Meta Vietnam's Khoi Le on the wave of disruptors in Vietnam

What are your thoughts on the emergence of the rapidly rising brands in Southeast Asia, especially in Vietnam?

|

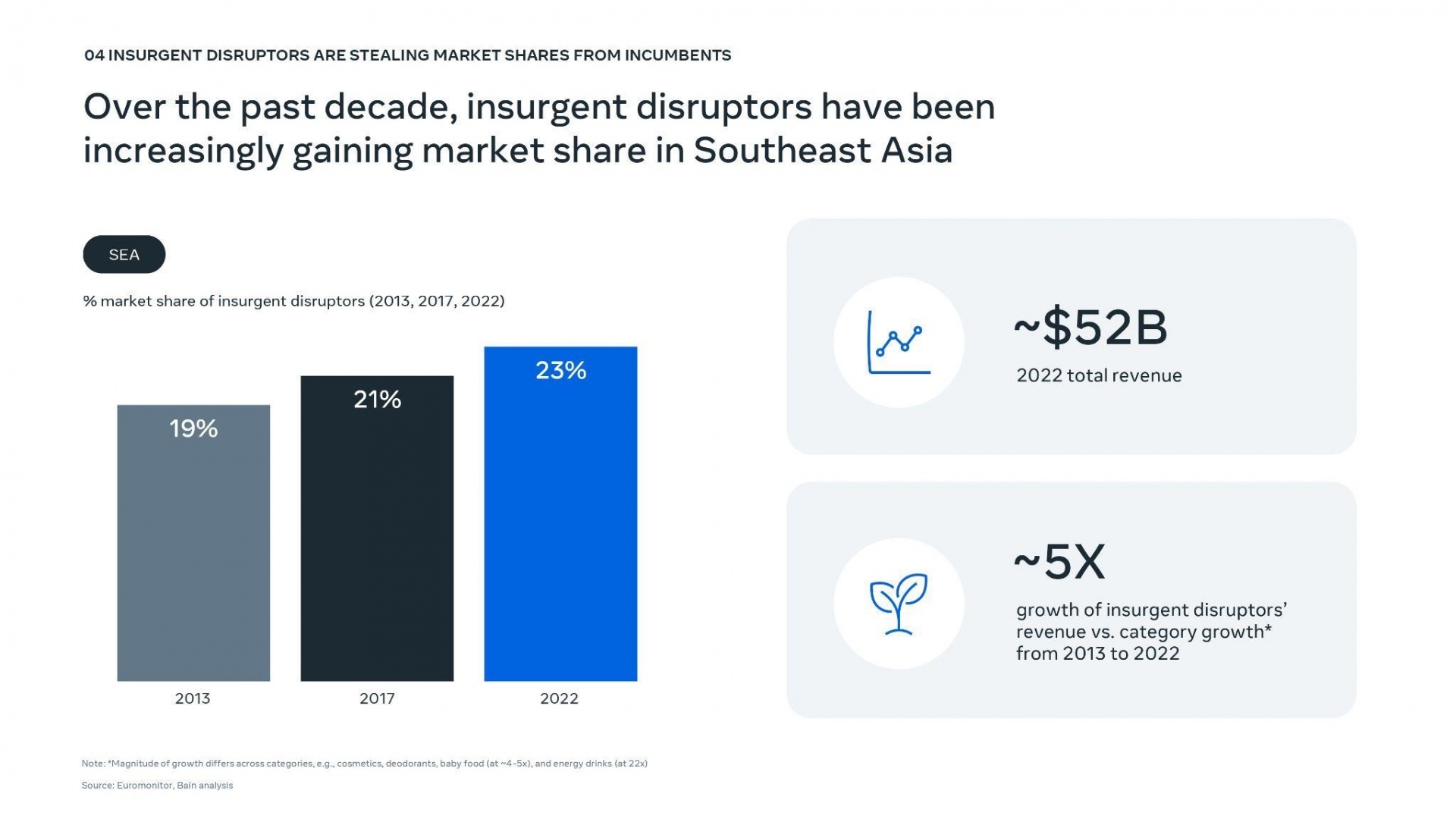

Disruptive startups have transformed the Southeast Asian landscape, with Vietnam being a prime example. Despite some being less than a decade old, these newbies are emerging as a challenge to major players with $52 billion in revenue, equivalent to nearly a quarter of the total market share. These brands often come from diverse backgrounds, including local companies, small independents, or even part of multinational corporations. Their growth rate is staggering, growing five times quicker in revenue compared to their category growth rate.

|

A combination of factors is contributing to this trend. The rise in single lifestyles and changing consumer habits post-pandemic have significantly impacted purchasing behaviours. Consumers are now more price-conscious, often opting for greater value in their purchases. This means they favour promotions or cheaper alternatives, which can be provided by insurgent disruptors.

