Newgen and FPT IS join hands on digitisation

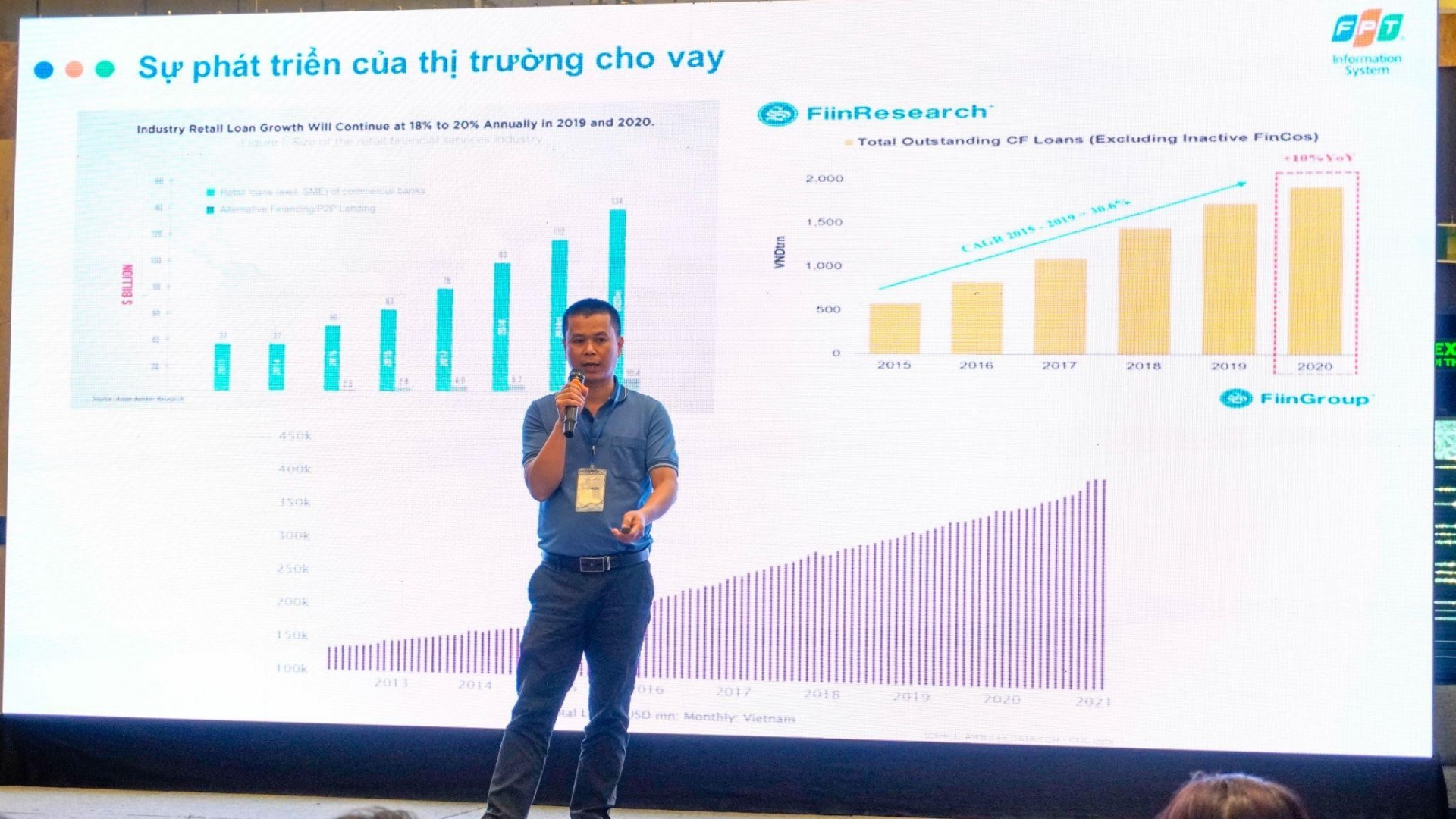

Currently, the credit market in Vietnam has seen rapid growth along with outstanding development of the economy.

This poses many challenges for financial institutions since they have to adapt to changes in customer habits, rapid development of IT, among others.

In addition, the strong emergence of fintech companies and non-financial service providers in the lending market with new and technology-based operational methods also puts a great deal of pressure on financial institutions in transforming their operational methods.

|

| FPT IS and Newgen discuss and address companies’ issues regarding digitalisation of the lending process |

Newgen suggests a number of technology solutions to assist financial institutions in setting up the lending process on digital platforms.

