Safely navigating choppy bond markets

|

| Nguyen Quang Thuan, chairman of the board cum CEO at FiinGroup |

Recently, bond investors have been pushing for early maturation, and many businesses have actively returned money to investors. The decrease in new issuance activity in the first nine months of 2022 has resulted in a significant reduction in the outstanding balance of corporate bonds. This means, although early maturity has created turmoil in the bond market and has spread to the stock market, the risks to the financial system are more-or-less under control.

The outstanding balance of corporate bonds as of September 30 accounted for approximately 15 per cent of Vietnam’s GDP. Corporate bonds issued by banks are low-risk.

Looking at China, where corporate bond outstanding loans amount to $8 trillion, accounting for 44 per cent of China’s GDP, turbulence from the bond market for the previous two years has still been managed. Therefore, Vietnam has no reason to collapse, even in a widespread default.

Liquidity matters

Like bank credit, some businesses will inevitably be late in paying interest and/or bond principal. This is partly due to the credit quality of the issuers, which have been unlisted enterprises and one-project companies with high financial leverage, weak credit profiles not well-established to face difficulties in credit growth, high-interest rates, and industry-specific difficulties like frozen licensing procedures in real estate. In other cases, they have unfortunately invested in businesses under scrutiny from management agencies, as with some recent high-profile incidents.

So if a bond default occurs, the first action for bond investors is probably to review the bond purchase contract to see if there is a clause on whether they are allowed to sell it back to the issuer or the intermediary distribution unit, a securities company.

However, early settlement or maturity may not be feasible, depending on the financial situation and capability of each business. Securities companies do not always want to, or can, help customers buyback, as their capital resources are limited, while most contracts today specify that they are not obligated to do so. They can only redeem when they have another customer willing to take over the bond, which is currently unlikely.

Moreover, while the charter capital of a securities company may be large, liquidity is not always enough to buy back from investors, especially amid credit tightening and the current stock market slump. The equity capital of securities companies is mainly used for margin lending activities and their own investment and trading.

In fact, cutting losses in bonds is more difficult than stocks because we do not have a centralised secondary trading market. Even if we do, bonds are very illiquid, and the transaction value is often high in large batches. To trade in large lots, it still takes time for dealers to find counterpart buyers before they can be transferred to an exchange that standardises procedures and identifies ownership.

Collateral can be helpful. However, when a default occurs, collateral is no longer valuable, especially for individual investors or non-bank organisations. If the bond has collateral, in the case of liquidation of such collateral, the bondholder will be prioritised over the unsecured bonds.

|

Ways out

So, is there a more efficient approach? Payment of bonds by bondholders or issuers in exchange for goods or services is a common practice in the Chinese market. Some Vietnamese real estate companies have followed suit, adopting this approach in recent years. Numerous real estate companies in the Vietnamese market have done this for their bondholders. They will not repurchase bonds but instead facilitate their exchange for housing options such as land lots, apartments, and condos.

The only issue is that the value of the land lot is generally larger than the bond value, so investors may locate a group of bondholders to collect and convert into joint ownership of that land. In addition, this project or real estate legal component may bring legal risks, so investors must thoroughly evaluate its legal status.

So, if none of the aforementioned options is viable, are there other ways out? A debt relief agreement plan is what is needed. The Chinese bond market is seeing a surge in demand for this choice.

Instead of forcing businesses or securities companies to buy back, bond investors require creditor representatives or distributors to negotiate with businesses and prolong the repayment term, combined with a payment portion or extend bond maturity.

This will aid bond issuers in resolving their own challenges, and investors could recoup their investments in the future. Depending on the evaluated or renegotiated degree of risk, investors may bargain to maintain or raise bond interest rates.

Therefore, this alternative necessitates the responsibility and accountability of all relevant financial institutions, including advisors, distributors, and, most importantly, bondholders or collateral managers.

Decree No.65/2022/ND-CP amending and supplementing Decree No.153/2020/ND-CP on the private placement of bonds, which went into force in September, also allows businesses to issue corporate bonds for debt refinancing, but only for the business itself. We believe that will reinforce the need for businesses to find other channels to refinance, particularly real estate firms that own many subsidiaries/affiliated companies to develop projects.