Together with consumers' behavioural changes, the surge in e-commerce and omnichannel platforms has also facilitated this tendency. In Vietnam, 55 per cent of consumers prefer online channels for product discovery, with social media being the top platform.

The shift towards online shopping, where 80 per cent of Vietnamese consumers show a preference, is a significant boon for these disruptors. These platforms offer affordability through promotions, challenging brand loyalty, and paving the way for new brands. The brand-switching rate is rising in non-essential categories by a significant rate of approximately 50 per cent for vacations, fashion, and beauty.

How should businesses adapt to compete with these insurgent disruptors?

Businesses need to reframe their traditional approaches to increase their operational efficiency and drive better results.

|

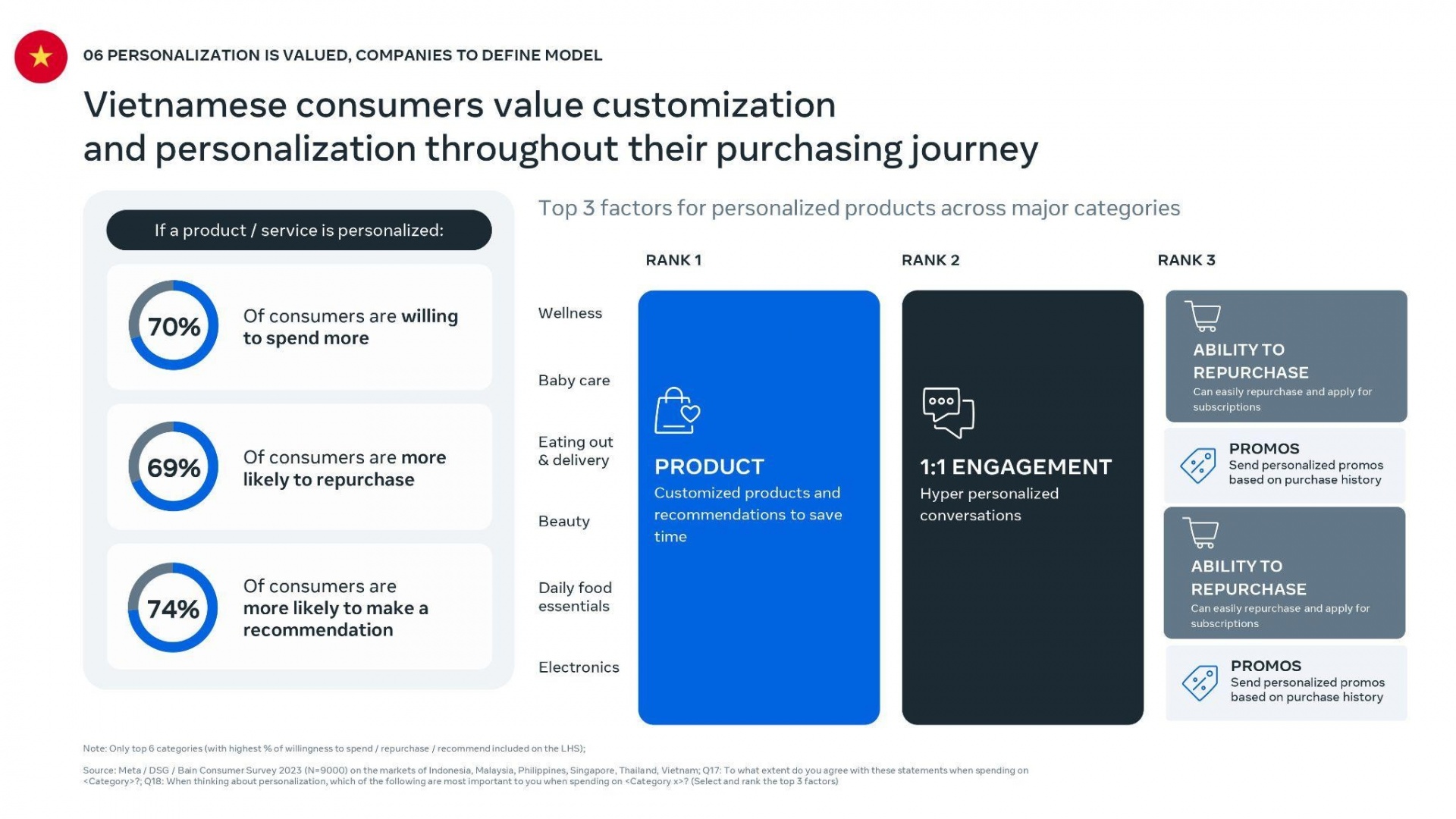

Personalisation is key. In Vietnam, consumers value customisation and personalisation throughout their purchasing journey. In a recent report from Meta, BAIN & Company, and DSG Consumer Partners, data shows us that personalised products can enhance recommendations by 74 per cent, willingness to pay more by 70 per cent, and fuel repurchase opportunities by an additional 64 per cent.

Hence, companies targeting the Vietnamese market need to offer personalisation to foster brand loyalty and advocacy. Engaging consumers through trusted creators who share the real pros and cons of products and selling customised products tailored to consumer preferences can be game-changers. More efficiently, by leveraging AI-driven personalised recommendations along with one-to-one messaging, businesses can better cater to individual consumer needs.

Staying the course in Southeast Asia is also vital. As the third most populous region globally, it offers substantial growth opportunities. Despite facing economic headwinds post-pandemic, consumer confidence in this area is rising again. The working population is anticipated to have grown by 24 million by 2030, signifying a massive market to tap into. Rising incomes and expanding 'high' and 'upper middle' classes will also fuel consumption.

To keep up with the proliferation of social media and other e-commerce platforms, businesses should build an integrated channel strategy, taking full advantage of online platforms. Strategic digital planning will help them to reach a broader consumer base and maintain brand loyalty.

What role does Meta play in balancing the growth of insurgent disruptors and traditional incumbent models?

Meta is a crucial player in this evolving market, especially in this digitalisation era. We provide a suite of tools that help businesses of all sizes save costs, increase efficiency, and enhance results.