With a presentation themed “Reimagining digital lending: The low code way”, Swaminathan Ganesan - Business Consulting director, APAC and AZ at Newgen Software - highlighted the importance of fintech companies in conquering customers in the digital era.

Digital transformation creates outstanding advantages for companies to seize opportunities and better serve Generation Y and Generation Z customers, who have the most demand for payment methods today.

In addition, with the use of technologies, companies can effectively implement initiatives and improvements to meet the increasingly high expectations of customers.

|

| Swaminathan Ganesan - Business Consulting director, APAC and AZ at Newgen Software highlights the importance of fintech companies in the digital era |

Newgen is currently providing a loan origination solution built on NewgenONE - a digital transformation platform based on cloud computing and low code.

NewgenONE solutions give companies the flexibility and adaptability to ensure operational efficiency in the best way.

The solution allows companies to expand the scope for all types of loans, including retail, microfinance, SME, commercial, remittances, and trade finance.

| NewgenONE solutions give companies the flexibility and adaptability to ensure operational efficiency in the best way. |

Furthermore, the solution ensures compliance with legal requirements and regulations, streamlining companies' lending process by connecting the business assurance divisions and IT divisions, and consistently managing intermediary and supporting teams.

Delivering a presentation themed “Accelerating loan process with digital technologies” on behalf of FPT IS, Tran Anh Tuan - senior consultant of the Finance and Banking Division - has given multiple suggestions to adopt technologies into lending transactions.

“Deeply understanding the challenges of the market, FPT IS has been developing digital solutions focusing on digitalisation of important components in loan processing lifecycle, such as digital loan document processing system, an enterprise content management system, and a record management system,” said Tuan.

Made-by-FPT solutions, including data integration, management and discovery platform, platforms for digitalising account and service registration, remote digital signature, electronic contracts, and more have been creating an important push for banking and finance companies to leap forward in the race of digital transformation, Tuan added.

|

| Tran Anh Tuan - senior consultant of the Finance and Banking Division, FPT IS - has given multiple suggestions to adopt technologies into lending transactions |

Tien Phong Commercial Joint Stock Bank (TPBank) is an FPT IS customer, having successfully deployed and officially launched technology solutions based on big data analysis in lending transactions.

Using a smart search engine, TPBank has made remarkable improvements in the appraisal process, helping users easily look up information, add or remove documents and search criteria, create documents online directly on TPBank's ECM system.

In addition, Customer Churn utility - a model that predicts the likelihood of customers to stop using products/services - has provided a multidimensional and more detailed view of customer behaviour, allowing the bank to develop appropriate actions to minimise the number of customers likely to stop using credit cards and e-bank services.

With a 28 years-plus track record in finance and banking, fully understanding and solving numerous key issues, via the cooperation with Newgen, FPT IS expects to continue to accompany finance and banking companies on the journey of digitalising financial transactions, turning technologies into competitive advantages.

| Cybersecurity crucial for ongoing digitisation of banking industry: researchers Cybersecurity is one of the central issues in the digital transformation of the banking system. |

| Financial institutions’ role in lending to domestic banks The Vietnamese banking system has had to contend with a myriad of internal and external factors in 2022. Andrew Jeffries, country director of the Asian Development Bank in Vietnam, told VIR’s Hong Dung about the current liquidity situation and explained how businesses can access loans from major financial institutions. |

| Vietnam accelerates digital transformation process Vietnam is making efforts to boost digitalisation with a view to becoming a digital nation by 2030. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Agro-forestry and fisheries exports jump nearly 30 per cent in January (February 09, 2026 | 17:45)

- Canada trade minister to visit Vietnam and Singapore (February 09, 2026 | 17:37)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- Vietnam forest protection initiative launched (February 07, 2026 | 09:00)

- China buys $1.5bn of Vietnam farm produce in early 2026 (February 06, 2026 | 20:00)

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Mondelez Kinh Do renews the spirit of togetherness (February 06, 2026 | 09:35)

- Seafood exports rise in January (February 05, 2026 | 17:31)

- Accelerating digitalisation of air traffic services in Vietnam (February 05, 2026 | 17:30)

- Ekko raises $4.2 million to improve employee retention and financial wellbeing (February 05, 2026 | 17:28)

Tag:

Tag:

Mobile Version

Mobile Version