Raising climate capital in emerging Asian markets

|

| Martin Lim, prinicpal project manager of the Sustainability and Resiliency Office at Surbana Jurong |

The United Nations reported that around 380,000 people in 20 countries have been affected by floods since August. There are also reports of increasingly severe droughts in Vietnam affecting millions and cutting off access to clean water for essential daily activities.

Around $90 trillion of investment is needed over the next 15 years to overhaul and replace ageing infrastructure in advanced economies and address the higher growth and structural change in emerging markets and developing countries, especially with rapid urbanisation taking place in many first- and second-tier cities.

Investing in sustainable infrastructure is key to tackling the three central challenges facing the global community: reigniting growth, delivering on the UN Sustainable Development Goals, and reducing climate risk in line with the Paris Agreement. The definition of infrastructure includes both traditional types of infrastructure such as public transport and sanitation, and also natural infrastructure like forests and wetlands.

Internalising climate adaptation

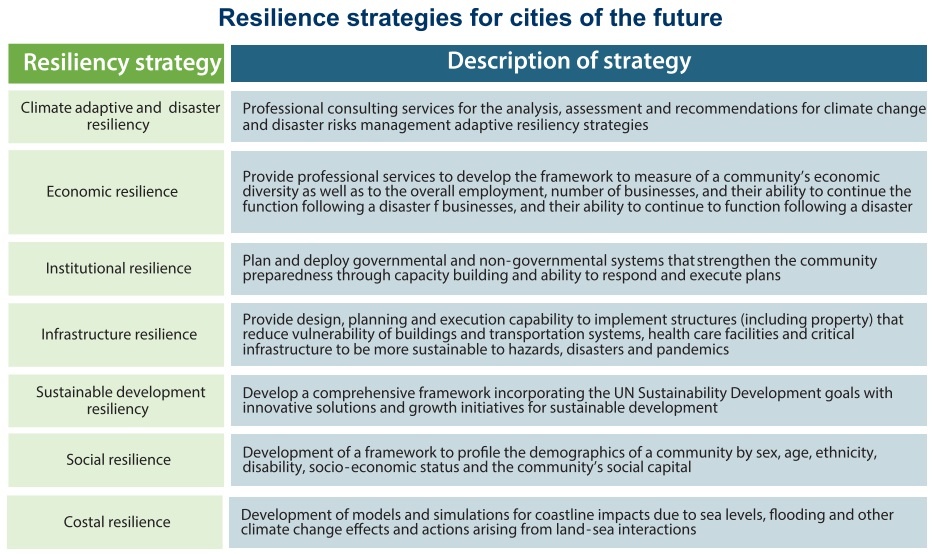

Restoring livelihoods and rebuilding economic and social infrastructure requires substantial financial resources, necessitating the development and implementation of financial strategies to manage disaster risks. Cities that directly face the threat of damage from climate change and biohazards will play a proactive role in building resiliency into overall master plans.

Where governments have been receptive to tackling head-on the challenges of climate change, foreign investors have underscored this confidence and have forged partnerships to pursue urban development projects, leveraging technical expertise to build smarter and greener.

Nippon Koei, an international engineering consultant, and Surbana Jurong, a global multidisciplinary urban and infrastructure design consultancy, signed an MoU in 2020, committing to deliver sustainable and resilient solutions to urban and infrastructure development projects worldwide. Under the MoU, Nippon Koei and Surbana Jurong will combine their knowledge and experience in climate change adaptation, resilience enhancement, and smart technologies to deliver these solutions.

The two firms have been collaborating on sustainability and resiliency since 2018. A notable project is the 9,460-hectare New Clark City in the Philippines. Building on our strong ties, Nippon Koei and Surbana Jurong will identify sustainable project opportunities globally, especially in Asia where public-private partnerships can encourage the adoption of smart technologies to scale up urban initiatives and solutions.

The project teams will identify a resilient and sustainable framework that lowers the propensity for risks in Danang’s industrial, commercial, and infrastructure projects. The development is expected to emphasise the necessity for integrating disaster management and risk mitigation strategies into the design, planning, and construction phases.

