Power purchase agreements just the ticket for Vietnam

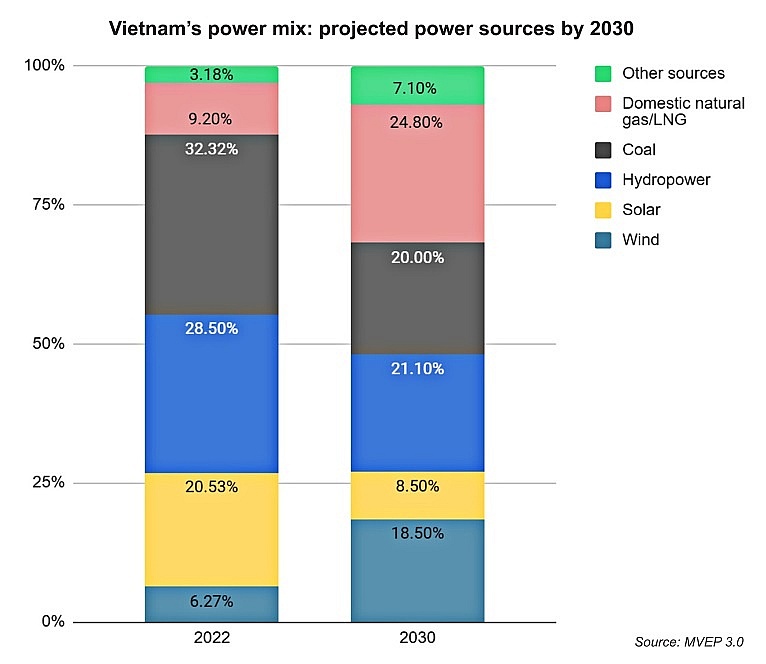

The Made in Vietnam Energy Plan (MVEP) 3.0 report, published by the Vietnam Business Forum’s Power and Energy Working Group in mid-November, said that the country needs needed clearer regulations and policies to support a clean-energy boom that would sustain its manufacturing ambitions.

|

It added that the country lacks clarity on policy and pricing, undercutting investor confidence and slowing negotiations on measures that would speed progress, for example allowing direct power purchases from energy producers.

“The lack of a clear long-term vision, and inconsistent policies are identified as barriers to investment and sustainability in Vietnam’s renewable energy sector,” the report said.

John Rockhold, head of the Power and Energy Working Group Steering Committee under the European Chamber of Commerce in Vietnam, said, “The most significant barriers for the development of renewable energy in Vietnam are divided into four groups of policies and legal framework: technology, standards, bankability, and human resources. Of these, bankability and its obstacles are relevant to power purchase agreements (PPAs), exposure to grid curtailment is an issue, while high risks related to project approval and perms are a headache.”

Bankability troubles

The transition from fossil fuels to meet the zero-carbon target by 2050 in Vietnam requires a lot of time, effort, and resources. The estimated $131 billion possibly needed for new power generation projects is expected to come from international and domestic private investors, with international power companies and development finance institutions identified as potential funding sources.

Furthermore, there is a perception that the global appetite for financing fossil fuel projects is diminishing, while the appetite for financing nuclear projects remains steady.

The MVEP emphasised that financing large power projects in Vietnam is seen as extraordinarily difficult, with some reporting instances of such projects falling through. Issues include the lack of a legal framework, approvals, PPA, pricing, funding mechanisms, and poor project management. Difficulties in financing liquefied natural gas power projects contribute to these challenges for development.

“Offshore gas pricing has been long delayed. Small-scale solar photovoltaic projects have received high support from local banks and investors, while offshore wind projects face the lowest level of support, possibly due to the complexity of the development and uncertainty of the regulatory time frame, and the hesitancy to invest large amounts of capital about $1.5-3 billion for an initial offshore wind farm of approximately 1GW capacity,” the MVEP report said.

Vietnam agreed on a $15.5 billion Just Energy Transition Partnership (JETP) funding deal last year to help finance its transition away from coal and to bring its peak-emissions date forward to 2030, but the plan has hit various hurdles around the cost of the funding.

The agreement calls for 47 per cent of Vietnam’s electricity to be generated from renewable sources by 2030, significantly higher than the 39 per cent forecast by the government’s power development roadmap. To attract more renewable energy investments, PPAs need to conform to international standards, the report said.

“On the bankability of PPAs, within Vietnam, there is a well-founded concern regarding curtailment risk, particularly with the significant rise in solar capacity observed in 2019 and 2020,” Rockhold said. “This surge had notable impacts on power system operations, leading to several solar projects to halt production unnecessarily, causing difficulties in repaying loans to banks on time.”

Vietnam’s government is not keen to guarantee agreements between investors and Vietnam Electricity (EVN), and that is apt to throw a wrench in the funding of projects through the JETP, Rockhold added.