Nevertheless, all information and the plan for capital use must be open, transparent, and unambiguous.

State management authorities have played an important role by instructing commercial banks to expand credit room for real estate businesses selectively, or lowering interest rates for authentic home buying demands, setting up real estate relief funds, and acquiring projects from insolvent developers. The most significant result is to boost confidence among investors and stabilise the whole market.

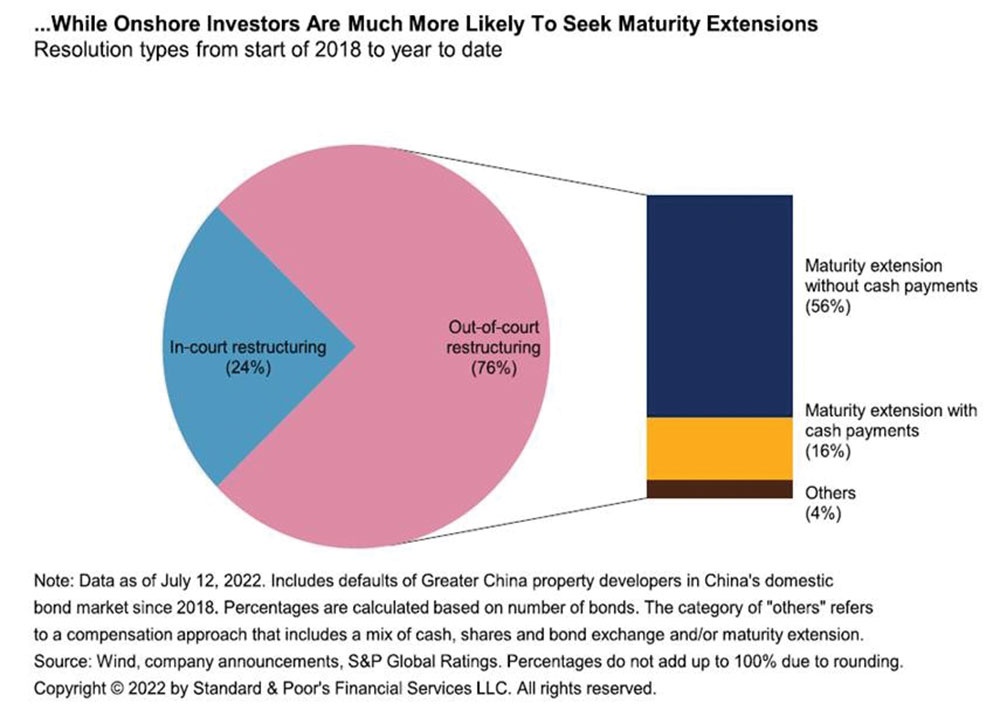

Most corporate bond defaults in China are resolved amicably by market players rather than requiring the involvement of courts or regulatory bodies, accounting for around 76 per cent, while only 24 per cent were in-court restructuring.

Around 56 per cent of these distressed debts have extended their maturity time without cash payment, while only 16 per cent are bonds with maturity extension with cash payment.

Bond maturity extension is similar to refinancing or debt restructuring that Vietnamese credit institutions have undertaken, particularly during the pandemic.

The current corporate bond market requires the close-knit companionship of bondholders, investors, and issuers, and responsibility when investing in a high-risk asset.

Bond issuers must also perform their debt obligations and publish transparent information to the public. Other intermediaries should be involved in the process, and the state management authorities should also develop clear, specific measures, and interventions.

In conclusion, challenges from corporate bonds, if defaulting, pose some risks to Vietnam’s financial and credit system, but not to a devastating degree. Bondholders should stay calm and negotiate with issuers and intermediaries to find the most viable options.

| Corporate bond market reform adds safety net for investors The fresh and stringent legislative framework for the corporate bond market is slated to pave the way for a better debt sector in Vietnam, while the interests of issuers and investors could be safeguarded. |

| New regulation increasing transparency in corporate bond market The government has promulgated Decree No.65/2022/ND-CP to amend and supplement certain articles of Decree No.153/2020/ND-CP on corporate bonds. Decree 65 took effect on September 16. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version