in the 2023 AGM, Techcombank is focussing on its retail segment while seeking to lessen dependence on corporate clients. Has there been any change from this strategy?

We have been clear about our intentions to do more retail and lending to small- and medium-sized enterprises (SMEs), however, as we operate a needs-based model and a customer-centricity approach, this may not hold up during certain periods.

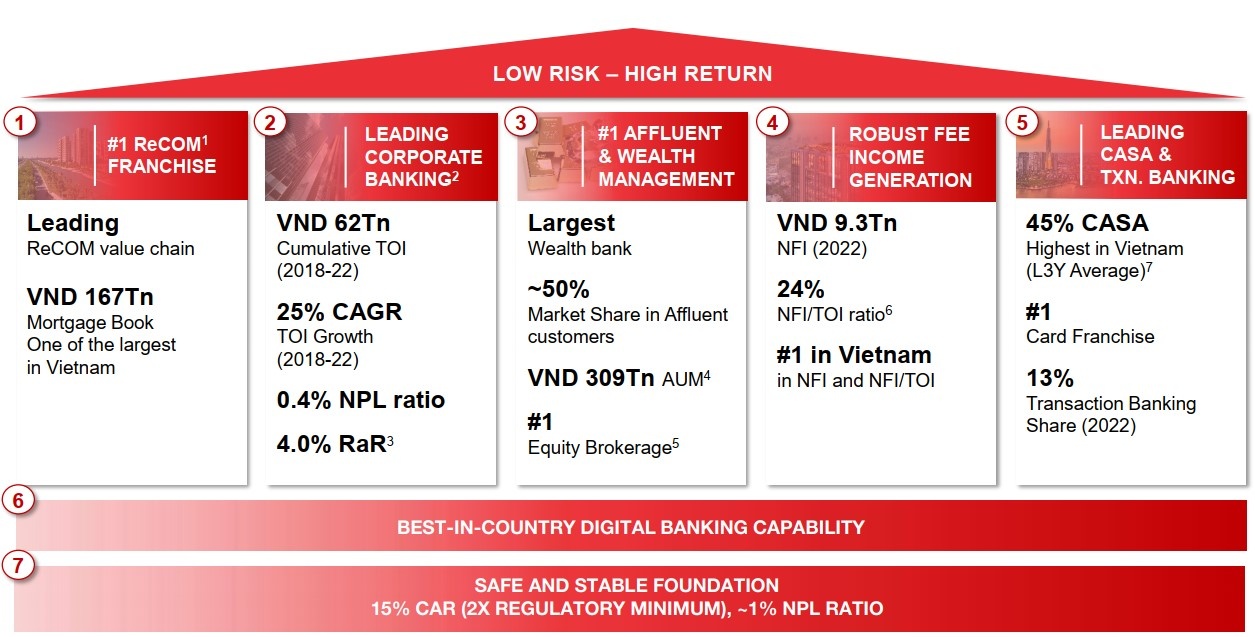

| After a decade of delivering strong results, Techcombank has grown to become the number one private sector bank in Vietnam with a strong retail banking focus and best-in-market digital banking capabilities. |

In this environment, the big companies and corporates are usually the ones who fare better because they have much more diversified cash flow streams. So, as we were looking at where the needs are and where the risk-adjusted returns were better, it was on the corporate side.

When you examine our financial data, you'll notice that some figures, particularly on the corporate side, represent short-term working capital financing. This flexibility allows us to transition relatively quickly to other segments and sectors. Our primary focus is still on retail. However, in the current circumstances, we might continue to emphasise corporate lending because it appears to be less risky. Nevertheless, as the market evolves, we will gradually shift our focus back to retail and SMEs. This is rather a timing issue than a strategy issue.

The Techcombank chairman recently hinted that the bank may end its ten-year practice of not distributing cash dividends. Is there a possibility of a gift for shareholders in celebration of the bank's 30th anniversary?

When we issued the policy 10 years ago, we were in a very different position. After a decade of delivering strong results, Techcombank has grown to become the number one private sector bank in Vietnam with a strong retail banking focus and best-in-market digital banking capabilities. Today, the bank generates over VND20 trillion ($844 million) profits annually, the highest among Vietnam's private sector banks.

Now, as we look at the bank’s earnings potential and the changes in upcoming regulations, we believe that we can maintain that trajectory of 20 per cent earnings growth and 15 per cent capital adequacy ratio while still paying regular cash dividends to reward the bank’s shareholders.

As we are analysing whether we can maintain such a policy for the following five to 10 years, it's important to note that we make our decision from a capital management perspective and not just do this as a birthday gift.

When the board decides if there will be a change in our dividend policy, I am sure they will make the proper announcements. But from the current analysis, it seems that we clearly have options.

|

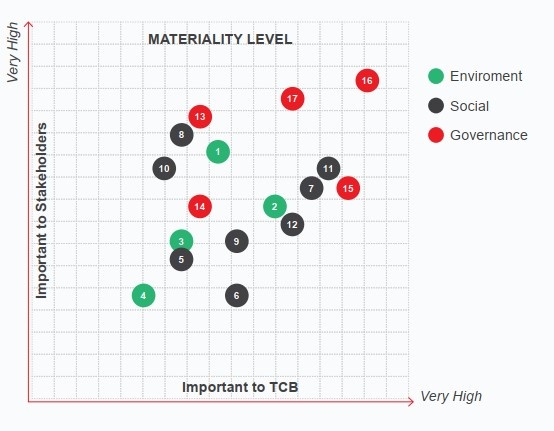

Could you elaborate on Techcombank's sustainability and responsible banking strategy?

When it comes to sustainability, many people interpret it only as green financing or carbon neutrality. While these are all important elements, for me, creating a sustainable business means building it on a solid foundation and making sure it can last through the natural boom-bust cycles of the economy. That principle has always run deep in our core.

On the business side, we try to help our customers gain clarity on what and how they can build their own sustainable companies. With the help of organisations like USAID and the Asian Development Bank, we work to provide financing solutions and are committed to provide around $5 billion in financing for sustainable projects. Techcombank has built in-house capabilities to channel green financing to our customers, but there's still more work to be done.

We should not think about sustainability as a 'feel-good' exercise. Rather, it needs to be rooted in good economic sense, and increasingly, people are starting to understand and internalise that concept.

|

| Key enterprises plug circular economy shift Company leaders have highlighted the need for a balanced approach of incentives and penalties as Vietnam’s business community explores a circular economy model. |

| Shinhan Bank Vietnam celebrates 30 years in Vietnam South Korean financial conglomerate Shinhan Bank has marked 30 years of presence in Vietnam and is proud to be a “trusted financial partner” to millions of Vietnamese customers. |

| Vietnam promotes shift to green production lines Investment in green factories is one of the first steps on the road to greening production lines, according to Douglas Lee Snyder, executive director of the Vietnam Green Building Council (VGBC). |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version