The market landscape and financing demands are rising rapidly with each passing year. According to the financial results of major listed banks in Vietnam, electricity investment has increased from tens of billions of US dollars in 2021 to about $100 billion in 2025. This is set to grow by more than $200 billion in 2030 and $628 billion in 2050.

Meanwhile, if the growth rate of domestic bank loan balances is assumed to be 14 per cent per year, domestic bank loan balances will be $366 billion by 2050, far short of the money required.

Therefore, to implement the goals set forth, bankability is deemed critical. Some institutions are committed to decarbonisation of the global economy to reach net-zero emissions by 2050, and almost a dozen financial institutions have committed to mobilise at least an additional $7.75 billion in private finance. International finance groups are ready to engage as soon as bankable projects emerge.

Recommendations for PPAs

Kojima Masao, managing director and regional head of Vietnam at MUFG Bank, said that large-scale projects with long tenor and big-ticket sizes need project finance. The involvement of institutional lenders, such as export credit agencies and multilateral development banks, is necessary.

“Under global practice, the current PPA is not bankable to major international financiers,” he said. “From global investor and lender perspectives, the bankability issue is unique to the Vietnam market.”

Masao proposed that relevant risk allocation between the public and private sectors should be balanced to encourage large new investments into the power sector. This should be reflected in the PPA.

Specifically, in the PPA currently, EVN does not have the contractual obligation to purchase its entire production from wind and solar projects. The group only pays for the electricity it receives (a take-and-pay obligation), with no minimum purchase. Curtailment is due to, among others, constraints on grid stability, transmission and distribution system overload, local demand, and overall generation costs.

The tariff is indexed to USD but paid in VND, and there is no statutory obligation or clear guidance for the Ministry of Industry and Trade to approve electricity price adjustment due to foreign exchange rate fluctuation. Foreign exchange rate fluctuation affects not only foreign loan debt servicing but also imported fuel costs and other foreign currency denominated operating costs, as no guarantee provided in respect of VND to USD.

“In the event of a change in law that impacts the project’s economic outlook, no remedies are provided. There is also uncertainty as to the level and components of cancellation amounts in the event of PPA termination, and whether EVN will compensate an amount that is sufficient to cover outstanding debts and/or incurred investment costs,” Masao said.

He proposed that where there is an unfavourable change in the law or tax regime in Vietnam, the investor is entitled to an additional tariff and/or some other cost recovery measures to ensure cost recovery and maintain the level of investment return assumed in the project’s feasibility study or agreed financial model for the remaining period of the project.

“Model PPAs should include a buy-out mechanism with pre-determined purchase prices subject to different termination events. Termination of the PPA due to an EVN default should provide termination payments enough to cover outstanding debt and/or incurred investment costs,” he added.

| The Power Development Plan VIII sets out a vision for investment in Vietnam’s electricity sector to 2050, with a focus on renewable energy and new technologies. Currently, Vietnam generates 24GW, about half of its electricity, from coal-fired power plants, with growth to 30-37GW by 2030. With the goal of reducing the share of coal-fired power in the electricity mix, the plan sets a target of not building any new coal-fired power plants after 2030. By 2050, Vietnam will no longer use coal for power generation. Coal-fired power plants that have been in operation for 20 years will be converted to use biomass and ammonia fuel. Coal-fired power plants that are over 40 years old and do not convert to other fuels will be shut down. The roadmap is intended to help Vietnam reduce its reliance on coal and focus on the use of clean energy sources. The government also emphasises the role of international cooperation in research, technology transfer, financing, and capacity building from foreign partners. In particular, the Just Energy Transition Partnership is an important solution for the energy transition process in Vietnam. This is relevant to transition to a low-carbon economy and support Vietnam’s green development in the future. Currently, the Ministry of Industry and Trade is urgently developing the implementation plan. |

| 24 renewable projects show interest in direct power purchase agreement 24 renewable energy projects with a combined capacity of 1,773MW have expressed interest in participating in a pilot scheme for a direct power purchase agreement (DPPA) in Vietnam, according to the Ministry of Industry and Trade (MoIT) in a report submitted to Prime Minister Pham Minh Chinh las week. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- EVN awards EPC contract for Quang Trach II LNG project (February 10, 2026 | 09:00)

- Canada backs Vietnam’s green transition with AGILE project (February 09, 2026 | 17:41)

- Momentum is real in the race to net-zero emissions (February 02, 2026 | 08:55)

- $100 million initiative launched to protect forests and boost rural incomes (January 30, 2026 | 15:18)

- Trung Nam-Sideros River consortium wins bid for LNG venture (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Envision Energy, REE Group partner on 128MW wind projects (January 30, 2026 | 10:58)

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

Tag:

Tag:

Mobile Version

Mobile Version