Interbank activity picks up pace during third quarter

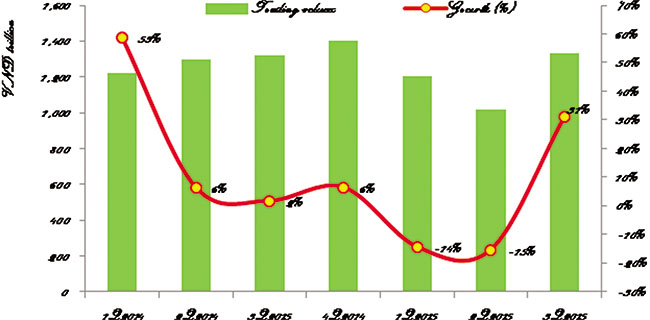

The market was particularly active in August and September. Market volume increased by 14.3 per cent in August and then surged in September to reach VND506 trillion ($23.1 billion) for the month, up 15 per cent from August and 38.1 per cent year-on-year.

Interbank market rates also increased quite strongly through most of the quarter and only fell slightly at the end of September. From the second quarter, interbank market rates rose strongly between the end of July and mid-August but fell slightly by the end of September. According to Bloomberg, interbank market rates were quoted as: overnight (2.2 percent, +10 points from the second quarter), one week (3.1 per cent, +30 points), two week (3.5 per cent, unchanged), and one month (4.1 per cent, +30 points).

Demand for short-term loans increased significantly during the quarter due to a growing demand for short-term funds used for credit activities. In addition, a rise in exchange rates from the end of July to mid-August also created significant pressure on interbank market rates.

Demand for short-term funds was mainly driven by strong credit growth during the period. Credit recorded its strongest growth rate since 2011. Through September 21, total outstanding credit has grown by 10.78 per cent from the beginning of the year, while total deposits of all credit institutions have grown by only 8.9 per cent. The lower growth in deposits created an increased demand for short-term funds in order to fund credit activities.

In addition, in the second quarter, bank liquidity was supported by a strong growth in banks’ tier 1 and 2 capital, whereas in the third quarter, this growth was not so high. As of August 2015, tier 1 & 2 capital of the whole banking system stood at VND547,213 billion ($24.9 billion), up by only 0.05 per cent from the previous month and 10.2 per cent year-to-date. The source of tier 1 and 2 capital in the second quarter effectively enhanced market liquidity and helped to reduce demand for short-term loans of banks. However, in the third quarter, banks were no longer able to tap this ample source.

Moreover, in the third quarter, the exchange rate between the dollar and the dong surged to a two-year high due to fears of further yuan depreciation and of a US Federal Reserve interest rate hike. In order to hamper a deep depreciation of the dong, the State Bank of Vietnam (SBV) continuously injected dollars in and withdrew dong out of the system. In the third quarter, the SBV net withdrew VND33,367 billion ($1.52 billion) via the open market. When the SBV decided in August to raise the average interbank exchange rate and widen the trading band, it sold a total of $3.8 billion into the market. A strong money withdrawal by the SBV to support the dong during that period caused demand for short-term funds and interbank market rates to rise.

Dong depreciation also caused concern for investors, which resulted in high demand for foreign currencies at banks. To meet the demand for holding dollars, banks advanced short-term capital in the interbank market to purchase dollars, which led interbank rates to surge. Only when the exchange rate stabilised and the SBV implemented effective policies to prevent dollar hoarding did interbank rates retreat slightly.

In the final quarter of the year, we believe that liquidity of the banking system will be improved by the high amount of bonds and bills that will be due. If the bond market fails to attract investors, the amount of bonds and bills coming due will enhance the credit activities of the system, as well as reduce demand for loans in the interbank market.

By Nguyen Thi Ngoc Anh Research Department VPBank Securities

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version