PDR posted profit growth of over $103 million in 2021

Thanks to its efforts, PRD has achieved pre-tax profits of over $103.24 million in 2021, up 52.2 per cent on-year, fulfilling 100.4 per cent of the year’s target. The results assert PDR’s commitments to create added values for its shareholders.

PDR recorded the highest profit earning in the fourth quarter of 2021

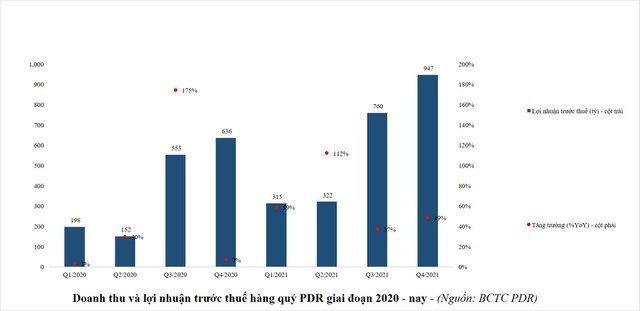

In the fourth quarter of 2021, PDR has improved its gross profit margin to reach 90.9 per cent, much higher than 51 per cent in the same period in 2020. As a result, the company generated a gross profit of $49.4 million, up 54.9 per cent on-year. Meanwhile, it posted $41.79 million in before-tax profits and $33.15 million in after-tax profits, up 48.6 and 49.6 per cent respectively.

This is PDR’s highest quarterly business result since its inception. Revenues and profits mainly come from the transfer of products in low-rise buildings in Nhon Hoi Economic Zone in the Ecological Urban Area in Binh Dinh province.

In 2021, PDR generated net revenues of $159.71 million, down 7.4 per cent on-year. Meanwhile, its gross profit reached $121.7 million, up 51.7 per cent on-year. PDR’s gross profit margin stood at 76.3 per cent compared to 46.6 per cent in 2020.

The company also earned $103.24 million in pre-tax profit and $81.9 million in after-tax profit, up 52.2 and 52.5 per cent respectively on-year. With this result, PDR has fulfiled all of the 2021 profit targets approved by the 2021 annual general meeting of shareholders.

|

| PDR quarterly before-tax revenues and profits since 2020 |

In 2019, PDR's pre-tax earnings topped $44 million for the first time. The figure surpassed $88.1 million in 2021 and is expected to surpass $132.16 million in 2022. In 2021, PDR is predicted to be among the top four real estate stocks on Vietnamese bourses with the highest pre-tax profits.

PDR continues to make good progress towards its goal of $628.63 million in cumulative pre-tax profits for the 2019-2023 period, which is equivalent to a compound annual growth rate of 51 per cent.

Strong financial structure

As of December 31, PDR's total assets reached $881.05 million, up 31.6 per cent compared to the beginning of the year. Among them, short-term assets increased by 40.3 per cent to $675.7 million while long-term assets jumped 11.2 per cent to $229.5 million.

The company's equity also rose sharply by 56.8 per cent compared to the beginning of 2021 to $358.59 million. Meanwhile, liabilities increased only 19 per cent to $546.69 million.

The current payment ratio in 2021 will reach 1.76 times while the proportion of equity in total capital will increase to 39.6 per cent compared to 33.3 per cent in 2020, ensuring PDR's debt payment in 2021.

In addition, the company has made efficient use of borrowed capital as short-term loans have been replaced by long-term loans with more favourable capital costs, ensuring optimising interest costs and the ability to repay debt due.

Specifically, short-term loans decreased from $62.1 million in 2020 to $35.54 million in 2021. Meanwhile, long-term loans increased from $21.37 million to $115.4 million.

The company's prepayment by buyers at the end of 2021 increased by more than 2.7 times compared to the same period last year, reaching $74.45 million, reflecting the positive signs of sales and absorption rate at PDR's new projects.

Expanding land banks to ensure sustainable development

In 2021, PDR will actively expand its land bank in many potential localities with noticeable deals.

With regards to residential property, PDR will develop targeted land funds to serve the business plan in 2022-2023. The land funds will stretch across localities including Danang (535.27ha), Quang Ngai (4175.16ha), Binh Dinh (159.35ha), Ho Chi Minh City (28.79ha), and Binh Duong (282.7ha), among others.

In terms of industrial real estate, PDR currently owns 24ha of industrial land in Cai Mep and Ba Ria-Vung Tau. PDR is taking steps to implement other projects in localities such as in the Dung Quat-Phat Dat integrated township and an industrial park in Quang Ngai. The project covers an area of 1,152ha, of which 838ha are for industrial land and 314ha for a township.

To ensure consistent incomes and long-term development, PDR has set the goal of developing an industrial land fund of 6,000ha in Quang Ngai, Binh Duong, Dong Nai, Ba Ria-Vung Tau, Danang, and Dong Thap by 2023.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Saigon Centre gains LEED platinum and gold certifications (February 12, 2026 | 16:37)

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

Tag:

Tag:

Mobile Version

Mobile Version