Maximising a vibrant M&A outlook for Vietnam in 2022

|

| Ong Tiong Hooi - Partner of Deals Services, PwC Vietnam |

The nation witnessed robust deal activities in 2021, with nearly 500 deals announced in the first three quarters totalling $8.8 billion in deal value. Despite a slowdown earlier in the year, consumer finance drove the country’s M&A activity with the announcement of Japan-based SMBC Consumer Finance’s $1.4 billion acquisition of a 49 per cent in consumer loan provider FE Credit. This strategic deal is the largest consumer finance transaction ever recorded in Vietnam’s M&A history.

Whilst it has been a favoured channel for foreign investors to establish a presence in the country, M&A is now becoming a means for Vietnamese enterprises to accelerate their growth. The first three quarters of 2021 witnessed a total investment value of $1.6 billion from domestic players. Some of the major local deals in 2021 include GTNFood and Vilico’s $203.5 million merger and Dong Nai Plastic’s $45 million acquisition of nearly 52 per cent in CMC JSC.

Going into 2022, Vietnam’s economy will continue to grow due to supportive regulations and policies of the government, although there are still certain risks in the context of the pandemic. Nevertheless, the Vietnamese market is expected to maintain a good growth momentum with many opportunities for domestic investors, providing strong prospects for Vietnamese corporations to compete on a greater scale.

In the coming years, the industries expected to be the most active include manufacturers of consumer goods, renewable energy, real estate, retail, ICT, and logistics. High-growth industries such as consumer finance, electronics, and retail will continue to attract attention from both strategic and private buyers, providing ample opportunities for dealmaking.

Global trends impacting M&A

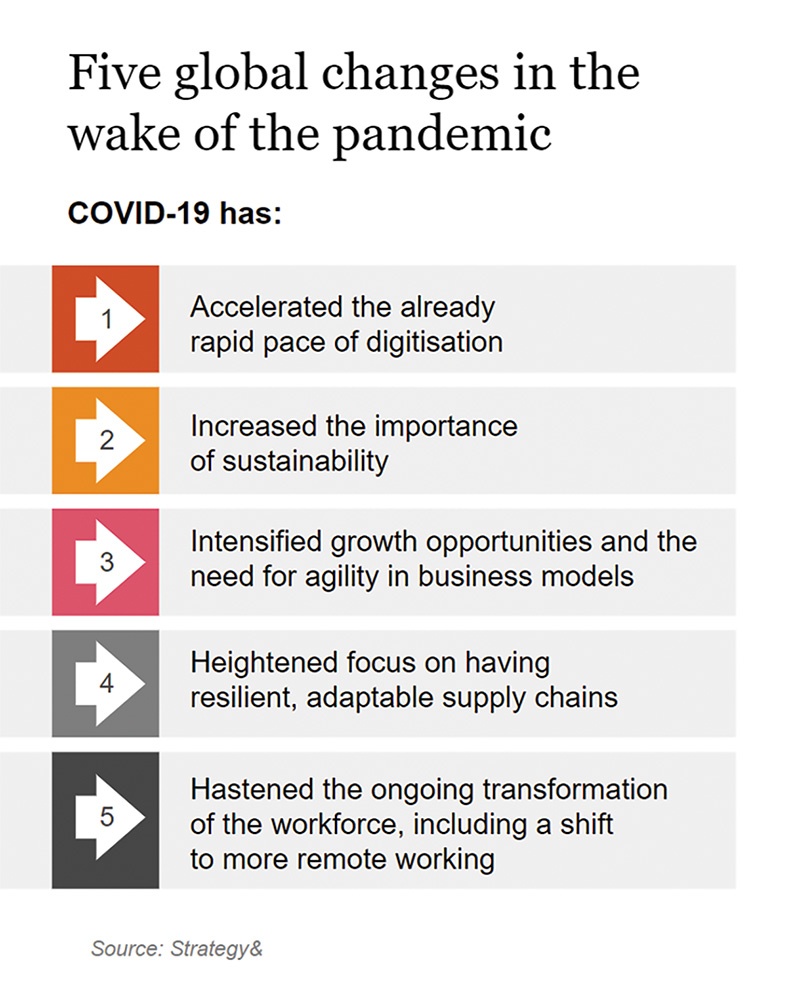

However, it is imperative to recognise that the global M&A playing field has changed. Triggered by the pandemic, several key shifts in the global business environment will undoubtedly impact any M&A transaction.

Some of these changes have been fairly prominent in Vietnam. For instance, the rise of new investments in renewables reflects the growing importance of environmental, social, and governance (ESG) processes in our local M&A space. Total investment in renewables reached $7.4 billion by 2020, which ranks Vietnam eighth globally. Listed companies such as Bamboo Capital, REE Corporation, and Ha Do Group have made a significant commitment to ESG through their expansion from traditional businesses to renewables.

Another lesson learned from the pandemic is the rapid acceleration of an organisation’s digital transformation journey. In the next decade, it is clear that the M&A processes and strategies employed will evolve to match a 4.0 society.

|

Capabilities fit - a winning formula in doing the right deals

Transactions in Vietnam are seeing a shift in focus from pure acquisitions to mutually beneficial cooperations. To effectively capitalise on the opportunity presented by the market rebound, capabilities fit needs to be carefully considered so as to maximise the returns on a deal. A capability is defined as the specific combination of processes, tools, technologies, skills, and behaviours that allows the company to deliver unique value to its customers.

Findings in a recent PwC study of 800 global corporate acquisitions over the past decade highlighted that capabilities-driven deals were able to generate a significant annual total shareholder return premium over deals lacking a capabilities fit.

Two types of deals have been shown to outperform the market: capabilities enhancement deals, in which the buyer acquires a target for a capability it needs, and capabilities leveraged deals – in which the buyer uses its capabilities to generate value from the target. These deals allow the buyers to critically assess their own maturity against each of the following five global shifts and focus on capabilities they can leverage to succeed, and which capabilities gaps they need to fill.

To start maximising the returns from various deals and make the most out of it in 2022, Vietnamese companies can consider a 5-step model (see image) to start incorporating capabilities fit into the business’ dealmaking activities.

|

Overall, Vietnam is well-positioned to maintain and nurture further M&A activity in 2022. With a shift in priority by Vietnamese organisations in response to societal evolution, it can support the evolving enterprise strategies to stimulate growth in the short and medium term.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version