Shining as a beacon for investment in years to come

Despite a number of clear short-term challenges, Vietnam does remain an attractive market in ASEAN for international firms seeking to expand their presence in the region, be it as a manufacturer based in Vietnam with a focus on exports or as a company coming to the country to benefit from the growing local consumption story.

| Tim Evans - CEO, HSBC Vietnam |

We continue to see businesses from a broad range of countries showing strong interest in developing their presence in Southeast Asia. They see the demographic growth that is helping propel the region forward and, as a result, expect their sales in this dynamic region to grow by over 20 per cent per annum. This represents an increase that is 4-5 times the rate of GDP growth expected in the ASEAN bloc, as confirmed by data from the HSBC Global Connections Survey, published in September.

This survey covered more than 3,500 businesses in China, India, the UK, France, Germany, the US, Australia, Hong Kong, UAE, Saudi Arabia, Bahrain, Qatar, Oman, and Kuwait. Of these surveyed businesses, around 27 per cent have indicated that they already have a presence in Vietnam. Just over half of companies surveyed indicated that they were prioritising their growth aspirations in the market over the next two years.

Vietnam’s economy grew 8 per cent in 2022, benefiting from global supply chain diversification. Its economic resilience is also an attractive feature for international businesses. However, other key attributes that make Vietnam an appealing investment destination include the country’s competitive wages, its skilled workforce, its political stability, and the large number of free trade agreements that have been concluded over the past few years.

Over the past 30 years, ASEAN and Vietnam have been strong recipients of foreign direct investment (FDI) flows. These flows have made their way to the market as investors see the enormous growth potential, the country’s cost-effectiveness, and trade agreements that provide access to key international markets and ongoing structural transformation.

HSBC’s economists project that ASEAN will be the fourth-largest economy in the world by 2030, given that 17 per cent of global FDI has flowed into this region, which is twice the amount as before the pandemic. This achievement is a clear reflection of ASEAN’s strong fundamentals, favourable demographics, and competitive supply chains.

When thinking of FDI and the benefits it can deliver, Vietnam naturally stands out. The country has received substantial FDI inflows over the past several decades, turning itself into a rising star in the global manufacturing supply chain. While much of the investment initially entered into the lower value-add sectors of textiles and footwear, Vietnam has quickly ascended the value chain, growing into a key hub for electronics assembly.

Despite recent challenges that have impacted global trade flows, the country continues to be at the frontline of receiving high quality FDI flows. According to the United Nations Conference on Trade and Development’s World Investment Report 2023, Vietnam was among the top ASEAN countries receiving FDI last year, registering $17.9 billion (up from $15.66 billion in 2021), only after Singapore and Indonesia. This is in stark contrast to developed economies such as the EU and North America, which saw a 37 and 26 per cent decrease in FDI flows, respectively.

This momentum has been carried forward into this year. According to Vietnam’s General Statistics Office, total registered FDI rose 14.7 per cent in the first 10 months of 2023. Despite a trade downturn, the trend provides hope for the nation to see a strong rebound when the cycle turns.

Vietnam and ASEAN have emerged as the biggest beneficiaries of the supply chain realignment caused by US-China tensions. However, a significant contributor to the FDI story is the increasingly important position that Vietnam has created for itself along the global tech supply chain, as tech giants have been seeking to diversify their presence and have continued to actively invest in the market.

There is however more to Vietnam than purely an FDI in, export out story. The country’s fast-growing middle class is also a real opportunity for international companies who are looking to tap into the consumer story that will see the country become the 10th largest consumer market in the world by 2030.

The growth in Vietnam’s consumption story is strongly supported by the country’s stable economic growth and a population size. It has shown resilience and aspiration of its consumers with its rapid recovery in the consumer space in 2022, with retail sales rising by around one-fifth higher, making it a top two economy in ASEAN’s retail sales recovery. Vietnam’s monthly average spending per capita also rose three-quarters over 2012-2022.