For example, Meta Business Messaging, enhanced by AI and automation, provides a more secure and relevant experience to customers. This offers a more personalised interaction at scale and is a vital tool in digital marketing that improves business performance. Our data shows that the order value from customers is over 22 per cent higher due to communication between sellers and buyers through business messaging.

Likewise, we also have Advantage+ Shopping Campaigns that optimise one's capacity to connect with individuals to purchase the advertised products. Advantage+ Shopping Campaigns applies machine learning to help businesses reach valuable customer segments with less setup time and greater efficiency. Compared to manual shopping ads, this tool requires minimal input, simplifies audience options, and streamlines purchasing processes.

To thrive in this competitive landscape, businesses must embrace personalisation, leverage technology, and optimise online presence. With the right strategies and tools supported by Meta, businesses can navigate this changing landscape and tap into the immense potential.

| Vietnam leads Meta's Business Messaging in the region Vietnam is one of the key markets for Facebook parent-company Meta to roll out its Business Messaging. Ankur Prasad, global director for Business Messaging Product Marketing at Meta, shared his thoughts with VIR's Thanh Van about the potential of the product in Vietnam. |

| The growth of business messaging: how it’s improving business performance in Vietnam People and businesses have been communicating for years, mainly through face-to-face communication. But technology has changed all of that, including where and how people and businesses communicate. As the world grows more mobile first, people’s expectations of businesses are also evolving. |

| Insights into Vietnam’s first AI-driven sales season Shoppers, especially the younger generation, agree that planning ahead financially for the holiday season is more important than ever. 'Mega sales' are acting as catalysts, with their promise of delivering solid bargains, entertainment and their cultural relevance. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Mondelez Kinh Do renews the spirit of togetherness (February 06, 2026 | 09:35)

- Seafood exports rise in January (February 05, 2026 | 17:31)

- Accelerating digitalisation of air traffic services in Vietnam (February 05, 2026 | 17:30)

- Ekko raises $4.2 million to improve employee retention and financial wellbeing (February 05, 2026 | 17:28)

- Dassault Systèmes and Nvidia to build platform powering virtual twins (February 04, 2026 | 08:00)

- The PAN Group acquires $56 million in after-tax profit in 2025 (February 03, 2026 | 13:06)

- Young entrepreneurs community to accelerate admin reform (February 03, 2026 | 13:04)

- Spring Fair 2026 launches national fair series (January 30, 2026 | 16:17)

- SnP celebrates 10th anniversary with new brand identity (January 30, 2026 | 14:41)

Mobile Version

Mobile Version