Saigon Port’s upcoming IPO in the spotlight

The company is one of the oldest and largest port operators in Vietnam. But its market share has been declining and a substantial portion of its operations are being shut down. The real value of the company is in its property holdings, which include prime locations in the centre of Ho Chi Minh City that are being converted to residential and commercial development projects.

Established in 1863, Saigon Port is a subsidiary of Vietnam National Shipping Lines (Vinalines). Saigon Port is located in the Ho Chi Minh City area, one of the most active port areas of Vietnam. According to the Vietnam Port Association (VPA), the company has the second highest throughput in the south of Vietnam, after Saigon New Port which owns the Cat Lai port area. But, Saigon New Port’s throughput in 2014 was four fold of that of Saigon Port thanks to its strategic location in the Cat Lai area and its connectivity to completed infrastructure. From 2008, in order to reduce transportation pressure in urban areas, Ho Chi Minh City relocated its port system towards the Cat Lai area and outlying areas of the city. This created a substantial loss in market share for Saigon Port. From 2010 to 2014, the throughput of the company decreased from 11.6 million tonnes to 10.9 million tonnes and its market share decreased from 4.5 per cent to 2.9 per cent while the throughput of Vietnam’s port system increased gradually from 260 million tonnes to 370 million tonnes.

According to the socio-economic development master plan of Ho Chi Minh City, starting from July 2016, Nha Rong Khanh Hoi Port, which accounts for 50 per cent of the company’s facilities and equipment and contributed about 50 per cent to the parent company’s revenues will be shut down. At that time, its replacement, Saigon Hiep Phuoc will not have completed construction. The company’s revenues are therefore expected to decline 17 to 18 per cent year-on-year in 2017 and 2018. The company’s other main ports of Tan Thuan and Tan Thuan 2 operate at nearly full capacity and cannot be expanded, limiting its growth potential.

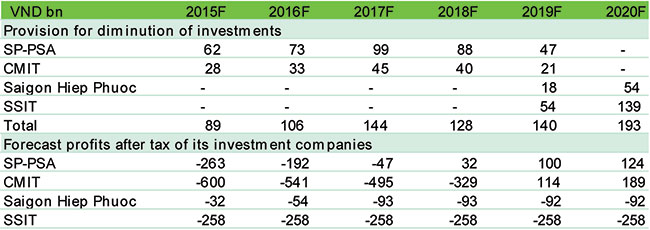

Additionally, the company has to make provisions from VND89 billion ($4 million) to VND193 billion ($9 million) each year from 2015 to 2020 for its investments based on their performance capability. These amounts will reduce the profitability of Saigon Port and damage its financial position.

The good news is that the Nha Rong Khanh Hoi property will be transformed into a 32.1 hectare complex residential area with commercial centers, condominiums and villas. The invested capital for this project is estimated to be VND11 trillion ($512 million). Saigon Port will own 26 per cent of this project. This is not Saigon Port’s only property. In total, the company owns 1.3 million square metres of rental lands. These include large areas located in central business district of Ho Chi Minh City. This land bank has a very low land rental fee and is carried on the company’s balance sheet at a very low price. The total value of land after reassessment value is only VND246 billion ($11 million). We believe that with these strategic locations, the company’s land value should be much higher than its book value.

At the initial auction price of VND11,500 per share, the 2014 price/earnings ratio of Saigon Port is 40.8x, which is much higher than the port industry average of 8.3x.Thiswould make the company substantially less attractive than its peers. However, the 2014 price/book ratio is only 1.1x, much lower than the port operator industry average of 1.7x and very cheap for a property company, especially considering the low book value of the land bank relative to its market value.

By Nguyen Thi Quynh Trang Research Department VPBank Securities Company

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version