Industrial property’s notable feats

For over a year, the industrial real estate segment continues to pique the interest of foreign investors despite continuing global economic volatility as well as ongoing local legal issues.

|

| Trang Le, head of Research & Consulting and JLL Vietnam |

Vietnam remains an appealing investment destination thanks to its solid long-term fundamentals for the logistics and industrial sectors.

For industrial land, both the southern and northern markets witnessed a scarcity in new supply with only more than 700 hectares welcomed in January-June, and contributing to more than 36,400 ha of total supply.

Strong investment interest in the two major industrial hubs pushed up performance with strong growth in rental prices and occupancy rate recorded.

Ready-built warehouses across the country currently cover 2.8 million sq.m and this is expected to almost double to 4.5 million sq.m by 2025, strong investment confidence in this market.

Ready-built factories and industrial parks (IPs) have been resilient and appear to be a bright spot thanks to continuous manufacturing investment.

The latest foreign investment figures for the first half of the year indicate that most newly registered projects are on a small scale, indicating the potential demand for ready-built factories, as this product type target aims to serve small- and medium-sized enterprises in the manufacturing sector.

Rising interest

In terms of real estate investment activity, we saw a slight cooling in the market at the end of last year, which continued into the start of this year. We are now seeing investment requirements returning and new international capital entering into deals and, as such, we expect an acceleration of activity into the final part of the year.

Some recently announced moves include Frasers Property Vietnam announcing a partnership with local multi-sector investment holding company Gelex Group to grow its industrial portfolio and build its presence across northern Vietnam, with a combined investment of $250 million.

Foxconn has also acquired more land in Vietnam valuing approximately $100 million in Quang Chau IP and WHA Industrial Zone 1, with efforts to shift more production away from mainland China as part of global supply chain diversification.

Besides traditional Asian investors, there has been a rising interest of Europe countries and the US in Vietnam’s real estate market.

For example, the Lego project, which involves a significant investment of over $1.3 billion, has propelled Denmark to seventh position in terms of total registered investment and ranked first among European countries putting money into Vietnam in 2022.

Looking across Southeast Asia, Vietnam has the largest amount of capital raised for logistics and industrial real estate investment, and has the largest number of active international players.

Despite global challenges and rising regional competition, the flow of investment into the nation continues to perform well thanks to the country’s solid market fundamentals.

