Advanced search

Search Results: 2,238 results for keyword "banks".

Building core competencies in digital age

07-05-2021 17:08

The “product-focused” business philosophy faces challenges, forcing banks to switch to “customer-centric” operations and build a digital ecosystem that fufils customers’ needs. Dam Nhan Duc, head of Research and Development of the Military Commercial Joint Stock Bank (MB) looks into the essence of this transformation.

How Circular 03 on debt rescheduling and rates exemption affect to Vietnamese banks

06-05-2021 18:20

Vietnam’s central bank has recently extended the roadmap for commercial banks’ debt rescheduling and provision in a bid to support vulnerable customers hit by the pandemic. Nguyen Thi Phuong Thanh, financial analyst at VNDIRECT, wrote about how loosening the schedule would support banks to retain earnings growth and assure capital safety.

Banks pocket hefty profits in first quarter

05-05-2021 17:56

Local commercial lenders posted soaring profits in the first quarter this year, as mirrored by their newly-released first-quarter financial reports, driven by escalating interest income and a jump in earnings from services.

Banks roll out green credits for eco-friendly approach

29-04-2021 10:00

Since the adverse impacts of climate change are better understood, many financial institutions operating in Vietnam are taking bold steps to finance and facilitate green and eco-friendly loan packages as an essential part of their sustainable investment and net-zero pledges.

Foreign bank moves pointing to repositioned focus

27-04-2021 20:00

Banking giant Citigroup has decided to shut down its retail division in 13 markets, including Vietnam, to reset focus on institutional clients. Kent Wong, partner, head of Banking and Capital Markets at VCI Legal, explained to VIR’s Celine Luu why some foreign lenders are withdrawing, and how fierce the competition between international and locally-invested banks is in Vietnam.

Real estate businesses shake hands with banks to increase benefits for buyers

26-04-2021 15:08

The partnership between real estate developers and banks have created preferential credit solutions, reduced opportunity costs, and increased returns for buyers.

Preparation crucial for banks to avail of green credit trends

24-04-2021 11:00

Many foreign and Vietnamese financial institutions are now enthusiastically enforcing green loans or bonds as they continue to work towards transition to a low carbon economy. However, issues such as debtors’ leverage ratio or energy project quality are associated with risks. Pham Nhu Anh, member of the Board of Management, head of the Corporate and Investment Banking Division at Military Bank, talked to VIR’s Luu Huong about the risks and rewards of these climate-friendly initiatives.

VietinBank Securities bags $90 million syndicated loans from international banks

16-04-2021 12:07

The $90 million syndicated loans, with preferential rates and support from foreign lenders, will add more fuel to VietinBank Securities’s loan advisory and financing arrangements activities.

Fresh CEO rush shakes up Vietnam’s banking arena

15-04-2021 08:00

With competition in the financial landscape mounting in recent years, a wave of new CEOs in some major foreign-invested banks operating in Vietnam is slated to boost corporate innovation and responsiveness to rapidly-changing business conditions.

Divestment slow off the blocks for banks

13-04-2021 12:43

Foreign investment in state-owned banks could quench the thirst for capital while assisting with consolidation, but major problems continue to hinder the process.

Strong rise in bank profitability in first quarter

09-04-2021 15:18

A number of banks recorded impressive growth in the first quarter and set a relatively strong profit growth target this year.

A comprehensive approach to SWIFT security assessment

06-04-2021 11:33

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) is a vast messaging network used by banks and other financial institutions to quickly and securely send and receive information, such as money transfer instructions.

Credit growth may reach 12-13 per cent in 2021

25-03-2021 15:58

Credit growth is expected to reach 12-13 per cent this year despite modest growth in the first quarter.

Foreign brokerages rack up agreements

25-03-2021 08:30

Several international banks, particularly from Taiwan, are boosting their financing offers to Vietnam’s brokerages, betting on the tremendous growth of the financial market.

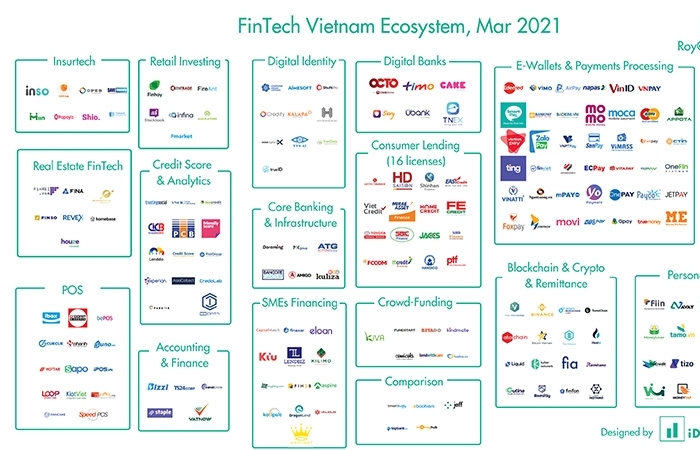

Financial institutions opting more into eKYC convenience

25-03-2021 07:00

Fintech companies, banks, and other financial institutions are making great strides to go paperless, eliminating physical movements and paperwork, and becoming more cost-effective through electronic processes.

Mobile Version

Mobile Version