Advanced search

Search Results: 7,583 results for keyword "bank".

World Bank approves 176-million-USD fisheries project in Philippines

01-06-2023 17:00

The World Bank (WB) on May 31 approved a 176-million-USD loan to fund a fisheries project that aims to improve fisheries management, enhance the value of fisheries production, and raise incomes for coastal communities in the Philippines.

Local banks seek foreign funding

31-05-2023 18:08

Saigon-Hanoi Bank (SHB) announced the completion of the transfer of a 50 per cent stake in its consumer finance subsidiary SHB Finance to its Thai partner, Krungsri Bank. Over a year on from initially signing the contract to sell the stake, SHB has now received $78 million from its foreign partner.

BVBank builds stronger identity with new name

31-05-2023 09:58

BVBank, formerly known as Viet Capital Bank, has received approval from the State Bank of Vietnam (SBV) to change its English name abbreviation as part of its strategy to enhance its customer-centric services and establish a stronger brand identity.

Rate reductions deemed well-timed

31-05-2023 09:26

The latest initiative from Vietnam’s central bank to introduce a round of interest rate reductions within a condensed timeframe is regarded as a favourable stride aimed at invigorating economic expansion.

Deutsche Bank expands investment in Vietnam

30-05-2023 18:49

Deutsche Bank has announced plans to inject an additional $100 million into its Ho Chi Minh City branch, raising its total investment in Vietnam to over $200 million. This substantial increase in capital infusion empowers the bank to expand its operations and offer an enhanced range of services to its valued clientele across the nation.

Preparedness crucial in safeguarding banking sector

30-05-2023 18:40

Banks are inherently fragile, it is therefore unavoidable that banks face turmoil periodically. Patrick Lenain, CEP senior associate, analyses how to limit the global banking stress impacts in Vietnam’s banking system.

How bad debts influence lending rates

30-05-2023 18:38

Last week the State Bank of Vietnam continued reducing diverse regulatory interest rates in a bid to help remove impediments for borrowers, as well as support credit institution efforts to drive down input costs, and from there be able to reduce lending rates.

Cashless Day 2023: digital payments drive financial transformation

29-05-2023 14:50

With non-cash transactions surging by 53 per cent in volume and internet-based transactions skyrocketing by 88 per cent in volume, Vietnam's drive towards a cashless society is gaining momentous growth, empowering 75 per cent of its population with active bank accounts and registering over 3.71 million mobile money accounts.

Tyme Group sets sights on Vietnam for digital lending services

27-05-2023 14:00

Tyme Group, backed by South African billionaire Patrice Motsepe, plans to enter the Vietnamese market by 2024 having secured $78 million in pre-series C funding. The digital lending entity aims to tap into Vietnam's underserved market and leverage its advanced technological capabilities to provide digital banking services.

Falling interest rates likely in H2

26-05-2023 16:09

On May 23, the SBV announced additional adjustments to a series of key interest rates, effective from May 25. This move marks the third round of reductions designed to boost the economy in less than three months. Interest rates are predicted to soften in the second half of the year, due to several factors in both the domestic and international markets.

Vietnam’s 10 most reputable and efficient public companies in 2023

26-05-2023 14:47

The latest Vietnam Report's analysis provides an overview of the reshuffled rankings within Vietnam's 10 most reputable and efficient public companies for 2023, with Vietcombank securing the top position.

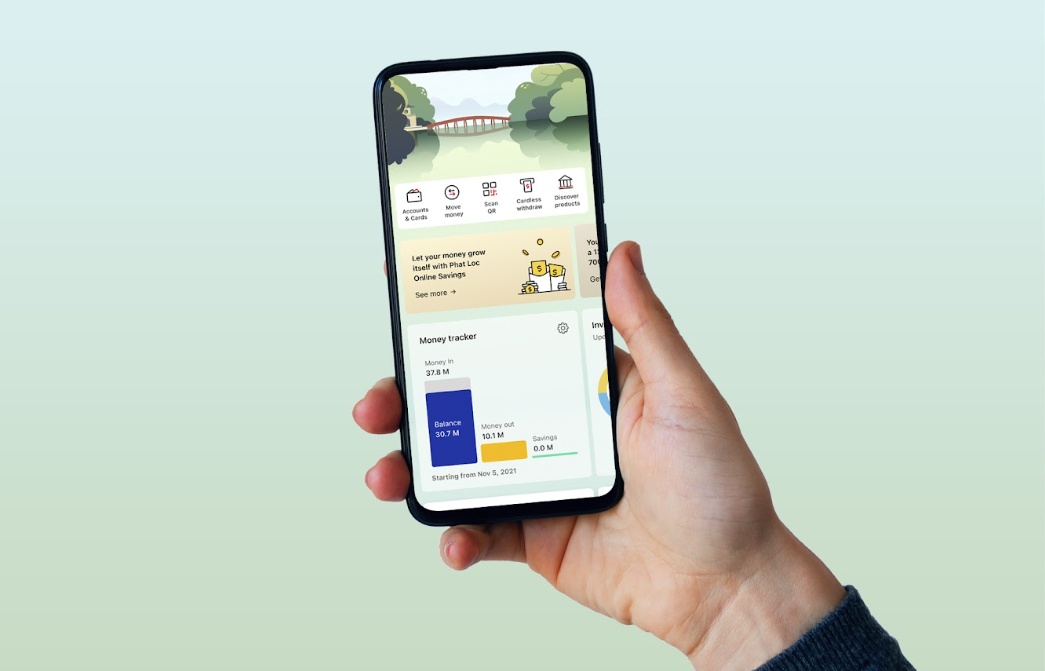

Techcombank partners with Personetics to revolutionise financial management with AI

26-05-2023 09:44

Techcombank and Personetics-a provider of data-driven personalisation and customer engagement tools for banks and financial services companies-are revolutionising financial management through the integration of AI technology to offer customers enhanced control over their finances.

VBSP driving digital finance to aid the disadvantaged

24-05-2023 18:11

On May 23 in Hanoi, Vietnam Bank for Social Policies (VBSP), in tandem with The Asia Foundation (TAF) and Mastercard, with support from the Australian Department of Foreign Affairs and Trade (DFAT) hosted a seminar on promoting digital finance and inclusion for disadvantaged Vietnamese people.

State Bank of Vietnam implements third round of interest rate cuts to boost economy

24-05-2023 16:29

The State Bank of Vietnam (SBV) has just announced a series of interest rate reductions. This marks the third time it has decided to lower operating interest rates since the beginning of 2023, with the new changes taking effect from May 25.

Further interest rate cuts hoped to fuel money flows into real estate

24-05-2023 16:15

The State Bank of Vietnam (SBV) is set to further reduce regulatory interest rates on May 25, the third cut in a row since mid-March, expected to give a boost to the stagnant real estate market.

Mobile Version

Mobile Version