Is there a future for crypto in Vietnam?

|

| Vinh Luu, managing partner at Asia Legal |

Last week, Vietnamese Prime Minister Pham Minh Chinh officially signed Decision No.942/QD-TTg approving the digital e-government development strategy in the 2021-2025 period, with a vision to 2030.

Particularly, the PM assigned the State Bank of Vietnam (SBV) to thoroughly research and build the pilot of cryptocurrency development and management mechanism based on blockchain technology.

The PM previously issued Decision No.2117/QD-TTg dated last December promulgating a list of prioritised technology sectors for research, development, and application to enhance the digitally-led services in the Fourth Industrial Revolution, including blockchain. The Ministry of Finance also established a special working group on virtual assets and cryptocurrencies under Decision No. 664/QD-BTC dated April last year to conduct research and propose management related to cryptocurrencies.

Cryptocurrency refers to a wide array of technological developments that utilise a technique better known as cryptography. In simple terms, cryptography is the technique of protecting information by transforming it into an unreadable format that can only be deciphered (or decrypted) by someone who possesses a secret key.

Cryptocurrency is secured via this technique using an ingenious system of public and private digital keys. However, no generally accepted definition has been agreed so far. In particular, the World Bank has classified cryptocurrencies as a subset of digital currencies, which is defined as digital representations of value that are denominated in their own unit of account, distinct from e-money, which is simple a digital payment mechanism, representing, and denominated in fiat money.

Meanwhile, the European Banking Authority has suggested referring to cryptocurrencies as virtual currencies, which it defines as digital representations of value that are neither issued by a central bank or public authority nor necessarily to a fiat currency but are used by natural or legal persons as a means of exchange and can be transferred, stored or traded electronically.

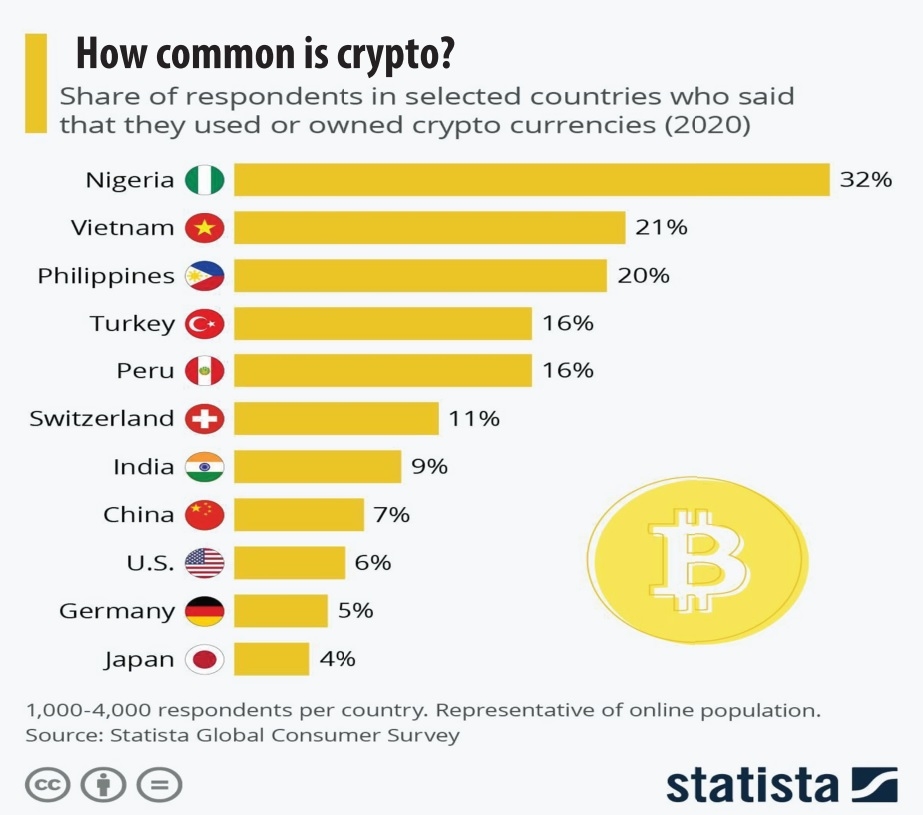

There is no definition of cryptocurrency under the laws of Vietnam. Nevertheless, it has been proving its popularity in Vietnam, after a report on survey results released by Statista, a global provider of market and consumer data, stated that 21 per cent of respondents in Vietnam said that they used or owned cryptocurrency in 2020, second after Nigeria (32 per cent).

|

Lawful means

However, there are some restrictions with regards to cryptocurrency in Vietnam – most notably in its regulations. Under the laws of Vietnam, cryptocurrency is neither legal property nor payment instruments. Particularly, under Article 105 of the Civil Code 2015, property is defined as that which comprises objects, money, valuable papers, and property rights; or that which includes immovable property and movable property. Immovable property and movable property may be existing property or off-plan property.

