Rich get richer in feed game as farmers toil over costs

|

Yet to recover from the losses caused by African swine fever (ASF) over the last two years, numerous farmers are going bankrupt because the price of animal feed has skyrocketed in recent months.

As a farmer in the northern province of Hung Yen’s Khoai Chau district, Tran Van Lap used to breed about 400 pigs and dozens of sows. But now there are only 16 pigs in his thousands-of-square-metre farm. After more than 30 years of doing husbandry, he has never been as anxious as present.

After efforts to pay off debts investing into pigs was ruined by ASF in 2019, last year, Lap borrowed VND500 million ($22,000) from the bank to develop a safe and modern farm. However, the sharp increase of animal feed has put new plans on the rocks.

“It takes 10-12 bags of animal feed to breed a pig, at a price of VND300,000 ($13). However, it has risen by VND60,000 ($2.60) per bag, while corn prices have also risen by VND4,000 (17.4 US cents) per kg. So I have to spend an additional VND30 million ($1,300) on animal feed in addition to the cost of medicine and breeding pigs,” Lap explained. “Additionally, the price of a breeding pig is still VND3.1 million ($135) higher than before ASF. The expenses outweigh profit, so the more pigs we breed, the more losses we sustain. I have been trying to sell them to cut my losses and give up husbandry altogether.”

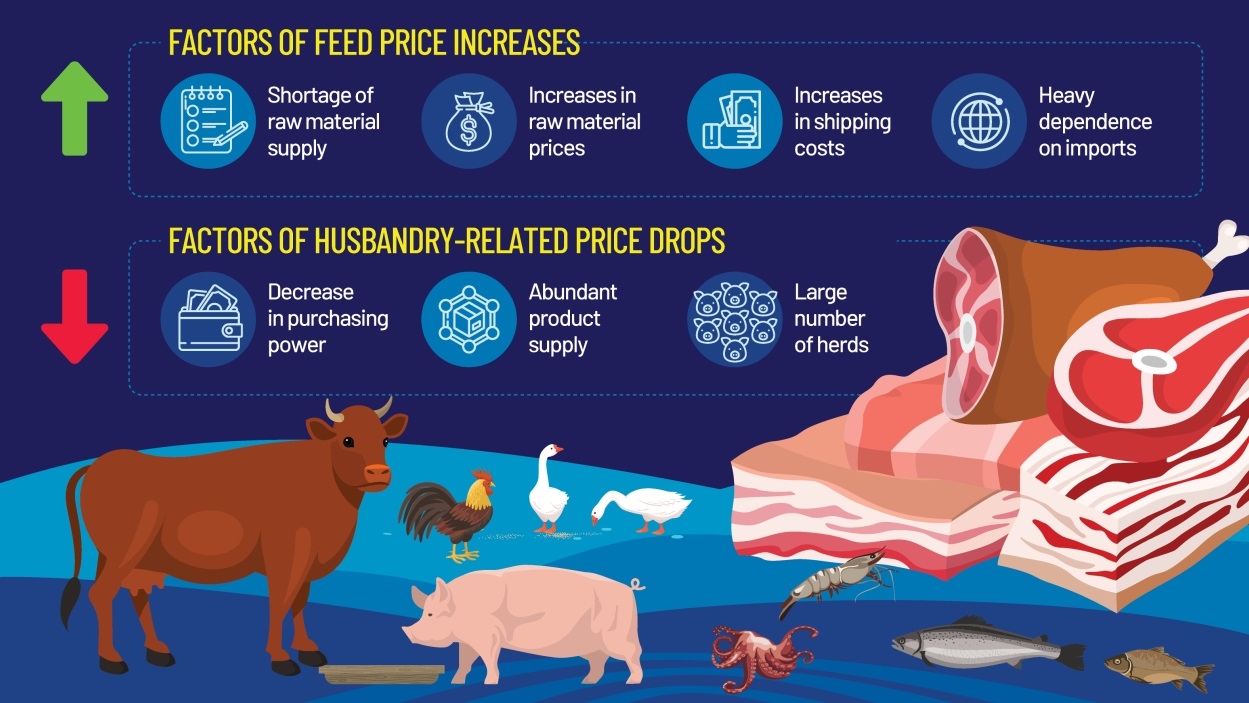

Pham Duc Binh, deputy chairman of the Vietnam Animal Feed Association, said that the movement of the market is unpredictable because of the coronavirus pandemic and continuing ASF risk as well as the climbing price of animal feed materials, which make up 80-85 per cent of the total expense of farming.

Binh said that animal feed production is controlled by importers and foreign businesses, while Vietnam only produces rice bran and cassava and has failed to develop areas to grow raw materials to produce feed because of poor productivity. The animal feed supply chain is also not comprehensive enough.

“The dependence on imports and the sharp increase in global prices of raw materials due to crop failures, along with China buying record quantities, means input prices have increased sharply. The lack of empty containers, which are stuck in various ports around the world, has also increased the price of imported raw materials,” Binh explained.

