New regulation increasing transparency in corporate bond market

Taking a slightly different approach from an earlier draft version, Decree 65 does not increase the statutory conditions for issuing bonds. Instead, Decree 65 focuses on tightening the eligibility for natural persons to be treated as “professional securities investors” to mitigate market risks and add more detailed requirements on the offering dossier, offering public disclosure to strengthen the transparency of information in the bond market.

|

| Duyen Ha Vo, senior partner at Vietnam International Law Firm |

Decree 65 applies to both VND and foreign currency bonds, but the implications for VND bonds are more substantial.

According to FiinRatings, during the first seven months of 2022, only 10.11 per cent of the bonds by value were purchased by individual investors in the onshore primary market but as high as 32.6 per cent of the bonds by value were purchased by individual investors in the onshore secondary market.

The tightening of the rules relating to individual investors and public disclosure requirements is intended to protect investors and the stability of the capital market. FiinRatings predicts that the onshore bond market will unlikely bounce back until the second half of 2023 while issuers, agents, and investors are working to fit with the new rules.

Permissible funding purposes

Decree 65 removes the line “increasing the operating capital scale” from the permissible funding purposes of a bond offering plan. The following funding purposes are retained:

a) Funding investment projects or investment plans;

b) Restructuring existing debts of the issuer; or

c) Other purposes permitted under the laws governing the business sector of the issuer.

Decree 65 is ambiguous as to whether a bond offering may fund investment projects or investment plans of the bond issuer’s subsidiaries or only investment projects or investment plans of the bond issuer. This should be further clarified with the Ministry of Finance.

The above funding purpose rules apply to both VND bonds and foreign currency bonds, but foreign currency bonds may be additionally subject to funding purpose conditions under the regulations on foreign borrowings of the State Bank of Vietnam.

Professional securities investors

As background, under the laws, only professional securities investors (PSI) may purchase and trade in VND corporate bonds (except investors who qualify as strategic investors with respect to convertible bonds and bonds with warrants).

Decree 65 does not change the definition of PSIs. However, it supplements the identification of natural person PSI. A natural person must hold listed securities with a minimum value of VND2 billion ($84,000) as determined by the daily average market value of the securities portfolio (excluding the value of margin trading payables and repo transactions) for a period of at least 180 consecutive days immediately prior to the date of determining the PSI status.

Additionally, the PSI status of a natural person once determined is valid for only three months. The above new rule is more stringent than the prior rule which followed the standard PSI rules of the securities laws. Under the prior rule, the 180 consecutive days criteria were not required, and the PSI status once determined was valid for one year. Note that the above new rule does not apply to institutional investors.

Decree 65 restricts the sale of bonds to a non-PSI investor or the contribution of capital to make a joint investment in bonds with a non-PSI investor in any form. When selling bonds in the secondary market, the seller must disclose in full to the buyer all the disclosures previously provided by the issuer in accordance with this Decree 65.

Amending the terms and conditions of the bonds

Decree 65 requires that amendments to the terms and conditions of a VND bond be subject to the following rules:

(i) Approval by the competent corporate body of the issuer pursuant to its constitutional documents; and

(ii) Approval by bondholders holding 65 per cent or more of the total outstanding bonds.

VND bonds issued before the effective date of Decree 65 may also be amended but the tenor of the bonds must not be amended.

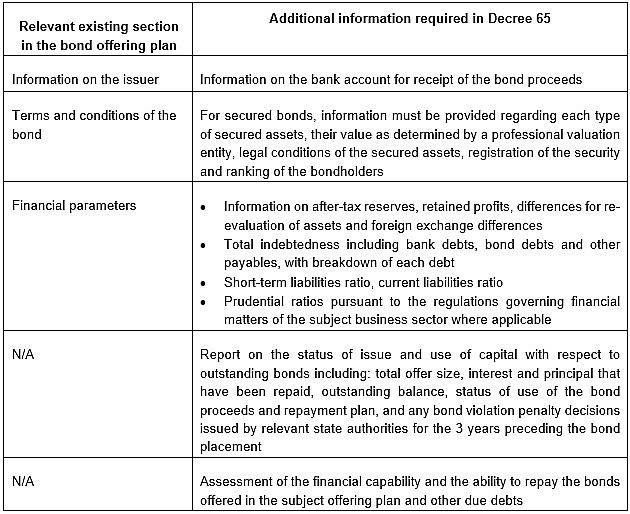

Additional requirements on the contents of the bond offering plan

Decree 65 imposes additional requirements on the bond offering plan. It is however unclear whether these requirements would apply only to VND bonds or also to foreign currency bonds. This may be subject to the interpretation of the State Securities Commission.

The following rules are notable additional contents required to be disclosed in the bond offering plan:

|

Other notable changes

Decree 65 also introduces the following important changes with respect to VND bonds:

(i) It increases the par value from VND100,000 to VND100 million or multiples of that; and

(ii) It reduces the bond distribution period from 90 days to 30 days from the disclosure date, and the aggregate bond offering period for multiple tranches offering from 12 months to six months.

Duyen Ha Vo, Tung Nguyen, and Nghiem Nguyen, VILAF.

| Changes in regulations to strengthen private placement bonds Decree 65 amends regulations on bond issuance purposes to strengthen the responsibilities and obligations of issuers in using raised capital for the right purposes. |

| Corporate bond market reform adds safety net for investors The fresh and stringent legislative framework for the corporate bond market is slated to pave the way for a better debt sector in Vietnam, while the interests of issuers and investors could be safeguarded. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version