Stress test – Necessary exercise to prepare for COVID-19 impacts

|

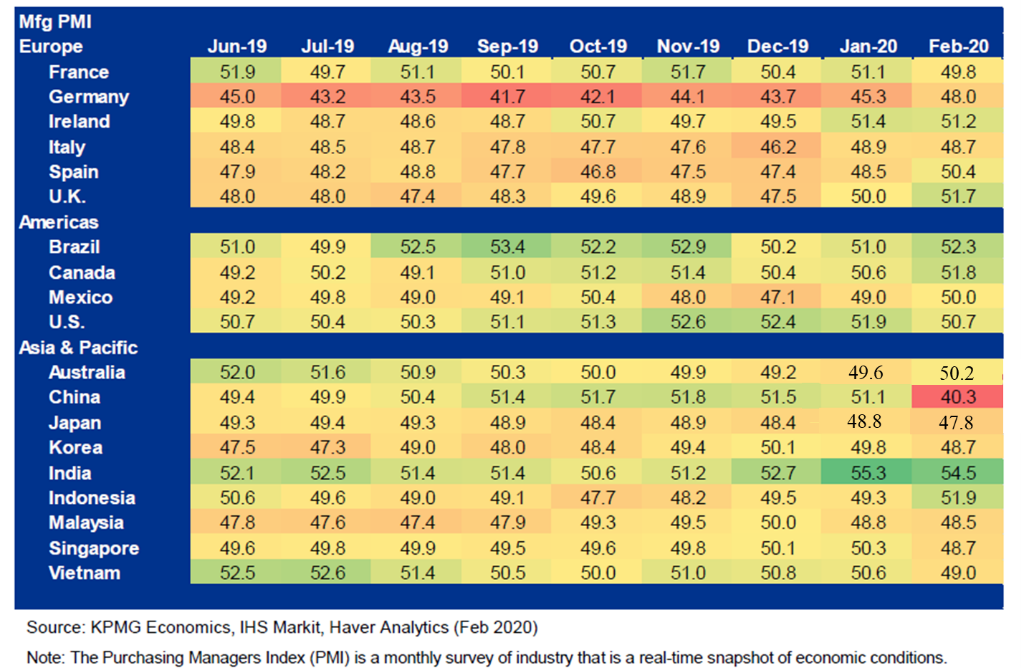

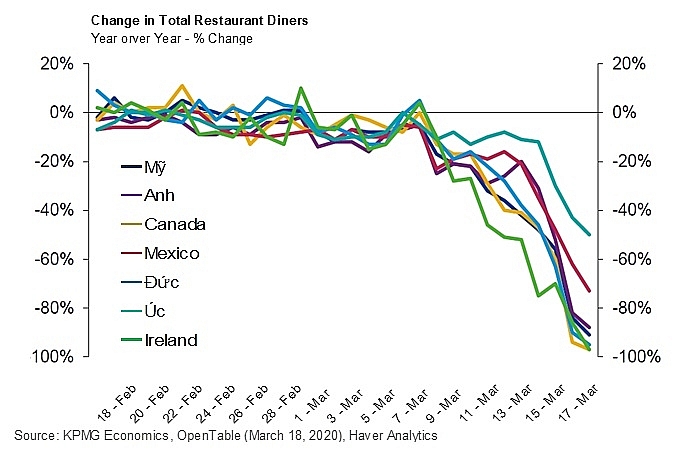

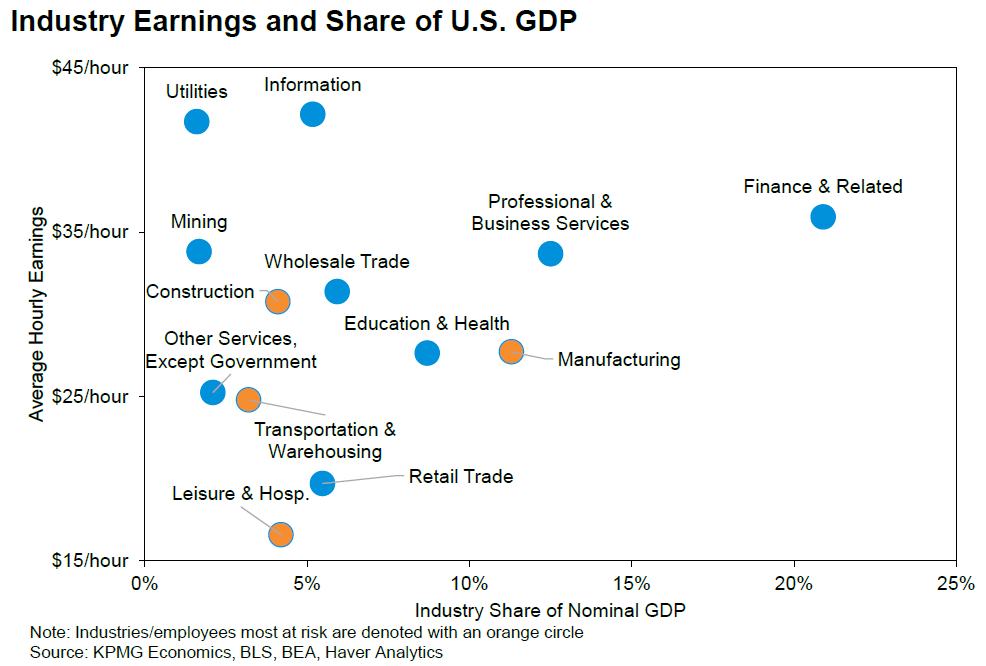

Not only in other countries across the world and in the region, even in Vietnam, every day, stores, restaurants and hospitality businesses, as well as manufacturing companies are going out of business or struggling to maintain operations. That is an inevitable consequence of value and supply chains shrinking and being disrupted. “Social distancing” also contributes significantly to this situation. An economic downturn has been forecast, especially in commerce and retail, the small- and medium-sized enterprises (SME) sector, as well as the manufacturing sector, with significant impacts on the finance and banking sector.

|

|

| Illustration: The heavily affected industries – Earnings and share of U.S.GDP |

Facing this situation, in addition to the continuous efforts to reduce and contain the contagion and protect the citizens, the Vietnamese government also promptly issued many measures to support the economy such as restructuring loan repayments; waiving, reducing interest rates and fees; maintain loan classifications; lowering the operating interest rate; as well as temporarily halting social insurance charges for those affected by the COVID-19 pandemic. These effective responses demonstrate the government’s determination and efforts to minimise the impact on the economy and to protect the vulnerable sectors and industries.

