Advanced search

Search Results: 141 results for keyword "alternative lending".

SBV warns banks off lending to property sector

10-10-2016 11:32

Recently the State Bank of Viet Nam (SBV) told credit institutions to restrict loans to real estate projects to reduce risks and credit concentration in a single sector.

VN bank profits surge on services, not lending

09-11-2016 09:06

Some commercial banks have reported high profits in the first nine months of the year thanks to a restructuring effort which focuses on services instead of lending as previously done.

Banks cut back lending for property sector

15-11-2016 09:44

The interest rates on medium- and long-term loans to the property sector have recently increased by 1-1.5 percentage points.

SBV to change foreign currency lending rules

16-11-2016 09:04

The State Bank of Viet Nam (SBV) is drafting a new circular on foreign currency lending.

Consumer lending may salvage credit growth target

30-12-2014 14:59

After seeing very sluggish growth of 4.5 per cent in the first eight months of this year, credit grew by 10.22 per cent as of November 30 from the end of 2013, reported the State Bank of Vietnam (SBV), making the whole-year target of 12-14 per cent now more feasible.

SBV allows foreign currency lending to continue through 2015

07-01-2015 10:14

The State Bank of Vietnam has just issued a new circular allowing credit institutions to continue offering short-term foreign currency loans to the end of 2015.

Soaring dollar lending rescues credit growth

24-11-2014 14:19

A fast rise in dollar lending has bolstered banks credit growth and is expected to continue through year-end.

Credit rating system needed to spur lending

11-08-2014 18:08

State Bank of Vietnam Deputy Governor Nguyen Phuoc Thanh recently stressed the need for local credit institutions to develop a corporate credit rating system to boost credit growth, but banks need to do better at mitigating their risk to control bad debts.

Interest rate dip fails to stimulate lending

07-04-2014 15:25

In mid-March the State Bank announced it would ease the ceiling interest rate applicable to one to six month term deposits by 1 per cent, to 6 per cent.

IFC manager discusses bank lending alternatives

27-08-2013 10:16

Rachel Freeman, IFC manager for Access to Finance Advisory Services in East Asia Pacific shared how movables lending could help resolve banks’ non-performing loans and expand financing to small and medium enterprises on the sideline of the international symposium on movables lending organized by IFC and the Vietnamese Banking Association on August 22-23 in Ho Chi Minh City.

VP Bank decreases lending interest rate

02-03-2012 16:54

Vietnam Prosperity Commercial Joint Stock Bank (VP Bank) on March 1 announced a decrease in lending interest rate by a maximum 2 per cent per annum from March 2012.

Banks asked to lower lending interest rates

24-03-2012 08:56

The State Bank of Vietnam has asked State-owned, commercial banks and joint stock banks in which the State holds more than 50 per cent of their registered capital to cut operation costs and lower lending interest rates.

Lending rate lag still causing bank unease

05-09-2023 17:17

Banks remain in a phase of inventory, facing challenges in the active monetisation of funds and resulting in an accumulation of excess liquidity.

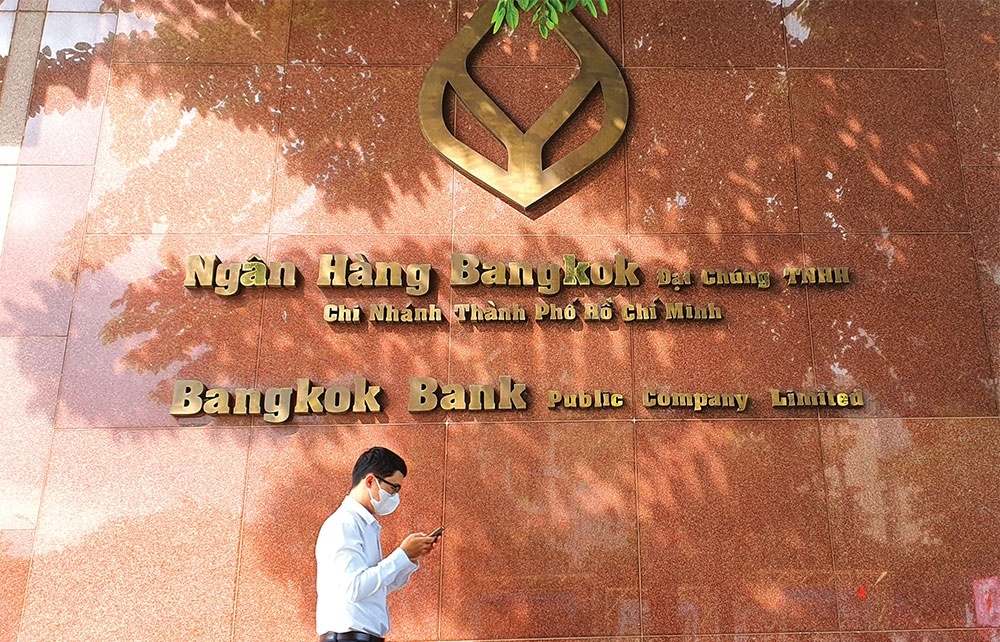

Thailand lending duo on the march with fortifying presence

06-09-2023 09:00

Vietnam’s dynamic financial landscape is proving to be a favoured destination for some Thai lenders.

Lending strategies playing part in CASA fluctuations

28-05-2024 13:00

A higher current account saving account ratio indicates that a bank has more related deposits. Banking consultant Le Hoai An spoke with VIR’s Hong Dung about the assessment of ratio fluctuations for 2024 in Vietnam thus far.

Mobile Version

Mobile Version