Several international businesses see Vietnam’s growing consumer market as a real opportunity, with 27 per cent highlighting the appeal of increasing consumer prosperity. Business decision-makers from Chinese to Indian companies highlighted the opportunity to scale quickly in its sizeable market, with 32 and 41 per cent, respectively, pointing to this as a material opportunity for them.

Indian businesses also pointed to the opportunity to develop and test new products and solutions in the market, with 45 per cent of them saying this attracted them to expand in Vietnam.

It should come as no surprise that the growing digital economy also appears as a selling point for international business expansion in the country. Insider Intelligence forecasts Vietnam’s smartphone users will reach 67.3 million by 2026, accounting for around 97 per cent of internet users. This digital literate population is an instrumental enabler for the country’s e-commerce sector, which saw 20 per cent growth in 2022.

It is expected to post revenue of $20.5 billion in 2023, which translates to a 25 per cent on-year increase according to the E-Commerce and Digital Economy Agency under the Ministry of Industry and Trade.

The reality, however, is that like all markets, Vietnam is not without challenges for international companies. Cultural differences and regulatory developments are the top challenges for foreign firms operating here. Almost one-third of foreign companies pointed to cultural difficulties, and the same proportion pointed to the challenge of adapting to fast-changing regulations and policies within the market.

Despite the hurdles, Vietnam remains an attractive destination for foreign businesses, and we continue to see strong interest in its story from customers throughout the HSBC network.

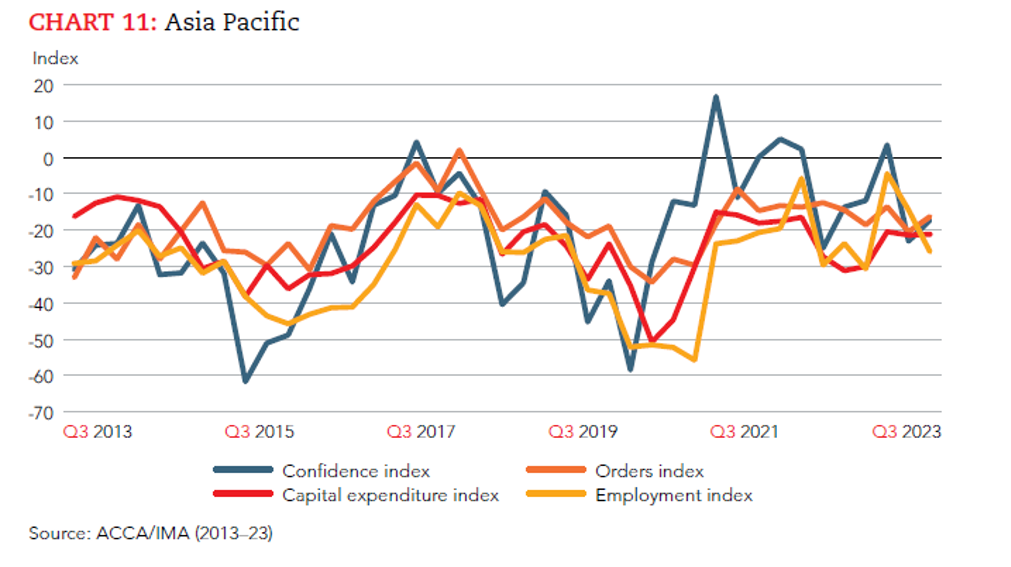

| Vietnam shows outstanding Q3 growth Following its recent impressive economic progress, Vietnam has featured in the Global Economic Conditions Survey (GECS) report for the third quarter of 2023 by the Association of Chartered Certified Accountants (ACCA) and Institute of Management Accountants (IMA). |

| Vietnam’s M&A flourishes over last 15 years At the Vietnam M&A Forum 2023, under the theme Thriving Together, experts discussed the many opportunities and challenges facing the Vietnamese M&A market, and ways to move forward. |

| Governance playing part in ESG goal Experts have underscored the critical role of solid corporate governance, ethical leadership, and sustainability adherence in fostering sustainable growth and resilience in today’s dynamic business environment. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Mobile Version

Mobile Version