Advanced search

Search Results: 211 results for keyword "fintech".

Mobile money to be officially launched from October

27-09-2021 22:11

Minister of Information and Communications Nguyen Manh Hung has just announced that mobile money would be launched in October.

Financial Times research highlights the need for banks to digitalise

17-09-2021 17:40

Two in three, equal to 67 per cent, of banks believe they will lose market share within two years if they fail to digitally transform, according to a new report from cloud banking platform Mambu and The Financial Times Focus (FT Focus).

HSBC Vietnam facilitates international investment in VNLIFE, Vietnam’s second unicorn

15-09-2021 16:57

HSBC Vietnam supported General Atlantic and Dragoneer Investment Group in co-leading a $250 million Series B investment in VNLIFE, a local tech startup operating in banking enablement, digital payment, online travel, and new retail. This capital injection is expected to accelerate the growth of VNLIFE’s existing businesses and support its development of new platforms and technologies to better serve its merchant partners and Vietnamese consumers.

Ambitions escalate for fintech sandbox

15-09-2021 10:00

The freshly-minted legal framework for sandboxes in Vietnamese fintech is expected to grease the wheels for tech-savvy, innovative financial services.

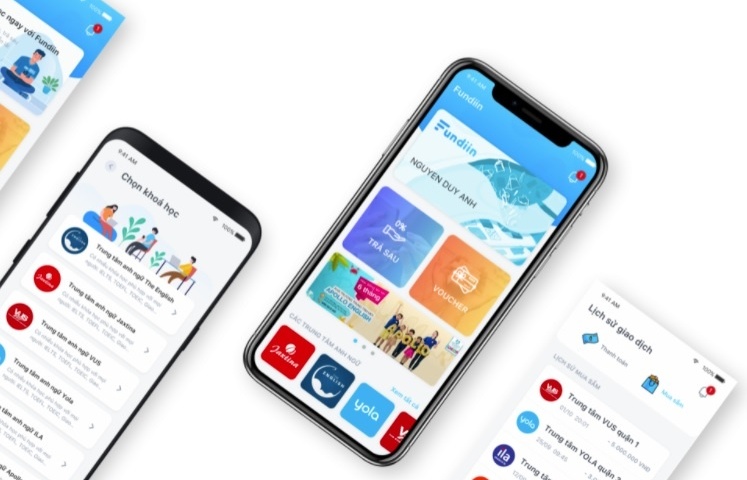

BNPL Fundiin raises $1.8 million in oversubscribed seed round

14-09-2021 09:44

Fundiin, the leading buy-now, pay-later (BNPL) fintech in Vietnam, has closed an oversubscribed seed round of $1.8 million with participation from Genesia Ventures, JAFCO Asia, Xffirmers, Trihill Capital, and existing investors 1982 Ventures and Zone Startups Ventures.

Modern parents teach children how to use technology to manage spending

13-09-2021 07:30

Parents are taking advantage of technology to help their children learn to manage spending and save more.

Pandemic driving digital-first mindset around financial services in Vietnam

10-09-2021 13:41

The global health crisis is driving a digital-first mindset in Vietnam when it comes to opening banking accounts.

Banks on the road of digital transformation

09-09-2021 08:41

Banks are taking advantage of Vietnam's potential environment to conduct digital transformation to meet increasingly technology-driven consumer demands.

Vietnam accelerates the development of regulatory sandbox for fintech

08-09-2021 17:59

The Vietnamese government is pushing forward a regulatory sandbox for fintech banking and cashless payments with a view to support the development of the local fintech scene.

Financial wellness and digital money management apps to ignite digital banking

08-09-2021 16:52

Financial wellness and digital money management apps are potential future sparks for igniting Vietnam’s race for digital dominance in the retail banking sector.

Incredible potential in reach for fintech

13-08-2021 08:00

Fuelled by generous amounts of venture capital, Vietnam’s fintech landscape is flying high on Singaporean investors’ agenda, promising to offer more innovative customer value propositions than traditional banks.

E-commerce groups tapping into ditigal market growth

31-07-2021 10:00

Vietnam’s fast-growing digital economy is hoping to lure big foreign funding to cash in on the enormous potential – although whittling down the use of physical cash could take a lot longer.

Vietnam among top 10 unbanked nations in the world

20-07-2021 11:07

Fintech investors are growing interest in Vietnam that, nevertheless, is among the top 10 unbanked nations in the world.

South Korean financial super app Toss raises $410 million, betting on Vietnam

29-06-2021 16:30

Viva Republica, the operator of popular South Korean financial app Toss, has raised $410 million in its latest funding round, with a valuation of $7.4 billion. The fresh funds will be used to expand in overseas markets, including Vietnam.

Vietnamese fintech startup MFast raises $1.5 million in pre-Series A round

21-06-2021 10:23

MFast has wrapped up a $1.5 million seed round investment featuring Do Ventures as lead investor and JAFCO Asia as co-investor.

Mobile Version

Mobile Version