Furthermore, banks are also proactive in conducting reviews to minimise the negative impacts on their stability and operations and are coming out with many effective measures to support customers in these adverse circumstances while ensuring that standards and capital adequacy ratio comply with regulations.

To proactively respond to the crisis, it has become extremely necessary to test the resilience of financial institutions to shocks under various circumstances. Several central banks and authorities in the world have provided warnings and required credit institutions to review and evaluate their ability to maintain operations against shocks caused by COVID-19.

Simply put, credit institutions face questions that need to be carefully addressed:

(1) Which are the most affected customers/industries?;

(2) How does that affect the capital adequacy, liquidity ratio, and general safety of the organisation?; and

(3) What response scenarios should be followed in these adverse circumstances?

Coincidentally, due to Circular No.13/TT-NHNN, this year banks are also required to implement the Internal Capital Adequacy and Assessment Process (ICAAP), in which stress testing is a core requirement – which makes this exercise more vital for banks than ever before.

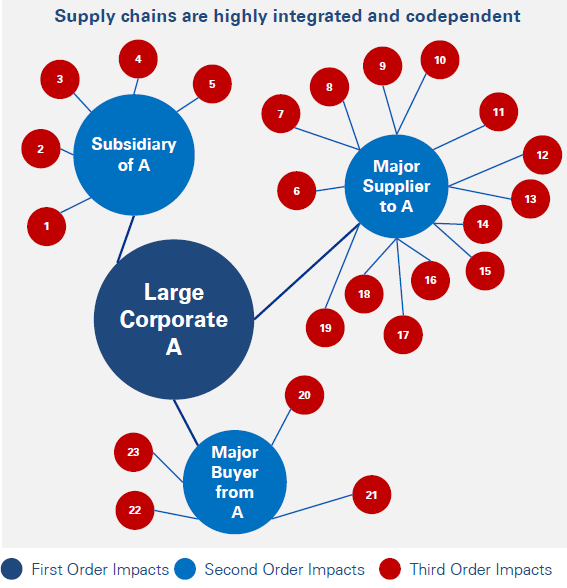

Implementing stress test, identifying vulnerabilities in supply chains

Crystallising the supply chain – and thereby determining the spillovers of potential impacts on the bank’s balance sheet and profits – are crucial. Thanks to this, banks can identify the borrowers who can run into trouble and then identify the supply and dependency linkages of these borrowers vis-à-vis the supply chain.

|

The following are brief recommendations for banks to consider when implementing a stress test.

