Large inventories stifling wood production objectives

Do Van Hai, director of Hai Oanh Production Forest Processing in Nong Cong district of the north-central province of Thanh Hoa, was not surprised to learn that nearby Dai Phat Trading and Forestry had sold a portion of its facility to sustain operations.

“The situation looks pretty feeble if you examine it closely enough,” he said.

A few months ago, Hai was obliged to cease production of laminated wood at a facility in Trieu Son district, and the commercial outlook for the Nong Cong factory was similarly bleak. A rising inventory of 1,400 cu.m of laminated wood, worth about $1 million, has prompted the firm to halt production and reduce its personnel by 80 per cent since the summer. Four enterprises are closing in the two districts of Nong Cong and Trieu Son.

The price of laminated wood is on a downward trend, at $500/cu.m a year ago and currently about $320. “We are even willing to reduce the price more in order to move some of it on,” said Hai.

|

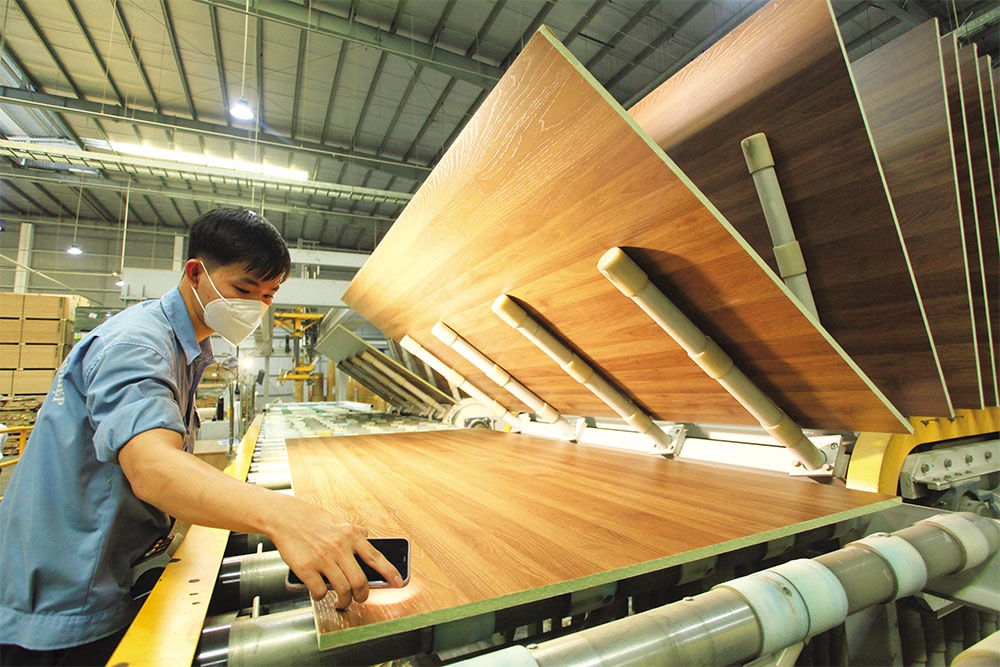

| Some wood companies are struggling to shift their products as big markets like the US and EU tighten their grip on spending Photo: Le Toan |

In 2018, Hai Oanh began manufacturing and exporting eight containers of laminated wood each month. Despite the pandemic outbreak, the firm sold four containers every month for the following two years. However, beyond the first quarter of 2022, there have been no orders at all from its typical markets.

The company’s profits are insufficient to cover its monthly bank interest payment of over $10,000, Hai explained. Previously, the profits were generated equally by the manufacturing of plywood bars and wood chips. Now, however, there is little money to go around.

Like many other producers of laminated wood, Hai Oanh relies on wood chips, the product line with the fewest processing steps, to continue output. According to Hai, wood chips provide a lesser profit than the manufacturing of laminated wood, which involves cutting, drying, and grafting.

Other companies are suffering the same fate. In September, Tan Thanh Phu Service and Manufacturing Trading Co., Ltd. ceased production of laminated wood and reduced manpower by more than 80 per cent, when the inventory totalled around $800,000.

Luu Phung Linh Tien, director of Tan Thanh Phu, which operates a plant in the Binh Nguyen Industrial Cluster in the south-central province of Quang Ngai, believed he will have significant issues with labour if and when the market heats up, which could be in the middle of next year.

According to the General Department of Vietnam Customs, timber and wood products accounted for 58.1 per cent of the total export value in the first nine months of 2022, a decrease of 5 percentage points compared to the same period in 2021. Due to the decline of exports to the United States, the value of exports to this area fell significantly. September 2022 exports of wood and related products to the US market were $607 million, down 11 per cent from August.

In specialised markets, there are still a handful of wood processing companies that can export more expensive items. However, the problem of frozen export orders in general is becoming more prevalent in the majority of wood processing businesses.

Next year remains an unexpected variable, company bosses say, with the market predicted to be particularly challenging in light of the fact that the US economy is struggling with interest rates and geopolitical instability. The US Federal Reserve hiked interest rates by 0.75 percentage points for the fourth time in a row last week.

Currently, several wood-processing enterprises in Vietnam have closed entirely due to lack of orders, while others produce just three days per week. Others indicate they will cease operations until February of next year before assessing the situation. Some firms, like Hai Oanh in Thanh Hoa, are keen to look into the domestic market and seek more modest orders using local resources in the meantime.

| Vietnam’s wood exporters under FSC standard pressure Weak export market demand and stable freight rates rendered some wood materials imported into Vietnam cheaper. However, FSC-certified logs imported from the EU market become more expensive for Vietnamese manufacturers, forcing them to look at home-grown, certified solutions. |

| Crucial certification needed to expand wood market The demand for FSC-certified wood is increasing, particularly from markets like the United States and Europe, forcing local wood processors to source more certified wood. However, this comes with a hefty price tag that increases the pressure on forest growers. |

| VAT refund delays cause fear of bad debt for wood groups As VAT refunds represent a crucial part of the cash flow of timber processors, the current delay is throwing a wrench in the operations of woodchip, furniture, and other timber-based producers, leading related associations to call for easier regulations. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version