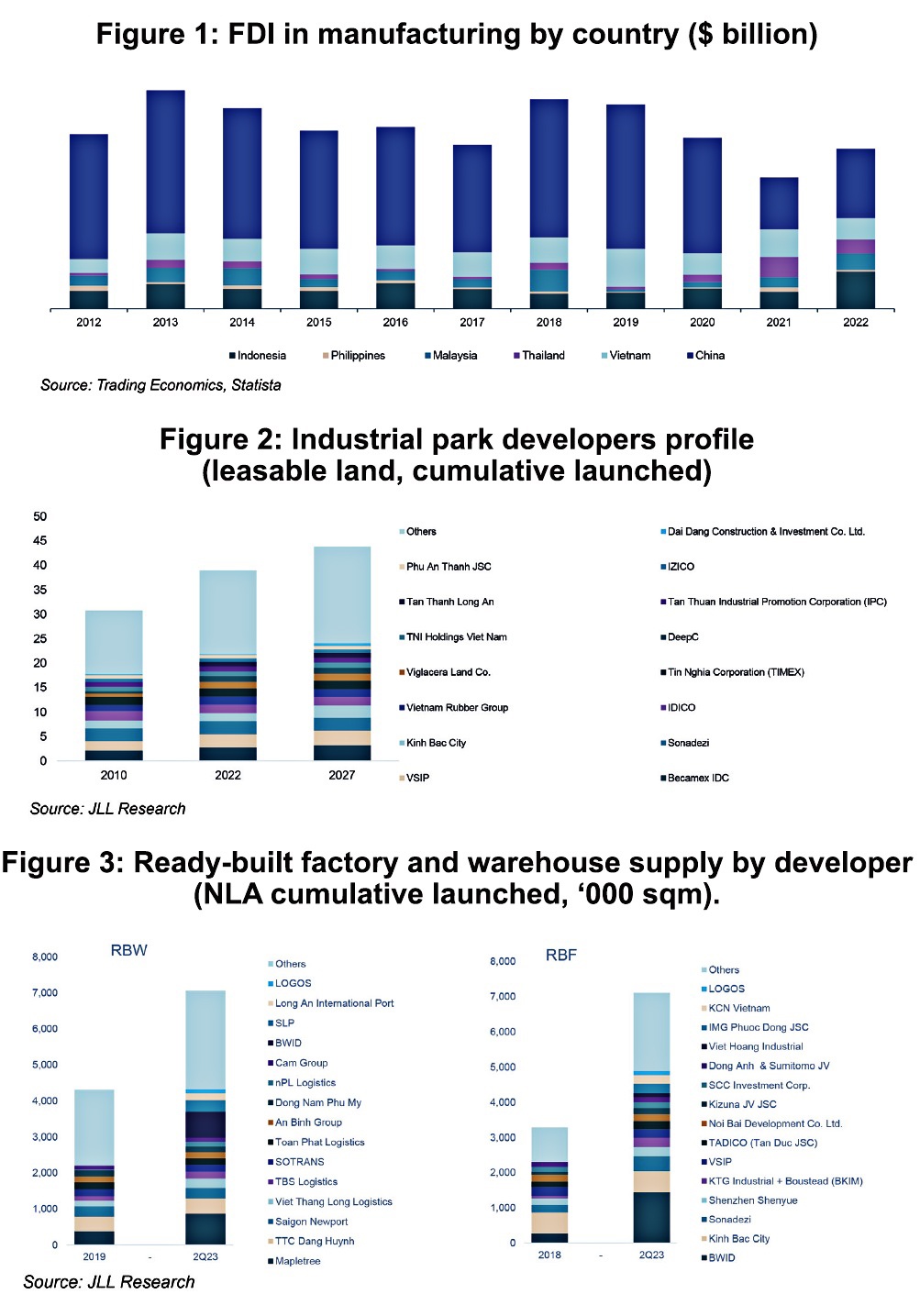

Manufacturing FDI flow to China significantly dropped, while an increase was found in Vietnam and other regional peers, as a strong proof of global and regional manufacturing shift. Vietnam, as one of the biggest beneficiaries of the China+1 strategy, has outperformed other ASEAN countries in attracting foreign manufacturing investment.

According to Trading Economics and Statista, Vietnam’s registered foreign direct investment (FDI) in manufacturing reached $13.9 billion in 2022, which was around 1.5 times higher than a decade previously, while China recorded only half of 2012’s registered FDI in 2022.

In addition, in the first half of this year, implemeted FDI into Vietnam ticked up 0.5 per cent compared to the same period last year. This is viewed as a positive indicator for Vietnam in light of multiple market challenges.

Since the country now has a strong ambition to move up the value chain and pull in higher value-added manufacturers, the industrial and logistics real estate market is also becoming more diversified and complex in response to the maturity of the manufacturing market.

|

Trends and agendas

JLL has noted five major trends in this market over the past decade. First, it is gradually maturing with the increasing presence of institutional.

While IPs have long been a playground for local developers owing to their advantages in accessing big land and understanding local market practices, foreign developers have progressively expanded their portfolios. Meanwhile, the presence of institutional investors is more evident in the ready-built sector.

Next, IPs compete with others by not only location and connectivity, but also by the value-added services they provide. During development, fierce competition appeared, forcing IP developers to improve their competitiveness to attract anchor tenants.

Under that pressure, developers have offered high-quality infrastructure as well as integrated services to support occupiers along their establishment and operation, rather than just simply providing land or property without any follow-up support, as seen in the preceding period.

The third trend is diversified products: The rising demand for different industrial property types required developers to offer a wide range of products types for the diverse needs of their customers. These include ready-built factories and warehouses, ready-built hybrids, multi-storey facilities, and built-to-suit complexes.

Fourth is sustainability – the megatrend across all sectors, not only in industrial real estate development. There is likely to be increasing demand from foreign investors for green initiatives and sustainable development in future industrial real estate projects in Vietnam. The commitment of multinationals to sustainability is resulting in higher demand for sustainable projects, forcing landlords to align in order to capture these high-profile tenants.

Furthermore, most developers, particularly international ones, also have their own green agenda and thus will strive to develop more sustainable projects moving onward. This will compel the market to integrate more sustainable factors from every aspect. Albeit humble progress so far, sustainability in industrial real estate will become increasingly visible in the near future in Vietnam.

Finally, there are early signs of tech adoption, although Vietnam may take a while to fully implement these trends given the current stage of development.

Automation, for example, is forecast to be an upcoming trend applied step-by-step in developed countries. In Vietnam, this remains at a basic and initial stage as most work, such as carrying heavy goods, still involves humans.

Meanwhile, the increases in industrial production and IPs have brought challenges such as environmental pollution, negative impacts on residents’ lives, the inefficient use of resources, and the inadequate application of green technologies. It is believed that developing eco-IPs would help address all of these problems.

Given that the monetary and fiscal policies are expected to stay neutral-to-accommodative, administrative procedures and legal frameworks are being reformed to support economic growth, and that a sizeable amount of FDI inflows are set to enter Vietnam, we expect the real estate market to continue to stabilise and expand in long term.

The regional and local landscapes have changed rapidly. Ongoing geopolitics, the onshore, offshore or nearshore global shift, and the application of global minimum tax rate will all drive the reform in emerging economies to stay on the game. Vietnam is at the tipping point to prepare for the next movement.

To navigate the increasingly competitive landscape, Vietnam needs to have its head in the game. Areas that firms consider when investing in a new country – infrastructure, administrative procedures, legal frameworks, labour force, and capability of the local supply chain – are the key to unlocking a brighter future for Vietnam’s industrial property.

| Industrial real estate firms to benefit from land fund shortage The demand for industrial land for lease in Vietnam remains high, but the supply of industrial land is low. |

| Industrial expansions help record stronger absorption The industrial estate market was a bright spot in Vietnam in the first half of 2023 with a positive absorption rate in industrial land, ready-built factories, and warehouses both north and south. |

| Supply shortages remain in industrial property frame New supply in the industrial real estate market will slow in the second half due to the influence of legal procedures as well as a decrease in demand from the manufacturing industries. |

| Vietnam’s real estate thirsty for M&A deals Mergers and acquisitions between domestic and international real estate developers were down in the first half of the year, but could be a future bright spot with Vietnam boasting attractive economic fundamentals and investors biding their time. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

Tag:

Tag:

Mobile Version

Mobile Version