Investment wave from EU on way

|

With his strong confidence that more European investment will enter Vietnam thanks to the EU-Vietnam Free Trade Agreement (EVFTA) Bruno Angelet, Ambassador and head of the European Union Delegation to Vietnam, told VIR that Vietnam has and will continue being a very good location for European investors.

“European investors remain quite optimistic about conducting business in Vietnam, where they see great potential,” he said. “The EU can offer investment in hi-tech, environmentally-friendly and less energy-consuming sectors. European businesses do not only bring technology and quality jobs but also responsible business practices,” he said. “This quality European investment can create useful links with local companies and integrate them in the global value chains.”

A rise in confidence

The EVFTA will eliminate over 99 per cent of tariffs, with the EU eliminating duties on thousands of items sourced from Vietnam. Meanwhile, Vietnam will liberalise 65 per cent of import duties on EU exports to Vietnam, with the remainder of duties being gradually eliminated over a 10-year period.

The EVFTA will benefit EU businesses exporting and investing in Vietnam. For example, Siemens Vietnam president and CEO Pham Thai Lai told VIR the EVFTA is a great foundation to further boost trade, to attract more investment, to create more jobs and to foster sustainable development between the EU and Vietnam.

“In the coming years, I strongly believe that we can expect a robust investment growth from the EU to Vietnam and a substantial increase in export from Vietnam to the EU as a result of the removal of over 99 per cent of tariffs on goods traded between the two economies,” Lai said.

Furthermore, according to him, Vietnam’s commitment to ensure a more open and transparent business environment will help to increase the investment flow from high-valued projects of the EU in Vietnam. This will enable Vietnam to become a hub for trade and investment activities of the EU in the Southeast Asia. The increase in value chains and value added services will support Vietnam to restructure its economic growth model and will be a key driver for Vietnam’s ambition to become an industrialised nation in a near future.

“Vietnam’s demand for basic infrastructure is huge. I see in the fields of energy generation and transportation, public transportation, industrial automation, efficient buildings and healthcare enormous potentials,” Lai said.

In another case, Swedish glove-maker Hestra Company said the EVFTA will give EU investors like it a helping hand.

“With the EVFTA in place, we would look to invest in a new factory in Vietnam with 200-400 employees, alongside our current factory. This would not only be a good opportunity for our company, but also create more job opportunities for the local community,” said Hestra’s owner Svante Magnusson.

Hestra, which exports its gloves to over 30 countries worldwide, will benefit from the removal of EU tariffs on gloves of up to 9 per cent. This will make it easier for Hestra to export its products to the EU.

The agreement’s new rules of origin will make it easier to trade products tariff-free when they include inputs from other countries the EU has trade agreements with. This will benefit textile producers, as well as the likes of Hestra. The company exports textiles and wool from the EU to its factory in Vietnam. With the trade agreement, the products can then be shipped to the EU tariff free.

According to the European Chamber of Commerce in Vietnam’s (EuroCham) Business Climate Index for the fourth quarter of 2018, conducted over 250 European companies in Vietnam, more than seven out of 10 European business leaders are optimistic about the future, with 74 per cent anticipating a positive start to 2019. Furthermore, over 50 per cent of business leaders anticipate growing their workforce in the first quarter of 2019, with 49 per cent anticipating a moderate increase and 7 per cent predicting a significant increase.

EuroCham members also sent a positive signal about their future investment plans in Vietnam, with almost six out of 10 planning either a moderate (47 per cent) or significant (11 per cent) increase. This is 6 per cent higher than in the previous financial quarter.

Nicolas Audier, co-chairman of EuroCham, said, “Vietnam has been on the radar of European investors for some time, and their interest continues to increase as we approach the final stages of ratification of the EVFTA. European companies are right to be optimistic about investing in this country.”

