Building core competencies in digital age

|

| Dam Nhan Duc, head of Research and Development of MB |

The Fourth Industrial Revolution has brought about significant innovations in banking and finance activities. Consumers are spending more and more time on online platforms using their mobile phones and personal computers. This rate has further increased as the COVID-19 pandemic broke out. This has given banks more favourable conditions to develop digital products and modern banking applications in order to attract customers. In recent years, banking apps in Vietnam have been ceaselessly updated, constantly launching new features. This shows Vietnamese banks’ relentless efforts in fostering digital transformation.

|

Digitalisation is a must

In recent years, the government has isssued a large number of decisive resolutions to promote digital transformation, such as Resolution No.1/NQ-P dated January 1, 2020 regarding the pilot institutional framework (sandbox), Resolution No.50/NQ-CP dated April 17, 2020 issuing guiding policies to actively participate in the Fourth Industrial Revolution, and Decision No.316/QD-TTg on the pilot usage of telecommunication accounts to pay for goods and services of small value.

| The increasingly rapid growth of the pandemic and the superiority of technology are the driving forces for organisations to stimulate digital transformation. |

Digital banking is a journey, not a destination. It requires a comprehensive strategy for change in all aspects, from business thinking to organisational culture.

Cashless payment not only helps improve the management efficiency of state administration authorities but also saves time and costs for citizens. To do so, developing mobile money and digital banking is a must. The increasingly rapid growth of the pandemic and the superiority of technology are the driving forces for organisations to stimulate digital transformation.

Potential is enormous

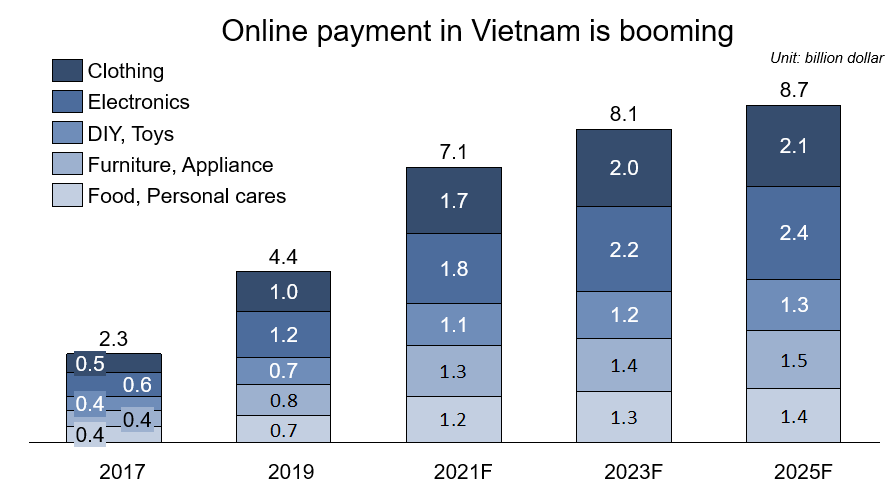

Vietnam is in its “golden population structure” with nearly 70 per cent of the population of a working age, 92 per cent of whom use smartphones. Yet, the proportion of population having bank accounts and mobile money apps remains low, especially in remote areas. Currently, only about 30 per cent of the population has a bank account and just 3.5 per cent has mobile money apps. The scale of online payments in Vietnam is estimated to reach $8.7 billion in 2025, nearly four times the size of 2017. This effectively means the potential to develop banking services in Vietnam is enormous.

Pioneer banks

In recent years, with their determination to change, as well as policy orientation from regulatory bodies, especially the State Bank of Vietnam, many Vietnamese banks have proactively innovated, transformed, and upgraded their information infrastructure to be able to fulfill customers’ demand on digital channels. Digital products such as QR payment, savings, digital loans and recently, electronic know-your-customer (eKYC), have been actively implemented by many banks.

Pioneers include MBBank, TPBank, and VPBank. MBBank was the first in Vietnam to establish a digital banking division, rolling out a series of traditional banking services on the MBBank App such as online loans in three minutes, digital savings, international payment, and recently, customised bank account number and launching a programme to match account number with the phone number of customers.

It’s just the start

However, upgrading the technical infrastructure to digitise banking products is just the very first step in the digital transformation process. Based on the upgraded platforms of advanced technology, Vietnamese banks have been continuing to complete their digital ecosystem, which provides customers with the experience of diversified products and services, such as shopping, travelling, investment, or entertainment.

Pioneering banks such as MBBank or Techcombank are enthusiastically completing their digital ecosystems. In addition to conventional services like other banks, the MBBank App also allows users to shop, book airline tickets, play games, search for information, and receive financial management, securities, bonds, and insurance investment consultation online.

Digitalisation is not a destination

Digital banking is a journey, not a destination. It requires a comprehensive strategy for change in all aspects, from infrastructure to business thinking and organisational culture. This competition is not merely about technology but also concerns a change in the way of thinking and organisational culture at banks.

More specifically, the conventional “product-focused” business philosophy is facing many challenges, forcing banks to switch to a “customer-centric” approach and build a digital ecosystem that fufils customers’ need.

The process of digitising banking operations or building new ways of doing business in a digital environment requires considerably high levels of innovation and flexibility. This might also be a challenge for banks because banking is a risky business that prioritises prudence and compliance. Hence, banks need to come up with methods to nurture the creativity of their digital banking staff.

The core elements

Requirements for digital transformation and steps to foster digital banking have been widely discussed. Many banks have shown no hesitation to invest large amounts of money and hire consultants to build up their system; others have managed to deploy digital banking systems by themselves. But at the end of the day, perhaps it is digital management that is the core in addition to other fundamental factors including business model, foundation, connection, technology, algorithm, data, and analysis. If banks have not made use of data inside and outside the bank into their business decision making process or turn them to become unique offering or special experience of customers, it is still at a very first stage of digital banking process.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- A cultural development pillar for the new period (February 19, 2026 | 08:22)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- IFC to grant $150 million loan package for VPBank (February 13, 2026 | 09:00)

- SABECO celebrates diverse Tet Traditions (February 11, 2026 | 08:00)

- Canada backs Vietnam’s green transition with AGILE project (February 09, 2026 | 17:41)

Tag:

Tag:

Mobile Version

Mobile Version