Outlining the preferential mechanisms for new PPP projects

According to the government’s report on the state of public-private partnership (PPP) investment projects, there have been 336 such projects implemented over the last 20 years.

However, the legal framework for this area is scattered in different pieces of legislation, including the Law on Public Investment, the Law on Bidding, the Law on Pricing, and 2018’s Decree No.63/2018/ND-CP on investment in the form of PPP. Furthermore, regulations are often unclear, overlapping, or inconsistent.

On June 18, the Law on PPP Investment was adopted by the National Assembly. Taking effect from next January, the new law intends to create a unique regulatory framework for PPP to ensure the effectiveness of project management.

|

Sectors and scale

Unlike the wide range of fields open to PPP investment in Decree 63, the new law narrows this scope to focus on important areas such as infrastructure development, social security, and essential services to promote socio-economic development, improve living standards, and adapt to Industry 4.0.

In particular, as prescribed by Article 4.1, PPP projects may only be conducted in five sectors: transport; electricity grid and power plants (not including hydropower plants and/or any case which is subject to state monopoly); irrigation, clean water supply, water drainage, sewage treatment, and waste disposal; health, education, and training; and finally IT infrastructure.

Article 4.2 also specifies the minimum level of total investment capital of PPP projects, in particular: VND100 billion ($4.35 million) with respect to PPP projects which are implemented in areas with difficult or extremely difficult socio-economic conditions or in the field of health, education, and training; and VND200 billion ($8.7 million) in other cases.

PPP projects implemented in the form of operation and maintenance contracts are not subject to the above limitation.

Under Article 69.2, state capital in PPP projects is limited. State capital for the support of construction, payment of compensation, site clearance, resettlement expenses, and support of the construction of temporary works in a project may not exceed 50 per cent of the total investment.

The government shall be responsible for preparing and issuing detailed guidance on the specific investment sectors and detail minimum levels of the total investment capital in PPP ventures.

Selection of investor

The law on PPP investment applies the mechanisms described in the Law on Bidding but develops several specific amendments and supplements to create a legal framework for the selection of financiers in such projects. Because of these changes, selection is excluded from the scope of regulation of the Law on Bidding.

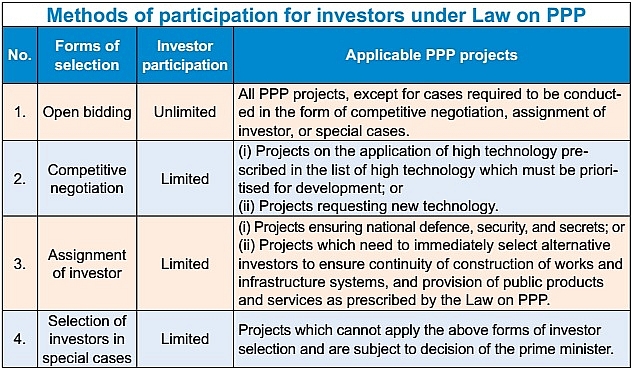

Under the law, investors may participate through various methods (see table). To ensure the publicity and transparency of PPP projects, the main information related to selection of the qualified investor must be disclosed on the National Bidding Network System.

Capital mobilisation

As per the new law, upon receiving approval of selection, an investor must establish an enterprise which must be in the form of a limited liability company or private joint-stock company.

This enterprise is for the sole purpose of signing and executing PPP project contracts. This is to ensure the enterprises focus on their projects and achieve optimal efficiency and timely performance.

Besides turning to banks for capital, the law allows PPP enterprises to issue corporate bonds, but not convertible or warrant-linked bonds.

Revenue mechanisms

Those implementing PPP projects may receive assurance from the state in accordance with the law on PPP investment and laws on investment.

The investor shall be assured access to land use rights and other public assets; to receive public services; and to receive assurance for the mortgage of assets or business rights of the construction, or infrastructure system to the lender.

For the purpose of assurance and incentives, the new law introduces a preferential mechanism to attract private investment capital to participate in related projects through the sharing of changes of estimated revenue with the Vietnamese state.

Investors and PPP project enterprises will share 50 per cent of the extra revenue with the state when the actual revenue exceeds 125 per cent of the revenue in the financial plan.

The state also shares with investors and enterprises 50 per cent of the difference if actual revenue is below the target, subject to certain conditions.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- From idea to market: fintech sandbox takes shape (May 16, 2025 | 09:46)

- Legal protections for local companies (May 08, 2025 | 10:39)

- Drawing insights from data law draft (March 27, 2025 | 15:00)

- Sandbox for crypto assets in Vietnam: if not now, when? (March 11, 2025 | 11:34)

- Securities law reflects alignment efforts (February 25, 2025 | 10:42)

- New law marks shift for electricity market (February 12, 2025 | 14:30)

- Indochine Counsel launches new corporate identity (September 23, 2024 | 06:52)

- Key developments for ID's at credit institutions (April 24, 2024 | 16:30)

- Virtual assets in Vietnam: a regulatory outlook (January 04, 2024 | 17:11)

- Investors must be wary of the status of digital assets (June 12, 2023 | 12:13)

Mobile Version

Mobile Version