Placing Vietnam at the centre of US attraction

|

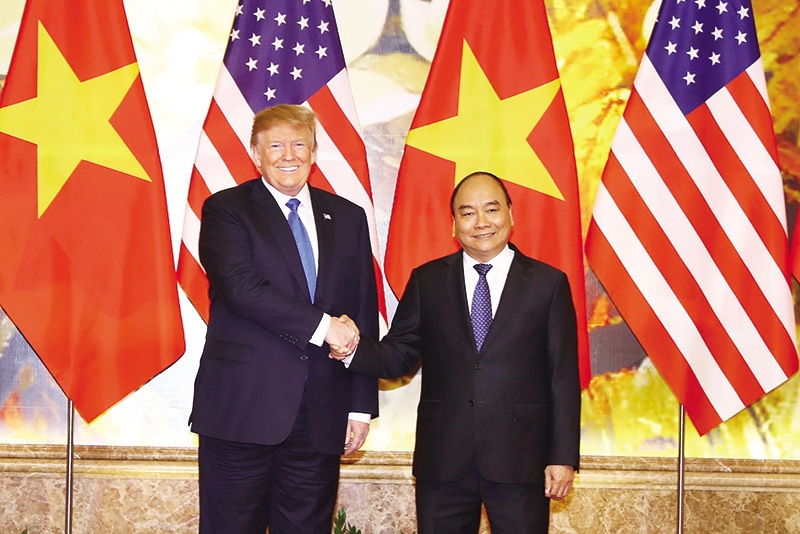

| US President Donald Trump and Vietnamese Prime Minister Nguyen Xuan Phuc |

25 years after normalising economic relations, Vietnam-US investment ties have proved pragmatic and effective. Looking at the journey, what have been the highlights of these bilateral ties?

|

| Vu Dai Thang, Deputy Minister of Planning and Investment |

The comprehensive partnership between the United States and Vietnam has seen remarkable progress over the past few years with important achievements obtained in all fields. With the view that the two economies can supplement each other, Vietnam wants to promote free and fair economic trade and investment ties with the US on the basis of mutual benefits.

To date, the US has invested in 949 projects in Vietnam with total registered capital of $9.19 billion, ranking 11th among the 132 countries and territories with investment in the country. The numbers, however, are yet to reflect adequately US investment inflows into Vietnam as a number of US giants such as Intel, Coca-Cola, and Procter & Gamble, among others, pour money into Vietnam via their branches or units registered in locations such as the British Virgin Islands, Singapore, or Hong Kong. If US investment via a third country is accounted for, the amount could be around $13-14 billion.

American investment focuses on 18 sectors in Vietnam, with the most attention being paid on lodging and dining with 21 projects worth $4.2 billion in total. The processing and manufacturing industry sits second with 352 projects with the total investment capital of $2.8 billion, followed by water supply and waste treatment, then transport and storage.

Excluding the oil and gas industry, US investors are present in 45 of the 63 cities and provinces in Vietnam, with the majority of projects concentrated in the southern economic region, which boasts developed infrastructure and the most dynamic economic hubs like Ba Ria-Vung Tau, Ho Chi Minh City, Binh Duong, Long An, and Dong Nai.

The US investment growth momentum continued in 2018 and in the first half of this year.

In particular, US companies invested 88 new projects in Vietnam last year with the total registered capital of $177.3 million, while adding $42.67 million in 29 others and pumping $335.4 million into stake acquisitions. During the year, the US focused investment here in the processing and manufacturing industry with $301.2 million, followed by sci-tech with $96.6 million.

Between January and June, the US was one of the 10 biggest foreign investors in the country with 57 new projects and the total registered capital of $121.26 million; 12 others have a total investment capital of $55.9 million; and also $56.28 million worth of stake acquisitions. Their investment continued to mainly target processing and manufacturing with $169.4 million, followed by real estate and retail.

Currently, US investors continue to seek new opportunities in Vietnam, especially in promising fields such as retail, IT, and consumer goods. Amid global competition and challenges, the moves among many other US corporations studying the market to move to Vietnam or expand here proves their trust and strong business perspectives in the Vietnamese market.

