Advanced search

Search Results: 211 results for keyword "FinTech".

Vietnam faces a possible gap in financial accessibility and awareness

27-05-2021 17:59

Despite Vietnam's 70 per cent adult population having a bank account, a new global research shows possible gaps in financial accessibility and awareness.

More banks collaborate with fintech firms to develop embedded finance in Vietnam

15-05-2021 12:57

A growing number of banks and fintech firms are forming partnership to implement embedded finance in Vietnam.

Timo appoints Nam Tran as a member of the Global Advisory Board

13-05-2021 17:58

Timo, the first digital banking platform in Vietnam, officially announced the appointment of Nam Tran, co-founder and chairman of Moca as a member of the Global Advisory Board at Timo from May 1, 2021.

"Buy now, pay later" on the rise in Vietnam

13-05-2021 15:22

The trend of buy now, pay later solutions is projected to gain traction in Vietnam with many players unveiling new services to tap into this fast-growing segment.

Four new payment intermediaries licensed in Vietnam since 2021

04-05-2021 09:42

From the beginning of the year, the State Bank of Vietnam (SBV) has issued new licences to four non-bank payment intermediaries, showing the increasing demand by local firms to join the fintech rush.

NextPay launches digital transformation ecosystem Next360.vn for MSMEs

03-04-2021 09:41

NextPay, a Vietnamese fintech firm owned by NextTech Group, on March 31 launched the Next360.vn digital transformation ecosystem for micro-, small-, and medium-sized enterprises (MSMEs), with the aim of conquering the huge growth potential of the local market.

Financial institutions opting more into eKYC convenience

25-03-2021 07:00

Fintech companies, banks, and other financial institutions are making great strides to go paperless, eliminating physical movements and paperwork, and becoming more cost-effective through electronic processes.

Mobile transactions in Vietnam to grow by three times by 2025

17-03-2021 15:31

Mobile transactions in Vietnam are expected to increase by 300 per cent between 2021 and 2025, led by strong growth in mobile payments, as revealed in the second edition of the Fintech and Digital Banking 2025 (Asia-Pacific) IDC InfoBrief, commissioned by Backbase.

Lenders reinforcing cyber defences

10-02-2021 16:26

Although banks and innovative fintech technologies already benefit customers’ experience, they also come with possible cyber threats, especially as customers often do not realise the risks.

MoMo announced its completion of Series D funding round

13-01-2021 17:23

Leading local e-wallet MoMo has published the results of its successful Series D capital mobilisation, including Goodwater Capital, Kora Management, and Macquarie Capital among the largest names.

ATM Online debuts new micro-loan product for unexperienced

06-01-2021 10:06

Singapore-headquartered fintech firm ATM Online has launched new products for its new clients.

E-wallet services to facilitate online payment convenience

10-12-2020 15:00

While there have been issues relating to peer-to-peer and other digital lending and e-payments solutions in Vietnam as of late, one of the most advanced areas of fintech in the country currently is the increasing use of e-wallets. Dung Dang, managing partner at Indochine Cousel, writes on the existing rules for e-wallets in Vietnam and how they pertain to privacy and accessibility.

VNG Cloud eyes new fintech solution partners at SWITCH 2020

03-12-2020 14:26

VNG Cloud will be sourcing for innovation partners at Enterprise Singapore’s (ESG) inaugural Southeast Asian Open Innovation Challenge at the Singapore Week of Innovation and Technology 2020 (SWITCH 2020) on December 7-11, 2020.

Shinhan Bank successfully modernises trading and risk platforms with Finastra

03-12-2020 10:40

Shinhan Bank Vietnam has successfully standardised and integrated its trading and risk platforms with Finastra’s Fusion Kondor and Fusion Risk.

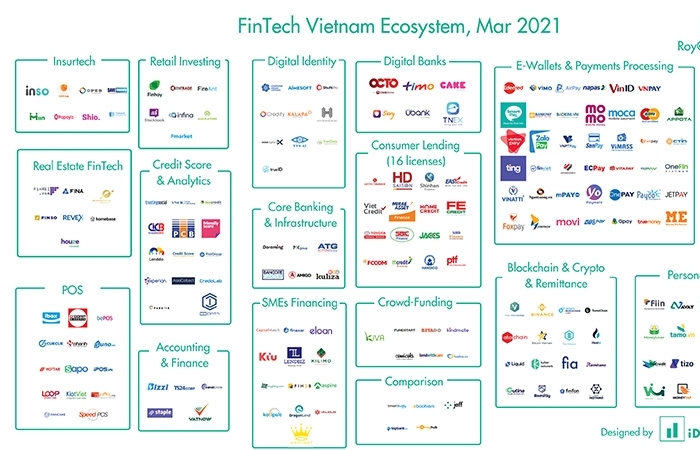

Vietnam fintech startup go from 44 in 2017 to 121

02-12-2020 10:11

Vietnam’s fintech startup landscape almost tripled in size between 2017 and 2020, growing from 44 startups in 2017 to now 121 startups, according to a new report released by Fintech News Singapore.

Mobile Version

Mobile Version