A. Stress test at bank’s level

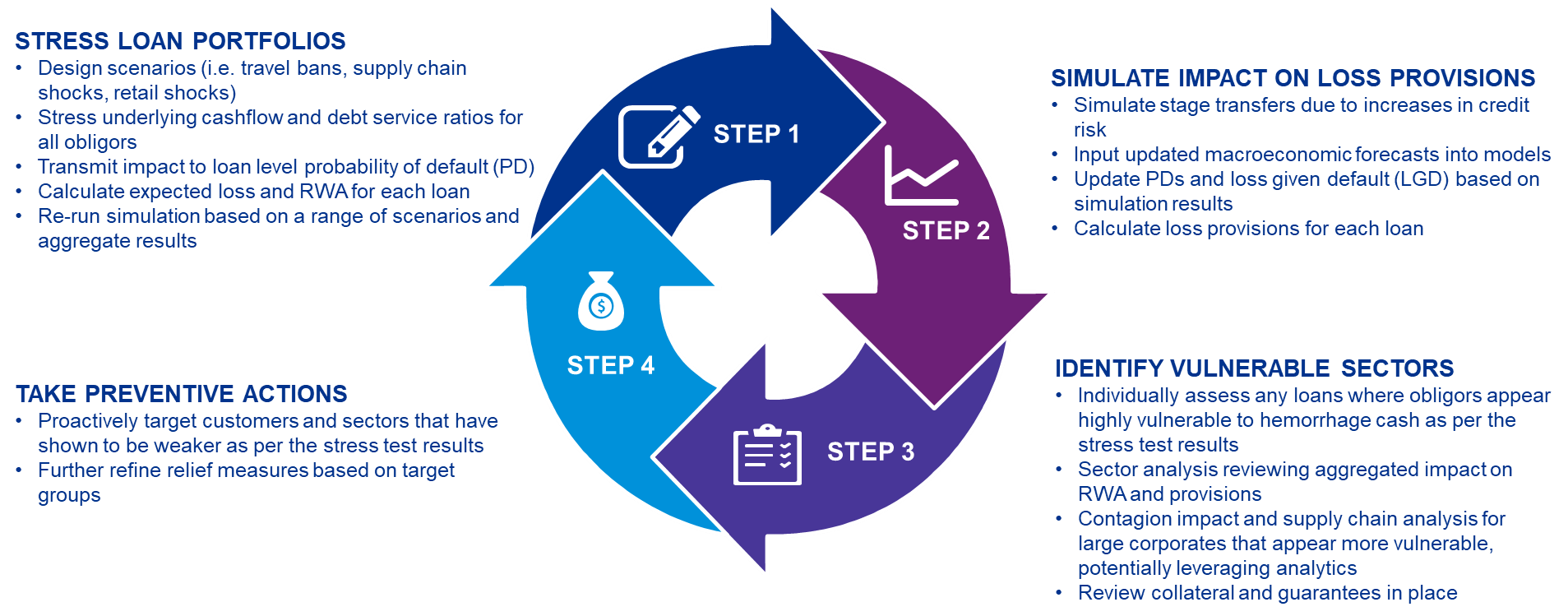

KPMG recommends that banks should run “stress test according to target” to identify the affected sectors and supply chain and to proactively produce precautionary measures.

|

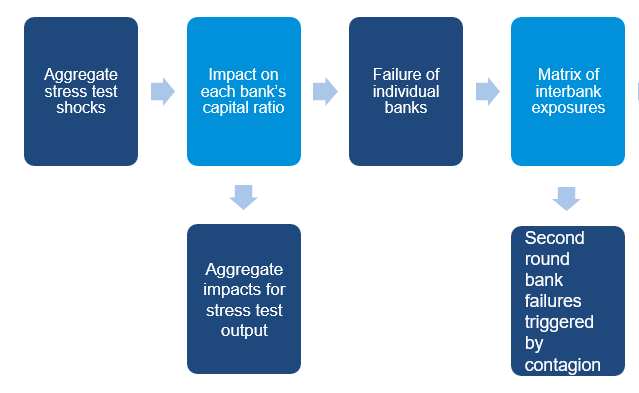

B. Perform stress test at a systemic level and study interbank contagion

One of the common ways is to implement stress testing for interbank contagion. The main activities include:

(1) Identify weak and vulnerable banks;

(2) Assess their level of systemic importance;

(3) Assess the consequences on the financial system if these weak banks face problems with their solvency and liquidity position;

(4) Continue the 2nd round of assessment based on the interrelations among banks.

|

Authors

|

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: COVID-19

- 67 million children missed out on vaccines because of Covid: UNICEF

- Vietnam records 305 COVID-19 cases on October 30

- 671 new COVID-19 cases recorded on October 1

- Vietnam logs additional 2,287 COVID-19 cases on Sept. 21

- People’s support decisive to vaccination coverage expansion: official

Related Contents

Latest News

More News

- Over 64,000 businesses enter market in first two months (March 07, 2026 | 10:00)

- Hanoi police roll out comprehensive security for upcoming elections (March 07, 2026 | 10:00)

- Finance Minister Nguyen Van Thang meets voters in Dien Bien ahead of NA elections (March 06, 2026 | 17:23)

- Viettel and Qualcomm to co-develop AI smartphones (March 06, 2026 | 09:00)

- Ministry: no further merger of government units (March 05, 2026 | 14:43)

- Greece seeks to expand economic cooperation with Vietnam (March 05, 2026 | 14:05)

- Middle East tensions drive cost pressures for seafood exporters (March 04, 2026 | 13:56)

- VN-EAEU trade talks target market access and supply diversification (March 04, 2026 | 11:27)

- Online election contest launched to boost public understanding (March 04, 2026 | 09:27)

- US-Iran conflict affecting asset prices (March 04, 2026 | 09:17)

Tag:

Tag:

Mobile Version

Mobile Version