Rising material and feed costs bridle husbandry companies

|

The consecutive increases of animal feed prices over the last few months have caused a lot of challenges for farmers. In March, farmer Nguyen Van Hau in the southern province of Dong Nai’s Trang Bom district received notices of increased prices from all leading animal feed producers. Of these, Japfa Comfeed raised its asking price five times in the period, while others like C.P., Masan, Cargill, De Heus, Emivest, Greenfeed, and more are said to have adjusted prices six times.

The average increase has been around VND400-800 (1-3 US cents) per kg, the highest rise ever, with companies warning that further rises could follow in the months to come.

Hau said that the increases in March were twice as high as regular adjustments. “They have changed the price 5-7 times since last October, with a total of around 17-30 per cent. Sales officers even advised us to order as much as possible, because prices would continue to rise,” Hau said.

Meanwhile, in the north, Hoang Manh Ngoc, an egg and poultry farmer from Hanoi’s Dong Anh district, said that the price of poultry feed has increased by 50 per cent, from VND800 to VND1,200 (3-5 US cents) per kg, while feed for pigs has increased by 30 per cent or VND1,500 (6.5 US cents) per kg.

Mixed fortunes

Since mid-2020, the price of animal feed has been rising, a trend that turned into a surge at the end of the year. Among the causes have been price hikes in key cereals such as corn and soybeans, which rose by 20 per cent last month. Even the prices of some additives like lysine and amino acid doubled.

Explaining the spiking prices, a representative of Japfa Comfeed said that the pandemic hit global logistics, significantly escalating freight costs. “One more reason is that China has suddenly started buying record quantities of input materials,” said the representative. Numerous animal feed producers agreed that instead of purchasing materials for the whole quarter or year, they were now only able to buy enough for a single month.

Involved stakeholders expected that the selling price of animal feed will rise by another VND1,000 (4 US cents) per kg in May or June, when batches are being produced. However, these changes will depend on the global market.

Vietnam is one of the top producers of animal feed in ASEAN. However, the local agricultural production can only provide around four million tonnes of bran and four million tonnes of cassava – both important raw materials for animal feed – while the demand is around 27 million tonnes. Meanwhile, other key ingredients like soybean and wheat are not strong advantages of Vietnam.

Thus, the country has to import 70-80 per cent of materials for animal feed production. According to the Ministry of Industry and Trade, in 2020 the import value of these products, as well as additional animal feed, amounted to around $3.84 billion, up 3.75 per cent on-year.

Amid the price increases for raw materials, small-scale animal feed producers are said to be hit directly, as their supply is decreasing significantly. While they often have to wait for new resources, they themselves have to raise their prices to stay competitive.

“Resource prices increased as fast as during the inflation in 2008 (over 21 per cent),” said farmer Hoang Manh Ngoc from Dong Anh district.

However, at present, despite the sharp increase in animal feed prices, chicken was sold 40 per cent cheaper than in the previous year as demand has been falling in the last few months.

In the case of pig farming, although the selling price of live hogs remains high, the surge in rates for animal feed also impacted re-herding efforts. The representative of Japfa explained that around 250kg of feed valued at around $130 is required to fatten a pig up to 100kg of body weight.

But as increased prices for feed have added another $13-22 to the cost, in addition to fees for vaccination and other expenses, “breeders, animal feed producers, and numerous farms do not want to expand their operations to control risks and losses,” said the representative.

|

Narrowing production

Amid these challenges, another representative of a local animal feed producer said that they have halted production for two days per week, and general productivity was reduced by 50 per cent, “because the more we work, the more we lose,” he said.

Dabaco Group, one of the leading local husbandry firms, has been facing hurdles in importing materials for its oil pressing and animal feed plants since January due to the interruption of global logistics.

One of the company’s vegetable oil plants runs around 18-20 days per month only because imported soybeans are not enough, despite the facility’s extensive material storage for up to 100,000 tonnes.

According to Pham Duc Binh, vice chairman of the Animal Husbandry Association of Vietnam, the price of animal feed and ingredients, which will continue to rise, will hit the husbandry sector significantly, potentially pushing some small-scale players over the brink to bankruptcy.

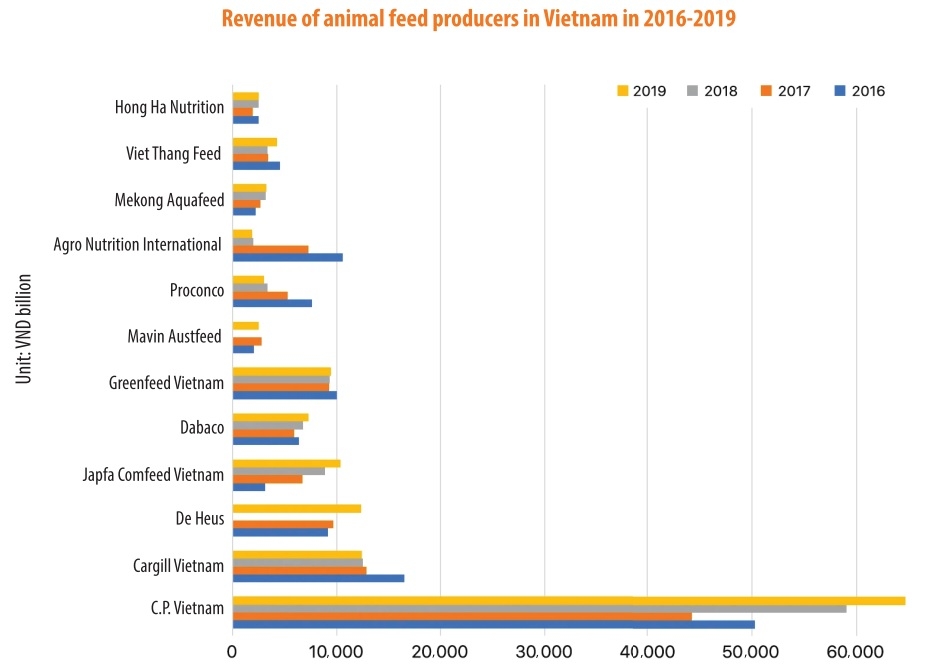

Meanwhile, large companies can predict market changes and cushion them with larger stores of materials. “Due to the delay of import materials and production, this month, numerous factories started to use resources that were bought at the highest prices, so the selling price of animal feed is going to rise soon. However, big players with affordable materials storage such as C.P., Japfa, and Cargill will dominate the market and push others into losses and even bankruptcy,” said Binh.

For the husbandry sector, it is a big risk to depend on imported materials and animal feed, as price changes remain unpredictable. Small-scale farms are among the most vulnerable to cost rises.

“However, this brings not only a lot of challenges but also opportunities for closed husbandry companies which can cover all phases of the production chain including feed production, husbandry, slaughter, and food processing. As these companies can share risks between the different production stages, they can offset some losses and overcome difficulties. Others with strong capital can also survive for a longer time,” Binh added.

At present, there are about 265 animal feed plants across the country, 85 of which are foreign-invested. However, the latter makes up 65 per cent of the animal feed market.

According to one source, C.P. Vietnam covers around 17 per cent of total market share, while 5-6 per cent is captured by Masan, Japfa, and De Heus each. Another 2-4 per cent features Emivest, Greenfeed, Cargill, New Hope, CJ Vina Agri, Lai Thieu, and Dabaco each.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version