He also emphasised that all the maize used for production of animal feed is imported. Maize costs are rocketing the most recently due to prolonged dry weather in Brazil.

The price of the product has risen consecutively by 35 per cent over April and May, reaching a peak not seen since 2013. Additionally, the price of soybean has soared by 23 per cent and wheat by 12 per cent compared to earlier in the year.

Sharp increases

Supply has been affected by natural disasters, especially abnormal weather in the United States and South America, while the demand increased sharply, affecting the supply-demand balance of grain and feed ingredients.

“Another important reason for the increase in corn prices is the strong demand in Asia, especially China, as the pig industry recovers and the demand for meat increases again as COVID-19 gradually passes,” added Binh.

While the costs are increasing day by day, the selling price of live hogs has been declining to rock bottom over the last year at about VND68,000 ($2.95) per kg, down VND10-20,000 (43-87 cent) per kg over the first quarter of the year and earlier.

Explaining the drop in pork selling prices, Nguyen Van Trong, deputy general director of the Department of Livestock Husbandry at the Ministry of Agriculture and Rural Development, said that in the first quarter, Vietnam imported around 34,600 tonnes of pork, a rise of 101 per cent on-year. Moreover, as farmers cannot suffer a sharp increase of animal feed consecutively over several months, they sell pigs as quickly as possible to cut losses.

Talking to VIR, a representative of Indonesian husbandry firm Japfa Comfeed Vietnam expressed the group’s worries over farmer partners cutting down pig populations in their farms. “It is serious if a large population declines, because it will lead to significant shrinkage in all production lines – from producing animal feed, breeding, and slaughtering, to processing, as well as affecting the jobs and income of hundreds or thousands of employees.”

However, Trong of the Department of Livestock Husbandry emphasised, “At a selling price under VND70,000 ($3), only big husbandry companies can be profitable because they produce and carry out business across all stages, while farmers have to depend on them totally.”

Stellar profits

In fact, some of the biggest husbandry groups have recently revealed bumper profits. The annual report of Thai giant C.P. Vietnam highlighted that profit for the fiscal year 2020 reached $966.7 million, an improvement of 125 per cent on-year. Particularly, the agricultural business of the corporation generated $3.5 billion, up 25 per cent on-year, including $898.5 million of animal feed (up 1 per cent), $2.42 billion of breeding (up 36 per cent), and $155.4 million of food business (up 41 per cent). The profit of the corporation equals the leading manufacturers in Vietnam like Honda Vietnam (over $1 billion in 2019), and Samsung Electronics Vietnam ($1.2 billion in net profit).

Another local giant in husbandry, Dabaco Group, also reported huge profits in 2020 with VND10 trillion ($435 million) in revenues, up 39 per cent, VND1.4 trillion ($61 million) in net profit, almost five-fold that in 2019. Animal feed contributed VND3.1 trillion ($135 million), up 35 per cent, while breeding added VND5.94 trillion ($258.3 million), up 27 per cent.

The after-tax profit of these two areas were reported VND996 billion ($43.3 million) and VND1.045 trillion ($45.4 million), respectively, 4.6-fold and 13.7-fold those in 2019.

Phu Son Livestock JSC, a medium-sized company based in the southern province of Dong Nai, also reported business results much better than the yearly plan. Its revenue in 2020 was VND175 billion ($7.6 million), including VND86 billion ($3.7 million) of pre-tax profit, equivalent to surpassing by 53 per cent of the yearly revenue target, and 187 per cent of the yearly profit target.

One husbandry expert told VIR that the huge increases in animal feed prices should be questioned and that businesses may simply be trying to take advantage of the rise of raw material costs in order to gain more profits.

| Export of animal feed flying high in early 2021 While the input costs and selling prices have soared, the export turnover of animal feed has also been growing. According to the General Department of Vietnam Customs, the total export value of animal feed in the first quarter in the country was $201.18 million, up 33.8 per cent on-year. Of this, in March only, the value was $90.58 million, a rise of 93.2 per cent on-month and 50 per cent on-year. Also in March, Vietnam’s export of animal feed to China soared remarkably by 251.7 per cent on-month, and 146 per cent on-year to $35.45 million. This contributed to raising the total export turnover to China in the first quarter to nearly $52 million, up 80 per cent on-year, surpassing Cambodia and making up 25.8 per cent of the total export turnover of animal feed of the country. Cambodia captured 16.7 per cent of Vietnam’s total export turnover of animal feed in the first quarter, and increase of 22 per cent on-year. Particularly in March, the export value to this market soared by 58.9 per cent on-month and by 20.7 per cent on-year to $13.5 million. The export value of animal feed to India in the same month reduced by 20.2 per cent on-month, and by 16.7 per cent on-year to $6.02 million. However, in the first quarter, the export value to this market was reported to have increased 22.6 per cent on-year to $24.75 million. Meanwhile, after sharp drops in February, the export value of animal feed to the United States in March increased by a huge 122 per cent on-month, and 44.2 per cent on-year to $9.45 million. Generally in the first quarter, it rose by 36.6 per cent on-year to $23.67 million. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version