Article 17 of the Law on the State Bank of Vietnam provides that it is the sole agency entitled to issue banknotes and coins of Vietnam, and banknotes and coins issued by the SBV are lawful means of payment on the territory of Vietnam.

In addition, Article 1 of Decree No.80/2016/ND-CP released in 2016 on non-cash payments provides that “non-cash payment instruments in payment transactions include cheques, payment orders, collection orders, bank cards, and others as prescribed by the SBV. Illegal payment instruments are those not included in Clause 6 of this article”.

In practice the SBV has not, so far, defined or named the so-called “other payment instruments”. Consequently, only cheques, payment orders, collection orders, bank cards, or any others which are named or defined by the SBV are payment instruments. Since cryptocurrency has never been named or defined as such by the SBV, it is not considered a legal non-cash payment instrument.

Furthermore, in 2017 the SBV reaffirmed its opinion on the legal status of cryptocurrency in Vietnam, when issuing a dispatch in response to a question about Bitcoin, Litecoin, and other virtual currencies. The dispatch said, “As stipulated in Vietnamese legislation, cryptocurrencies in general, or Bitcoin and Litecoin in particular, are not currencies and do not act as lawful means of payment”.

More recently, the SBV has issued a directive requesting organisations issuing bank cards, intermediary payment service providers, and representative offices of foreign banks to supervise, inspect, and check card transactions arising at merchants in order to prevent card transactions that are not in accordance with the provisions of the laws – relating to prize-winning games, gambling, betting, foreign exchange business, securities, and virtual or digital currency, to name a few.

|

| Is there a future for crypto in Vietnam? Source: freepik.com |

Associated risks

The government has not yet issued any licences to any organisations wishing to do cryptocurrency business in Vietnam.

Running such a business has been excluded by Vietnam in the Schedule of World Trade Organization Commitments, and in the absence of domestic legislation on this kind of business, any investor wishing to do cryptocurrency business here is requested to consult with and obtain the approval from various competent authorities in Vietnam including the Ministry of Planning and Investment, the Ministry of Finance (MoF), the SBV, and other relevant ministries if any in accordance with Article 10 of Decree No.118/2015/ND-CP enacted in 2015 on detailing and guiding the implementation of a number of articles of the Law on Investment.

Doing cryptocurrency business in Vietnam without a licence shall be subject to administrative sanctions in accordance with the laws of Vietnam. Specifically, any investor doing so shall be subject to an administrative penalty of VND50-100 million ($2,200-4,300) and the foreign exchange operations of the credit institution shall be suspended for 3-6 months.

In addition, according to Clause 1 of Article 206 in the Criminal Code 2015 (amended and supplemented by Criminal Code 2017) on the offense against regulations of law on banking operations and banking-related activities, from 2018 anyone who commits acts including issuing, supplying, or using payment instruments causing damage to other individuals or enterprises from VND100-300 million ($4,300-13,000) shall be fined from $2,200-13,000 or imprisoned for anywhere between six months and three years.

The crypto future

Cryptocurrency is revolutionising the global payment industry, by allowing online payments to be sent directly from one party to another without going through a financial institution serving as a trusted third-party to process electronic payments. Backed by an electronic payment system based on cryptographic proof instead of trust, it avoids inherent weaknesses of the trust-based model.

However, Vietnam seems to take very cautious steps towards cryptocurrency as it is alleged to have no government supervision and therefore prone to illegal activities, such as tax evasion, money laundering, terrorist funding, and hacking, and that cryptocurrency might possess the capacity to destabilise existing financial systems which can affect the nation’s economy.

While related trading and use are booming globally in terms of popularity, Vietnam cannot stand outside the game, and one of the most recent actions in response to cryptocurrency is that the MoF established a research group in March to conduct an in-depth study, with a view to achieving legislative reform for the industry in Vietnam.

In practice, the current transition of Vietnam’s economy offers a particularly favourable context for cryptocurrency, when non-cash payment has been increasingly with many apps, QR codes, and e-wallets such as Moca, MoMo, and ZaloPay.

The research on crypto seems to be backed by Directive No.22/CT-TTg, dated May 2020, figuring out measures to accelerate implementation of a scheme on development of non-cash payment in Vietnam. This comes five years after implementing Decision No.2545/QD-TTg approving a scheme on development of non-cash payment for the period of 2016-2020 with an ambitious goal of slashing the ratio of cash to total payment instruments to below 10 per cent.

Even with recent active responses by the government and the boom of cryptocurrency in Vietnam, its future will not be secure and reliable in the country until regulatory frameworks are put in place.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version