Profit comes before ambition

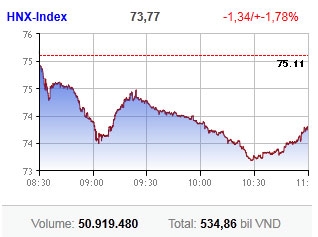

The Hanoi Stock Exchange’s (HNX) HNX-Index fell 1.34 points or 1.78 per cent to 73.77 points. Some 219 stocks ended lower with 85 hitting the floor, compared with 52 gaining and 115 unchanged.

Micro-cap and small-cap stocks lost the most, according to Vietstock.vn statistics. Mid-cap stocks also significantly fell.

Among the major stocks, banking shares Saigon-Hanoi Bank (SHB), Habubank (HBB) and Asia Commercial Bank (ACB) sharply lost 4-6 per cent each.

Security company shares Saigon-Hanoi Securities (SHS) and PetroVietnam Securities Inc. (PSI) hit the floor, while VnDirect Securities (VND) and Bao Viet Securities (BVS) significantly dropped off.

Liquidity reduced to 51 million shares worth VND535 billion ($26.1 million) on the northern bourse. Kim Long Securities (KLS) outperformed the market with 6.4 million shares traded.

Meanwhile, more than half of the Ho Chi Minh Stock Exchange (HoSE) sunk into red. Some 183 stocks were down with 70 hitting the floor, while were 60 up and 57 ended flat.

Most major stocks declined, led by Vincom Corp. (VIC) falling 2.52 per cent. Real estate stocks Licogi 16 (LCG), BECAMEX Infrastructure Development (IJC), Binh Duong Trade and Development (TDC), Hoang Quan Consulting-Trading-Service Real Estate Corp. (HQC) skidded.

Vietcombank (VCB) and PetroVietnam Finance (PVF) were among the top decliners.

The benchmark VN-Index, however, was supported by blue-chips Masan Group (MSN) and Bao Viet Holdings (BVH), adding 0.43 points or 0.1 per cent to 436 points.

Foreign investors boosted buying to more than six million units, accounting for net buying of VND67 billion ($3.3 million).

The HoSE’s total volume hit 41.5 million shares, worth VND708 billion ($34.5 million). Among them, some 4.4 million shares worth VND120 billion ($5.9 million) were negotiated.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Central Bank of Cuba chief visits Hanoi to work with VBSP (November 22, 2024 | 15:49)

- Credit sees steady growth towards year-end (November 21, 2024 | 17:46)

- HDBank wins three titles at Vietnam Listed Company Awards (November 21, 2024 | 10:01)

- VLCA’s corporate governance mission (November 21, 2024 | 10:00)

- The promotion of ESG via banking (November 21, 2024 | 09:32)

- Standard Chartered committed to Vietnam’s financial success (November 21, 2024 | 09:24)

- Full ESG adoption the priority for Agribank (November 21, 2024 | 09:07)

- Banks entice youth with tech advances (November 21, 2024 | 08:00)

- Banks shaping the future as business advisors (November 20, 2024 | 21:00)

- ESG represents a shift towards sustainability for banks (November 20, 2024 | 13:00)

Tag:

Tag:

Mobile Version

Mobile Version