Advanced search

Search Results: 837 results for keyword "State Bank of Vietnam".

Key sectors contributing towards state budget surplus

22-09-2024 09:00

The state budget has experienced a surplus so far this year, driven by an increase in revenue from export and import activities, rather than crude oil.

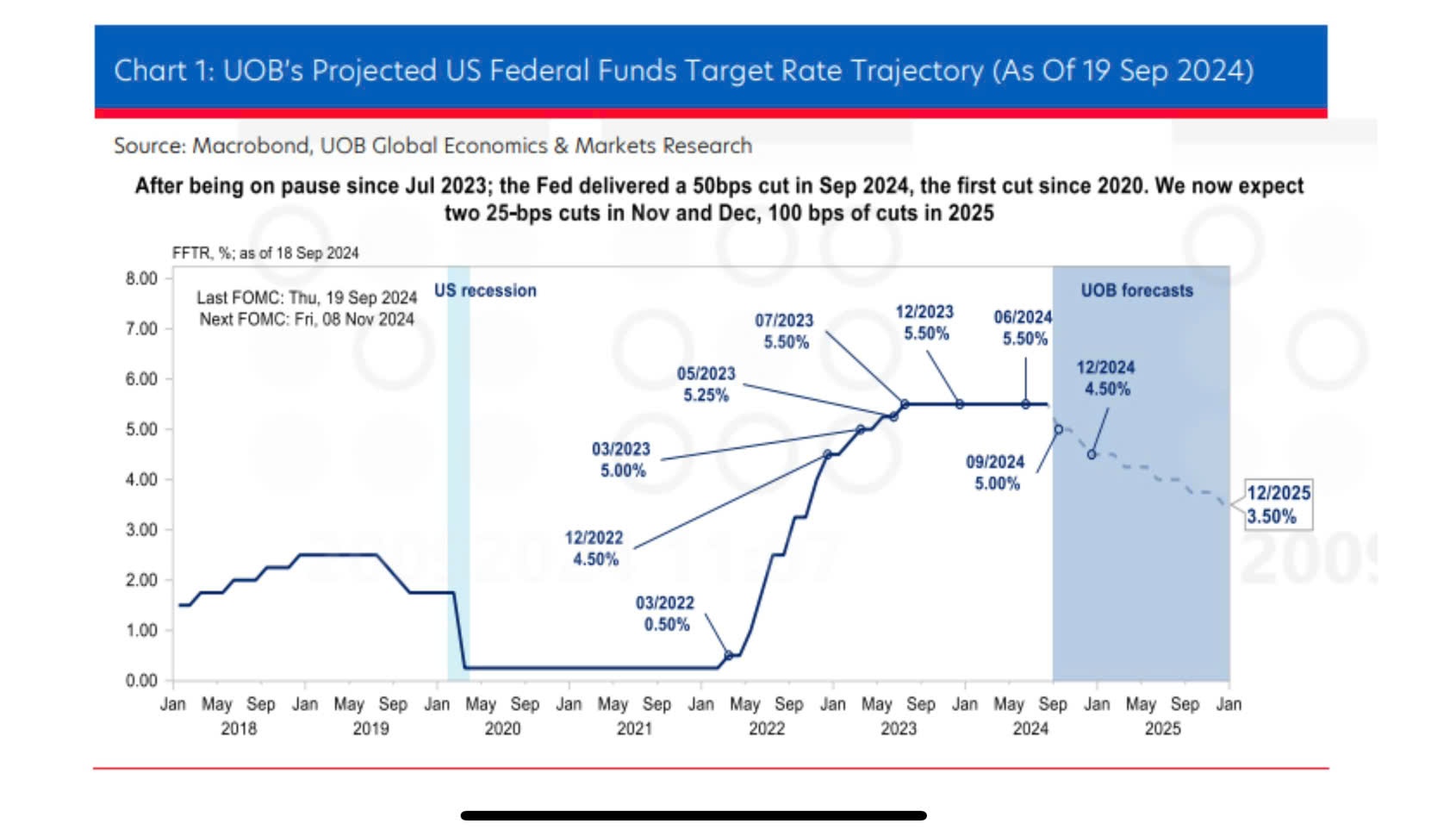

'A good strong start' to Fed’s rate cut cycle

20-09-2024 16:38

The bumper 50 basis points (bps) interest rate cut announced by the US Federal Reserve at its September meeting may increase the likelihood and pressures of the State Bank of Vietnam (SBV) considering similar policy easing.

Central bank preparations underway for Fed rate move

19-09-2024 22:00

Investors have increased their bets on a strong interest rate cut by the US Federal Reserve next week. Trinh Ha, a financial market analyst from Exness Investment Bank, explained more to VIR’s Phuong Thu about the rate cute scenario and its impact on the Vietnamese markets.

Credit support for businesses on offer after Typhoon Yagi

19-09-2024 15:21

The banking sector is sharing the burden with businesses by reducing interest rates on existing loans and providing unsecured credit for new ones to help those affected by Typhoon Yagi.

Banks required to list suspect accounts for better supervision

17-09-2024 17:30

Commercial banks must provide information on accounts that show possible signs of fraud, swindling, or law violations at the State Bank of Vietnam (SBV) 's request every month.

Banks set to stimulate credit growth in last quarter

16-09-2024 12:22

Banks are developing favourable credit schemes for the manufacturing and business sectors, while relaxing lending standards across all customer groups and the majority of loan sectors in the last quarter of the year.

SBV orders debt relief and lending support following Typhoon Yagi

11-09-2024 14:35

The State Bank of Vietnam (SBV) has instructed credit institutions to consider offering interest rate reductions, debt restructuring, and new lending support for borrowers impacted by Typhoon Yagi.

SBV offers fresh catalyst for growth

10-09-2024 10:33

The State Bank of Vietnam’s efforts to lower interbank interest rates and increase credit limits for banks will provide additional momentum for growth, with economic recovery pace being crucial to sustaining credit demand.

Uneven credit growth registered in first eight months

06-09-2024 10:01

Credit growth rebounded in August after July's slowdown, but it remained uneven, with Hanoi's rate nearly triple that of Ho Chi Minh City.

Bad debt risks make banks switch focus

04-09-2024 08:00

Vietnamese banks are increasingly shifting their focus from retail lending to corporate clients, driven by concerns over rising bad debts in the retail segment and heightened risk perceptions.

Reference exchange rate continues going up

30-08-2024 10:33

The State Bank of Vietnam set the daily reference exchange rate for the US dollar at 24,224 VND/USD on August 30 up 4 VND from the previous day.

Central bank takes looser monetary measures

29-08-2024 17:33

The State Bank of Vietnam (SBV) has relaxed monetary measures in the context of sharp declines in the foreign exchange rate in recent days.

New policy promotes green banking development in Vietnam

27-08-2024 09:08

The State Bank of Vietnam (SBV) is pushing all credit institutions to go green in terms of banking and credit.

Reference exchange rate up at week’s beginning

27-08-2024 08:49

The State Bank of Vietnam set the daily reference exchange rate for the US dollar at 24,254 VND/USD on August 26, up 4 VND from the last working day of previous week (August 23).

Vietnamese, Lao central banks discuss cooperation in using local currencies in bilateral trade

23-08-2024 10:08

The State Bank of Vietnam and the Bank of Laos have jointly organised a conference to share experience in promoting the use of respective domestic currencies in bilateral trade and investment cooperation activities to prevent external risks.

Mobile Version

Mobile Version