Short-term policy support complementing 2025 targets

Under a draft report submitted to the National Assembly (NA) Standing Committee, the government has suggested that more new fiscal policies, especially on taxes and fees, be soon designed and enacted to assist enterprises and labourers, therefrom helping to ensure macroeconomic stability and social security. The report will be discussed by the NA over the next few weeks before specific solutions are crafted.

|

| Short-term policy support complementing 2025 targets, Photo Le Toan |

“There will be more solutions to help the public and enterprises have access to bank loans at favourable rates,” the report stated. “In addition, the government will continue to drastically and effectively implement already-promulgated solutions to support enterprises and production and business activities such as Resolution No.58/NQ-CP on policies and solutions to support enterprises to adapt, recover, and develop sustainably towards 2025.”

Under Resolution 58, the government requested the Ministry of Finance (MoF) to continue implementing in the short-term tax administration reform for individual business households, and report to the prime minister this quarter.

At the same time, the government has directed the General Department of Vietnam Customs to coordinate with authorities at all levels in simplifying the current administrative processes or consider applying priority import and export processes to help businesses optimise time and costs, as well as speed up the import process and procedures for essential commodities, and accelerate the export of agricultural products and key export commodity groups.

“Enterprises are now in massive difficulties and lack capital. Many major enterprises say they have sold most of their assets at half of the real value, and the buyers are foreign enterprises and investors,” said Minister of Planning and Investment Nguyen Chi Dung. “Cumbersome investment procedures remain popular. Currently, it would take 1-2 years to remove an unnecessary procedure, meaning enterprises cannot do anything, while the economy is increasingly becoming difficult.”

Deputy Minister of Planning and Investment Tran Quoc Phuong last month said that his ministry has advised the government to order all provinces and cities in the country to establish local-level taskforces in charge of helping business projects which are now facing difficulties.

“Besides special taskforces set up by the government, these local-level taskforces are the first of its type in Vietnam. Chairpersons of provinces and cities will act as heads of these taskforces, which will have to work directly with ventures in difficulties and map out solutions for them,” Phuong said.

“The key aim behind this new solution is to lift production and business activities out of difficulties as soon as possible. If this situation continues, it will be difficult to reach the government’s growth target of 6.5 per cent for the whole year.”

It is expected that the government will issue a new related resolution, with a focus to be laid on continued reductions and exemptions of some types of taxes and fees compiled by the State Bank of Vietnam.

The government last week agreed on a draft NA resolution on VAT reduction until the end of 2023 from 10 to 8 per cent for all types of goods and services. The government will submit the draft resolution for issuance in May or June under simplified procedures.

Specifically, the VAT reduction policy will help businesses reduce 20 per cent of the percentage for tax calculation when issuing value-added invoices, for goods and services currently subject to the 10 per cent tax rate. With this proposal, the MoF estimates, the budget will reduce revenue by $252.2 million per month and $1.52 billion in the second half of 2023.

With the orientation to stimulate economic demand, as well as increase production and business to promote economic development, the MoF also proposed many other support policies, such as lowering the collection rate of 35 fees and charges in the second half of the year equivalent to a decrease in revenue of $30.4 million.

This is the second time Vietnam has introduced a policy to reduce VAT from 10 to 8 per cent. In 2022, Vietnam also applied the policy, but for only some types of goods and services.

Last month, the government promulgated Decree No.12/2023/ND-CP on extending the deadline for paying VAT, corporate income tax (CIT), personal income tax, and land rental in 2023.

The decree stipulates a six-month extension for VAT amounts from March-May and Q1 of 2023; five months’ extension for VAT in June and Q2 of 2023; four months’ extension for July; and a three-month extension for August.

When it comes to the CIT, the decree stipulated that payment would be extended for the temporarily paid sum for Q1 and Q2 of the tax calculation period in 2023. Specifically, the time for payment extension will be three months as from the date of ending the CIT payment time under the tax management law. It is estimated that the value of the CIT payment extension will be around $1.9 billion.

Furthermore, according to Decree 12, the government is applying a six-month extension for paying half of the land rental in 2023 for those renting land from the state. This scheme lasts from May 31 to the end of November.

The General Department of Taxation has required provincial and municipal tax departments to disseminate information to taxpayers in their localities to promptly implement the deadline for paying tax and land rental.

In January, the government also enacted Resolution No.07/NQ-CP on reducing land and water surface rentals for 2022 for those hit by the recent pandemic.

The resolution stipulates a 30 per cent reduction in land and water surface rentals in 2022 for organisations, units, businesses, households, and individuals that were directly leasing land from the state under a decision, or contract, or certificate on land use rights ownership of houses and other land-attached assets of authorised agencies, in the form of land rental featuring an annual payment.

| More expressways to be built in central region by 2025 The Ministry of Transport has set a target of completing and putting into operation the eastern North-South expressway by 2025, bringing the total length of highways in the north central-central coastal region from 193km to 1,390 km, said Transport Minister Nguyen Van Thang. |

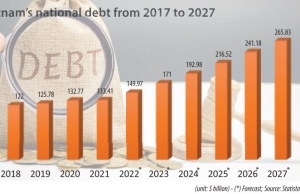

| Public debt management picture clears towards 2025 Vietnam’s plan for borrowing and paying public debt has been revealed, and the budget landscape finalised for this year, with public debt set to stay within the permissible limit. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

Tag:

Tag:

Mobile Version

Mobile Version