Gov’t gives green light for new corporate income tax proposal

July 25, 2019 | 16:19

The Government has turned green light to the Ministry of Finance’s latest proposal on preferential corporate income tax rates for small and micro enterprises (SMEs).

Foreigners earning incomes from providing services in Vietnam, what are their tax liabilities?

February 20, 2019 | 08:19

With the increasing trends in economic integration, it is normal that overseas organisations and foreigners generate income from doing business in another country rather than their home countries. In Vietnam, if a foreign organisation earns income in Vietnam through providing services, or selling goods together with services, or trading, its income will be subject to Vietnamese Withholding Foreign Contractor Tax (“FCT”). How about tax liabilities of a foreigner earning income through providing services in Vietnam?

Optimising benefits from tax incentives

December 20, 2018 | 08:00

Corporate income tax incentive is a big concern for most investors when doing business in Vietnam, and there are many pitfalls ahead.

NFSC proposes lowering corporate income tax on SMEs

October 16, 2018 | 10:04

Corporate income tax levied on small and medium – sized enterprises (SMEs) should be reduced to promote the business development, a solution together with broadening tax base to increase budget revenue from business and production.

Having a permanent establishment in Vietnam could cost a pretty penny

September 21, 2018 | 08:00

While more and more companies have cross-border activities, not all of them understand domestic tax regulations in the host countries or in tax treaties.

Investors happy about new cut in corporate income tax

April 09, 2018 | 23:12

The stock market has shown positive reactions to the disclosure of the government’s intention to slash the corporate income tax (CIT) from 20-22 percent to 15-17 percent.

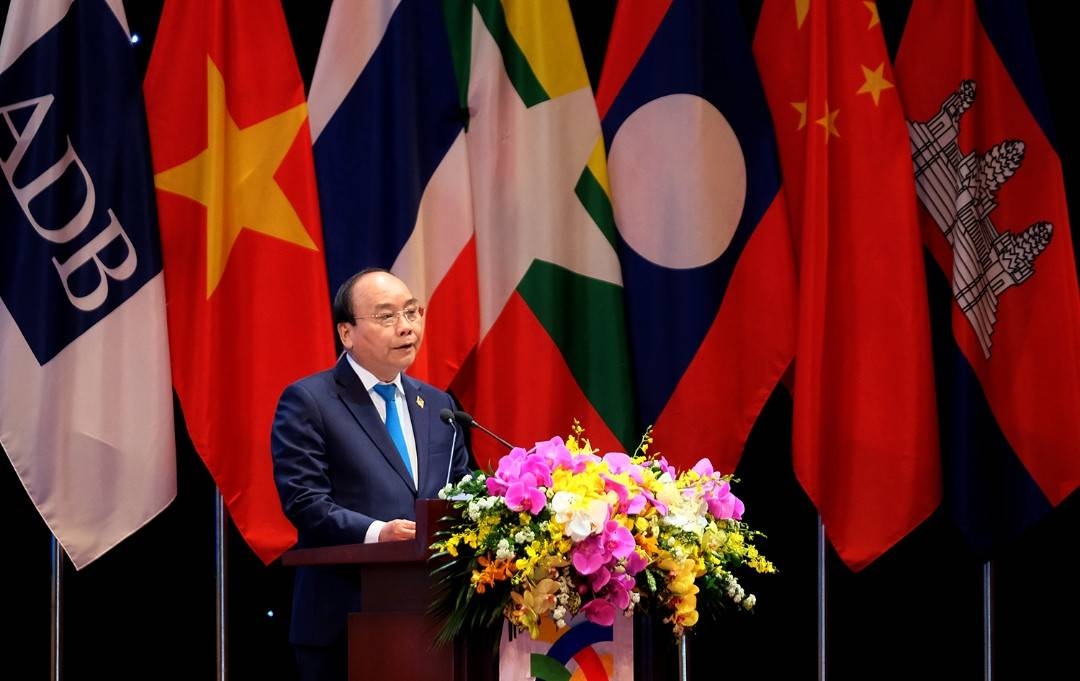

PM promises 5-7 per cent corporate income tax cuts at GMS Summit

April 03, 2018 | 13:45

Vietnam has been steadily implementing initiatives and commitments to facilitate business activities towards inclusive and sustainable development.

New CIT law aims to halt tax evasion

January 24, 2018 | 13:34

In the latest draft of Law on Corporate Income Tax (CIT), the Ministry of Finance has raised a regulation aimed at preventing multinational companies with related-party transactions from evading taxes.

1 2

Mobile Version

Mobile Version