Advanced search

Search Results: 2,239 results for keyword "banks".

Businesses borrow money from banks rather than issue bonds

19-04-2019 16:06

The government’s decree 163, with loosened requirements on bond issuance, is expected to encourage businesses to seek capital from bond issuance and rely less on bank loans.

Avalanche of credit programmes to support SMEs and individuals

17-04-2019 15:30

Southern banks are deploying a raft of major credit programmes in anticipation of burgeoning capital requirements from individuals and businesses in the upcoming months.

Vietcombank, PwC cooperate on digital banking transformation

16-04-2019 22:02

Vietcombank and PwC Consulting Vietnam have officially kicked off Vietcombank’s Digital Banking Transformation project today in Hanoi. This is considered a pioneering project of its kind among large commercial banks in Vietnam.

20 banks and VAMC to be audited for bad debts performance

11-04-2019 16:35

The State Audit Office of Vietnam (SAV) will audit the accounts of Vietinbank, BIDV, VAMC, and 18 other joint-stock commercial banks for their performance in resolving bad debts.

Banks forecast further improvements

11-04-2019 10:00

A majority of credit institutions in the country said their business performance in the first quarter of 2019 was better than the same period last year, according to the State Bank of Vietnam's March survey released late last week.

Foreign investors set their sights on poorly-performing banks

05-04-2019 11:21

Foreign financial institutions were eyeing up poorly-performing Vietnamese banks after being given the green light to acquire stakes in local institutions in a move to speed up the restructuring of the country’s banking industry, according to banking expert Nguyen Tri Hieu.

Corporate bonds give bank deposits a run for their money

01-04-2019 17:28

A question being asked by many experts now is why banks are joining a race to increase deposit interest rates though there is no ostensible liquidity shortage.

Gov’t urged to help local banks lure foreign capital

01-04-2019 12:24

The Government should help Vietnamese banks lure capital and experience from prestigious foreign banks so as to help local firms develop sustainably, experts said.

Domestic banks gain CPTPP benefits

29-03-2019 10:07

The Comprehensive and Progressive Trans-Pacific Partnership is expected to bring in fresh opportunities for international banks in Vietnam, as well as possible merger and acquisition deals with local partners.

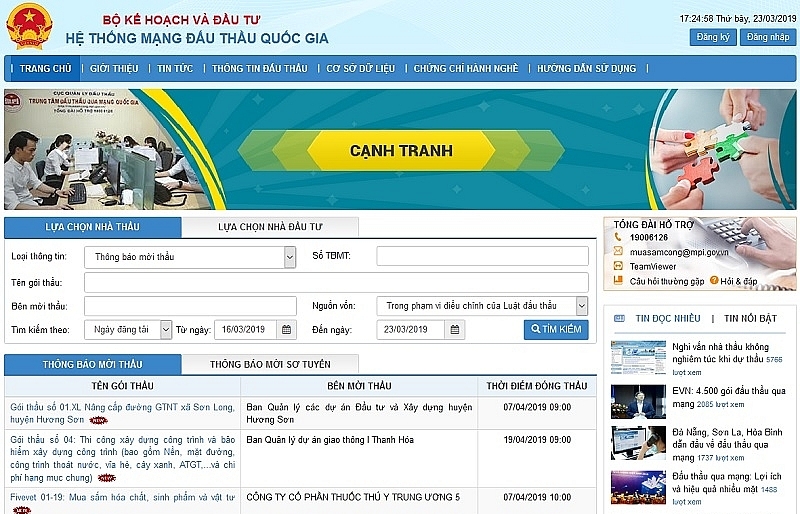

E-procurement system applied to banks’ projects

25-03-2019 08:00

In order to enhance competitiveness and transparency, two major lenders have begun using the Vietnam National E-Procurement System to bid online for construction and goods supply contracts for their projects.

Banks gearing up for change

25-03-2019 08:00

Innovative technologies, changing customer demands, and shifting regulatory landscapes are transforming the global banking industry. John Garvey (left), Global Finanical Services leader of professional services firm PwC, and Grant Dennis (right), general director of PwC Consulting Vietnam, discuss the impact of these trends on Vietnamese banks and their shift towards a more customer-centric and digital mindset.

Banks struggle to lure long-term capital

20-03-2019 10:46

Banks have to mobilise long-term capital at high costs by issuing certificates of deposit (CD) in Vietnamese dong with high interest rates to lure depositors, causing concerns about a domino effect on lending rates.

Local stocks extend gains for a third straight day

15-03-2019 09:45

Vietnamese shares ended Thursday on a positive note with extended growth among commercial banks, but stronger selling hindered the market’s short-term prospects.

Banks urged to complete listing plans

10-03-2019 14:42

The latest regulatory requirements make it impossible for banks to continue delaying their listing plans.

Foreign investment in banking to surge

08-03-2019 17:48

The improved business performance of Vietnamese banks and a Government regulation to require local banks to meet stricter capital regulations as part of Basel II standards is spelling the start of a wave of foreign investment into the country’s finance and banking sector in 2019, experts said.

Mobile Version

Mobile Version