Regional competition in investment attraction is growing significantly. What are Vietnam’s advantages in attraction of US funding in comparison with other regional countries?

Global foreign direct investment (FDI) flows are on a downtrend. Global changes and trade tensions have made impacts on the adjustment of investment attraction among countries worldwide, including Vietnam. In this context, competition in this area from regional countries has intensified, while Industry 4.0 is having a strong influence on investment, manufacturing, business, sci-tech development, and human resources.

Vietnam is now making strong reforms and integrating deeply into the global economy. The country has become a middle-income one, with the position and prestige increasingly strengthened in the international arena. The country’s economic restructuring and renewal of the growth model has come to initial fruition. What is more, the domestic private sector has strongly developed with the presence of many powerful privately-run groups. These are important factors for Vietnam to lure more FDI.

Vietnam has several advantages in investment attraction in this area. With the signing of a number of free trade agreements (FTAs), Vietnam is the linkage to other regional and global markets. The country has been actively promoting international economic integration by signing and negotiating more FTAs.

According to the European Chamber of Commerce in Vietnam, when all the 16 FTAs that Vietnam have signed take effect by 2020, Vietnam will be among a massive economic network of 59 partners, including five permanent member countries of the UN Security Council, 15 of the 20 nations from the G20, and other emerging economies.

Located in the ASEAN bloc, one of the most developed and dynamic economic regions in the world, Vietnam’s economy has continued to grow well. In the first half, the country’s GDP was estimated to expand 6.76 per cent in the context that 70 per cent of economies worldwide are reporting slower growth. In addition, the GDP growth prospects in the middle term is positive, thus making it an important factor to add attraction among international investors, while helping Vietnam increase national competitiveness in regional FDI attraction.

Besides the economic achievements, Vietnam has succeeded in stabilising other macro-economic indexes. In June the consumer price index (CPI) dropped 0.09 per cent on-month, thus resulting in an on-year increase of 2.64 per cent in the January-June CPI. The growing middle class and young population, with about 60 per cent under the age of 35, are further other advantages that Vietnam has.

Together with this, trust in the business climate has improved greatly. By issuing Resolution No.19/NQ-CP in 2015 on continuing to implement tasks and solutions focusing on improving the business environment to enhance national competitiveness, and Resolution No.35/NQ-CP in 2016 on business support and development towards 2020, the Vietnamese government showed its strong determination in creating more favourable conditions and a fair and healthy business environment for businesses.

Now, the Vietnamese government is taking numerous policies to increase national competitiveness, while restructuring the economy and renewing the growth model, with a focus on the restructuring of public investment, state-owned enterprises, and the banking-finance system. Together with the supporting policies, the government commits to continue its administrative reform to further facilitate business activities.

These efforts are also coming to fruition. According to the World Bank’s Doing Business report, Vietnam ranks 69th among 190 economies for ease of doing business, gaining 13 spots. Moreover, global ratings agency Standard & Poor’s has upgraded its long-term sovereign credit rating on Vietnam to BB from BB- on the back of the economy’s strong macro-economic performance and improved government institutional settings.

US investment inflows into Vietnam remain lower than expected, due in part to capital entering via a third country. How will Vietnam’s orientation in the country’s new FDI attraction strategy attract more direct and high-quality US investment in the months to come?

The Ministry of Planning and Investment is working on the new FDI attraction strategy. Some of the most important highlights will be the focus on attracting FDI in the sectors of hi-tech, environmentally-friendly technology, renewable energy, healthcare, education, high-quality tourism, financial services, logistics, smart agriculture, and advanced technical infrastructure, especially new sectors based on technology of Industry 4.0.

The country will call for investment in the sectors in which the US has strong expertise such as banking and finance, energy, infrastructure, high-quality food processing, and manufacturing. Attracting US investment funds is also a target, and the country will be more active in approaching influential US groups to call for relevant investment.

On the other hand, we will encourage American investors and businesses to pour money into infrastructure projects in Vietnam under the public-private partnership model in order to improve the infrastructure network in this country.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Tag:

Tag:

Mobile Version

Mobile Version