Navigating tariff roadmaps for automobile imports

|

| Dr. Daniel Borer - Lecturer of economics RMIT University |

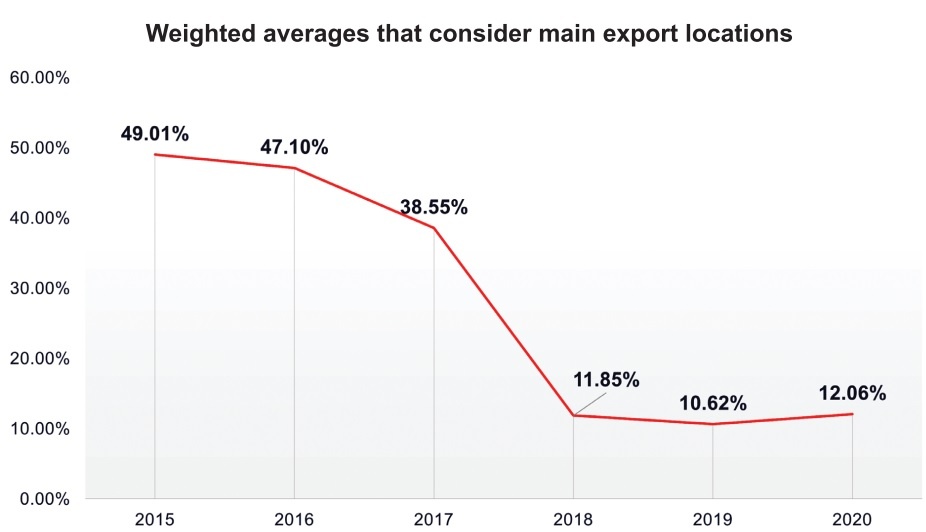

Most importantly, the reductions on tariffs on imported cars are imposed by the ASEAN trade framework, which aims at substantially reducing protectionist measures among member countries. Tariffs on other non-ASEAN countries have not been changed so far. The observed average tariff reduction paid on imported cars has been mainly induced by a re-shifting of the demand for foreign cars from Indian and Chinese cars to those produced in Thailand.

This year, we have entered a new phase of tariff reductions as the Regional Comprehensive Economic Partnership (RCEP), of which ASEAN countries are all members, started to take effect. The RCEP includes key car-producing countries like China, Japan, and South Korea. Before the RCEP, these countries were imposed the high 65-75 per cent tariffs of third countries. It is foreseeable that these rates will decrease for RCEP members, making it possible to reduce prices for cars in ASEAN.

It is advisable to understand the roadmap for reducing car import tariffs and how it depends mainly on the free trade agreements Vietnam has signed. Agreements within the ASEAN led to a substantial tariff reduction for cars since 2015.

Within the RCEP, overall tariffs are planned to be completely eliminated until 2035, which should include cars. The implementation of the EU-Vietnam Free Trade Agreement should gradually eliminate tariffs on imported European cars until 2030. Furthermore, to improve the competitiveness of domestic car manufacturing, the government has eliminated tariffs on spare parts and car accessories since 2020.

These changes could result in easier access to modern, imported cars for the Vietnamese. From a social point of view, this would in turn contribute to lowering traffic accidents caused by outdated cars.

|

Intuitively, the connection is due to households having the possibility to obtain brand new cars with modern safety technology at cheaper prices thanks to the tariff decreases. These technologies aim at making the car a safer vehicle, indicating to the driver when technological problems appear, and also correcting potential driver’s mistakes.

This intuitive thought is furthermore backed by a statistical study I conducted in 2016 including a panel of 161 countries. The study showed that tariffs on imported cars contribute significantly to the deaths in road traffic accidents. In fact, an increase of the tariff by 10 per cent could increase deaths from accidents by 7.5 per cent.

Perhaps equally interesting are the implications of the tariff reductions on the automobile manufacturing and assembly industry in Vietnam. Compared to Thailand, the main car manufacturing hub in ASEAN, car production is estimated to be 20-30 per cent more costly in Vietnam as the infrastructure here is not yet as developed. This may be changed but massive investments from the private as well as the public sector would be necessary, while it may be unclear if these investments will achieve the desired benefits due to the harsh competition of other manufacturing hubs in the region.

Clearly, competition with foreign cars will hit the domestic industry hard. Domestic producers have the advantage of competitive salaries and capable workforce, but for professionals like engineers and designers the work prospects are more attractive in other countries. Hence, foreign companies may use Vietnam increasingly as a production hub but the cars will not truly be Vietnamese.

On the other hand, it will be very difficult for genuinely Vietnamese brands like VinFast to overcome the harsh competition that will only intensify. Some companies have become even stronger in the face of challenges, while others have disappeared. Clearly, the consumers will be the big winners of these changes, enjoying cheaper and better cars, be it from VinFast or foreign companies.

Furthermore, looming tariff reductions this decade will coincide with the next revolution which we will witness in the car industry: autonomous driving. Autonomous cars are being successfully tested around the world and will conquer the world sooner than we think. They will bring enormous benefits like massive accident reduction, worry-free traveling from police controls as the car does obey all the traffic laws, no accident insurance, no searching for a parking space as the car drops us and leaves, relaxed environment in a car designed to offer comfort, and does not bother about driving space.

Not only will this change the usage of private cars favouring car-sharing and taxi services. We may also soon say goodbye to the friendly taxi driver, while we use their service more than ever. This would be an unprecedented revolution especially for Vietnam. A car taxi ride will start to cost as little as a motorbike ride. Car-sharing companies together with Grab, Gojek and Vinasun cars will populate our roads more and more while private cars and motorbikes will slowly disappear.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Mobile Version

Mobile Version