Vietnam’s new mindset in FDI attraction

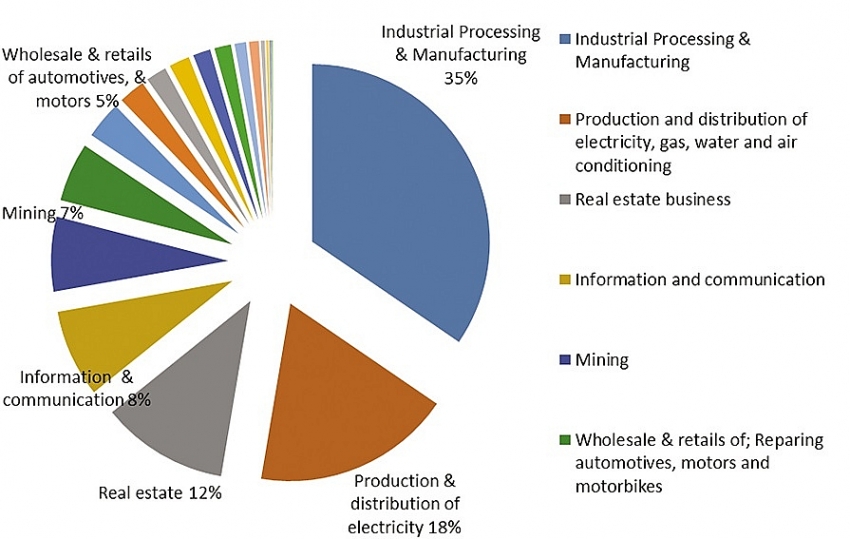

According to Bruno Angelet, European investment in Vietnam does yet not meet its full potential. Over the past decade, investment from the EU accounted for $23.9 billion in capital and 2,133 in number of projects, mostly on the sectors of industry, construction, and service. The EU’s ranking in comparison with other important foreign direct investment (FDI) partners of Vietnam during the past 10 years varies from third to sixth position.

Angelet said that Vietnam would need to improve its way of attracting FDI. Until now, the country’s FDI attraction policy relied heavily on tax breaks, concessional rates and import duty exemptions. Many investors have come to Vietnam because of the investment incentives and low labour costs.

“Attracting innovative, technologically-advanced FDI requires a more sophisticated investment policy and tools,” he said. “Therefore, Vietnam should continue working towards removing existing trade and investment barriers and improving the business climate. In this context, transparency is key for investors to know the regulations and procedures to follow.”

It is also vital that Vietnam guarantees a stable legal framework for investors to operate and a functioning enforcement system. “We urge Vietnam to improve the recognition and enforcement of foreign arbitral awards and to set up a grievance system for investors to avoid disputes. Vietnam is also strongly encouraged to accede to the International Centre for Settlement of Investment Disputes Convention,” Angelet stressed.

Expected to be inked soon

Last week, EuroCham said that the EVFTA may be signed in the latter half of this year, not before May as expected.

However, in the long term, EuroCham believes that Vietnam has “the opportunity through new-generation free trade agreements like the EVFTA to take the next step up the value chain and become an even more open and successful leader on the world stage.”

Vietnam and the EU had expected that the deal would be inked and become valid in 2017 and then last year. However, after finalising negotiations in 2015, the process of adoption and ratification has been slow. The main factor was the need to split the EVFTA into two parts in order to align it with the decision of the European Court of Justice on the competence sharing between the European Union and its member states.

Instead of having one single agreement, the so-called mixed agreement implied double ratification by EU institutions and one by the member states and ratification of individual members, according to constitutional rules.

The agreement has been split into two parts, the first on trade and the second on the investment protection agreement (IPA). The trade part is to be adopted and ratified by the EU Council and EU Parliament, whereas the IPA which will continue to require ratification from individual member states.

“Against this background, it appears unlikely that the ratification process can be concluded before the coming elections of the EU Parliament [in May]. Therefore, it can be expected that the procedure will be completed by the end of 2019 at best,” said the Whitebook released by EuroCham last week. “This delay is somewhat unfortunate, as European investors are exposed to the competition of third parties who already benefit from preferential FTAs like the ASEAN Free Trade Agreement or the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). In any case, the challenge remains in the form of the pending approval of the EU Parliament.”