Around 68 per cent of the economic losses in Danang are due to flooding. The project team envisions an infrastructure design for Danang that mitigates disaster risk through flood-control mitigation and adaptive strategies.

|

Gearing up financing

In 2015, the Sendai Framework for Disaster Risk Reduction 2015-2030 was adopted at the Third UN World Conference on Disaster Risk Reduction, as an international guiding instrument for disaster risk reduction through 2030.

The pressure is mounting for companies to account for climate change. Central banks and other supervisory authorities are now considering climate change as a risk to financial stability. This has led to the establishment of the Task Force on Climate-related Financial Disclosures (TCFD) in 2015, and the Network for Greening the Financial System in 2017, both concerned with enhancing climate-related awareness, risk management, and transparency.

In 2021, Surbana Jurong successfully priced a $186 million sustainability-linked bond to be due in 2031 under its $1 billion multicurrency debt issuance programme. This is the first first public sustainability-linked bond issuance from a Southeast Asia-based company. The offering was more than six times oversubscribed, drawing over $1.26 billion in orders.

If the sustainability goals are not met, Surbana Jurong has committed to pay investors a premium payment of 0.75 per cent of the redemption amount at maturity. The bond is issued in accordance with its newly-established Sustainable Finance Framework, guided by the Sustainability-Linked Bond Principles (2020) developed by the International Capital Market Association.

The sustainability-linked bond complements other funding initiatives. In 2018, Surbana Jurong and Mitsubishi Corporation set up a new fund management company to provide project owners with a capital bridge to drive urban infrastructure development, transit-oriented developments, and affordable housing targeting emerging Asian countries. Such ventures tap into both partners’ know-how across financing and investing, as well as technical and risk analysis to deliver sustainable returns.

Sustainability standards

In a 2019 Deloitte report, companies were already feeling the pressure to account for climate change risks and effects on their business. Central banks and other supervisory authorities are now considering climate change as a risk to financial stability.

There is greater awareness of accountability in sustainable development but the transformation to a sustainable financial system takes time.

Currently, over 1,500 organisations globally, including over 1,340 companies with a market capitalisation of $12.6 trillion and financial institutions responsible for assets of $150 trillion support TCFD. Traction for TCFD has been reinforced through the efforts of the World Business Council for Sustainable Development, the Institute of International Finance, the UN Environment Programme Finance Initiative, and other organisations. Although TCFD adoption is neither legislated nor regulated, many large asset managers and owners encourage investee companies to integrate climate-related risks into their risk management processes disclosing information in line with the Task Force’s recommendations.

Scrutinising assets through rigorous environmental, social, and governance (ESG) rating standards is a key strategy to assess climate-related risks. Infrastructure assets such as roads, railways, bridges, and other critical utilities require massive volumes of materials to build; construction lasts for years, often decades, and the impact on surrounding communities is sizeable. Given the tremendous impact on the environment and surrounding communities, it is important that investors and financers of such assets can rely on a credible system of assessing climate risk.

Infrastructure sustainability considerations vary and fluctuate depending on the different stages of design and project development, location, and requirements. Currently, there is no singular international framework that provides a holistic approach that fulfils industry-leading ESG factors.

Efforts are being made to create an international framework using a quadruple bottom line assessment framework to set and quantify sustainability goals from the design to operation stages. It also emphasises stakeholder engagement, good governance, and decision-making to ensure that projects maximise benefits. It is currently utilised in Australia and New Zealand to assess the sustainability of the planning, design, construction, and operation of infrastructure programmes and networks.

While the rating scheme is still new to the region, its standards could unlock various new value propositions. This includes helping clients unlock access to green funds for project financing and will result in projects with lower carbon footprint and reduced costs.

The challenge is urgent with a diminishingly narrow window because of capital lock-in, outpaced tech, and a shrinking carbon budget. We can build cities where we can move, breathe, and be productive where ecosystems are robust and resilient and where we can avoid the potential displacement of millions of people. This inclusive economic growth is significant as it will help eliminate poverty and reduce the risk of climate change. Now is the time to act.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version