Navigating an alternative venture path in Vietnam

Beside “creating unicorns”, developing an ecosystem is also about “solving social issues” via impact startups. These startups are fast-growing businesses whose main purpose is fulfilling both social solutions and financial returns. In the past few years, Vietnam has witnessed increasing impact investing activities. In 2019, Vietnam was among the top 5 largest impact investment destinations in South Asia and Southeast Asia.

|

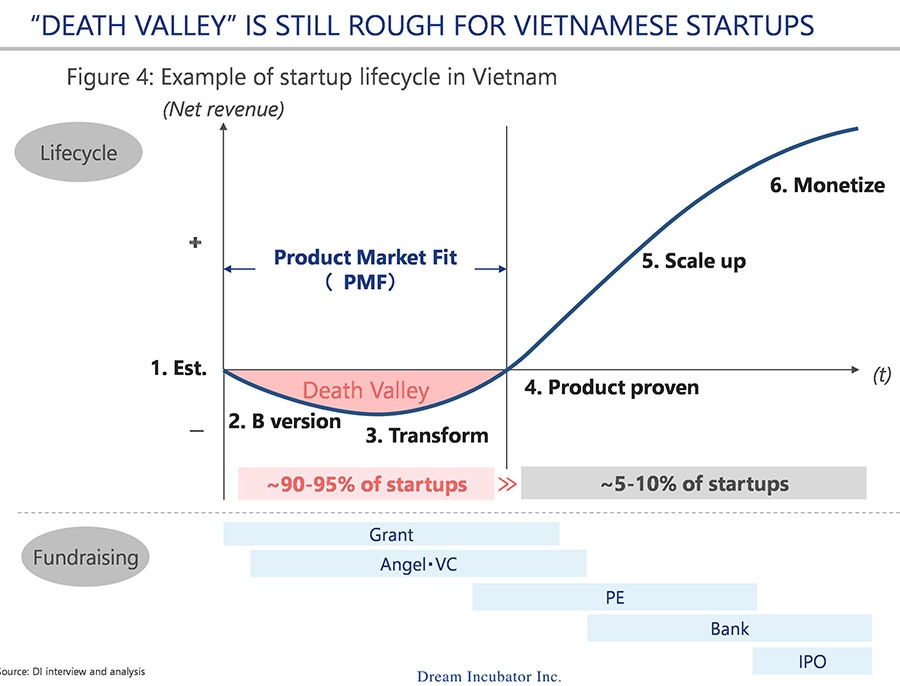

| Example of startup lifecycle in Vietnam – figure by Dream Incubator Vietnam |

Although there has been strong growth in impact investing firms recently, the market is still very nascent and fragmented compared to India – a global top startup capital destination, and Indonesia – a fast-growing ecosystem with the most unicorns in Southeast Asia. Given the present surge of global interests in Vietnam startups, only around 5-10 per cent of startups successfully graduated from Series A to B. Meanwhile, 90-95 per cent of startups fail in the early stages as they do not have enough funding for the expansion stage. This gap arises from a mismatch between investors’ certain requirements of proven successes and startups’ ability to demonstrate their potential growth.

This is even more challenging for impact startups, when carrying out and fulfilling social missions may boost the cost of capital, hence, lower the internal rate of return. Growing Vietnam’s ecosystem for impact startups requires more than just capital. Impact investors should also pay attention to other assistance facilities enabling a startup’s development. For instance, Japan International Cooperation Agency (JICA) – a Japanese governmental agency delivering official development assistance to developing countries, together with Dream Incubator Inc., has introduced a conceptual model called Technical Assistance facilities. This supports impact startups to bridge the most critical stage – the “Death Valley”.

| “JICA is aiming to build an ecosystem where startups can be born and grow sustainably, becoming a driving force for economic growth and solving social issues. JICA will continue to actively collaborate with startups and ecosystem players as our partners to tackle issues together” - Director of JICA’s Economic Development Department. |

Dream Incubator Inc., with extensive experience in strategic consulting, fund operations, and business producing, serves as a consultant to JICA to track trends in impact investment in developing countries, screening promising business sectors and companies to invest in, and make recommendations to establish an investment framework, including a new public-private sector fund.

However, being an impact startup is not the only way to create social impact; startups may have their own way to achieve impactful success. A notable example in Vietnam is Axie Infinity, a top NFT game startup expected to hit $1 billion in revenue within 2021. It has been generating massive impact to the society by creating hundreds of thousands of jobs in countries that are severely impacted by COVID-19. The game is a critical lifeline for lower-income people, especially those hit hard by the pandemic.

As one of the few leading seed fund focusing on Vietnamese market, Ascend Vietnam Ventures believes there will be more global & regional market-leading startups arising from the country. These startups have great potential to positively transform the lives of people everywhere. With the right support and great collaboration of all ecosystem’s players, hopefully startups in general and impact startups in particular are well-equipped to scale then build a stronger market.

DI-GEST ASIA MARKET REPORT

NAVIGATING AN ALTERNATIVE VENTURE PATH IN VIETNAM, DEC 2021 - see full pdf

More than a traditional consulting firm, Dream Incubator (DI) is a “business producing company”. DI’s services, which originally focused on strategy consulting and venture incubation, have currently evolved into “business producing”, which provides a wide range of support for client companies to create the business. DI is also committed to exploring new business fields with the management of group companies and investment and incubation of innovative venture firms.

More about our latest insights, please visit : https://www.dreamincubator.co.jp/

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version