However, Angelet from the European Union Delegation to Vietnam, told VIR, “I am confident that Vietnam and the EU will ink the EVFTA this summer. However, whether the deal will be adopted by the newly-elected EU Parliament remains unclear,” he said. “It is expected that in September or October, we will be able to know about the parliament’s plan on adoption of the deal.”

| Marko Walde - Chief representative German Industry and Commerce Vietnam

Based on dynamic economic development and further integration into the global economy, we see many new opportunities emerge to access markets across a range of sectors, covering goods, services, and investment for German companies in Vietnam. This is particularly true in the automobile, green energy, electronics, IT, food processing, and health care sectors. For example, a mega project by VinFast will prove to be a huge success for not only Vietnam, but also the German automobile industry as most technologies, know-how, and dual vocational training concepts are from Germany. We have observed the trend of the so-called “China Plus One” strategy, which some German investors in China have already implemented. Now they are turning to Vietnam due to rising costs and an increase in regulations. Moreover, Vietnam is also close to China, and has competitively priced labour, a similar political system, and a strong network of trade agreements as well. Thanks to the EVFTA, German companies can enjoy protection for their investments with trade facilitations and easier market access over the short term. For mid-term expectations, we hope investors will increase their investments in Vietnam based on the improved conditions here. Financiers would bring with them their well-known technology in management and training, allow more value-added production, as well as being more efficient with material and resources. Laurent Genet - General director Automotive Asia Limited Company

My recommendation is that Vietnam, especially the Ministry of Transport, should work alongside other ministries and accept that Vietnam and Europe are moving towards a free trade agreement. Within that framework, certificates are valid without a test. Cars are only homologated once. Spare parts already in the car should not need additional testing. It is being classed as an extra safety precaution in Vietnam but these procedures are not carried out elsewhere in the world. Those barriers are not making vehicles any more accessible to Vietnamese customers. They are delaying and making the life of importers very complicated to do business. Meanwhile, we bring a lot of revenue, especially from Europe. The tax from Europe is two to three times higher than from the ASEAN. So in the spirit of free trade with Europe and the EVFTA, Vietnam should do like we do, and be fair. No testing and no additional homologation after the first time. Businesses are the ones who have been suffering the most from Decree 116, not only premium ones but all brands. In the end, although it is a small market, it’s a high tax contributor for the government so I suppose this market will develop because the population is getting wealthier in Vietnam. People want a car, and then they want a better car. For companies like us, it makes sense to serve this market. At the same time when poor decisions are made in terms of certificates and regulations, then we have an issue. Vietnam wants to grow, but why should life be complicated for businesses that have been there for a long time by bringing in regulations not seen anywhere else in the world? Denis Brunetti - Co-chairman, EuroCham

Building on the phenomenal socio-economic journey experienced by Vietnam over the past 30 years, which has been mainly driven by labour intensive manufacturing, the jobs and growth of the future will predominantly come from the digital economy and high-tech jobs related to Industry 4.0 across all sectors and industries. And just as European enterprises were a trusted, reliable, and secure partner in helping to develop the country’s earliest telecommunications and ICT networks, driving significant Internet usage across the country, our members remain committed and dedicated to helping the country take advantage of a new wave of inclusive and sustainable digital innovation. Europe contains some of the world’s most innovative, market-leading, and sustainable future-focused companies, and EuroCham’s 11th Whitebook contains the insights and recommendations of business leaders from these corporations. Our publication is to help Vietnam adapt to the new opportunities that Industry 4.0 will present, and in so doing, make the country increasingly more competitive in the global economy and more attractive to international trade and investment. Tomaso Andreatta - Chairman, Green Growth Sector Committee, EuroCham

EuroCham, AmCham, and other international organisations have proposed supporting the private sector entering into energy, especially clean energy in Vietnam. Accordingly, private businesses are completely capable of directly investing into the sector. Private businesses’ ability, specifically capital and finance, could resolve Vietnamese government’s concern about how to get enough energy to supporting Vietnamese economic growth. Similar to the government, the private sector also has first priority on the quality of environment like air, water, land, so they are very willing to pour huge money into renewable energy. Learning limit ability of local traditional power plants, we have been studying the possibility of offshore source, whose power is much more useful than the current power source in Vietnam. However, we have yet to see the government’s priority on providing incentives for the private sector joining into energy. Vietnamese government has issued some decrees outlining investment on diversified form of renewable energy, but none of them highlighted the role of private businesses, which means that they are not in the position of making investment in the sector in Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: EVFTA & EVIPA

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version