Inbound cross-border M&A flows to slow down in 2017

|

| Source: Oxford Economics |

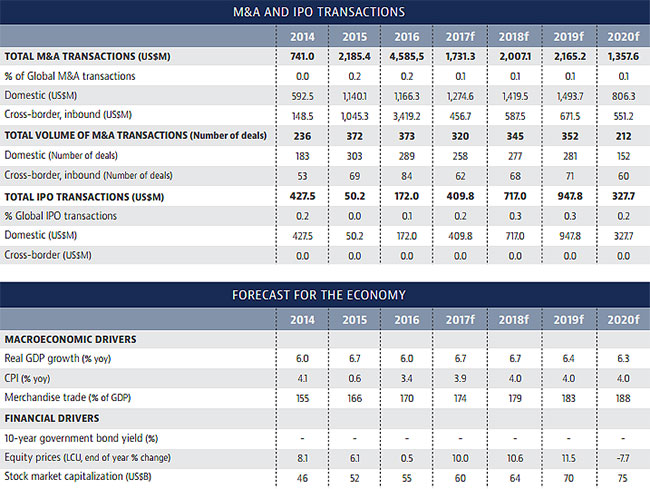

The country forecast for Vietnam, part of the second Global Transactions Forecast issued by Baker McKenzie in association with Oxford Economics on January 16, put the number at $456.7 million, compared to 2016’s $3.4 billion.

But Seck Yee Chung, head of Baker McKenzie’s M&A practice in Vietnam, noted that a few looming deals set to occur in 2017 would lead to cross-border inbound M&A activity surpassing the $1 billion mark for a third consecutive year.

"2016 was a big year for inbound cross-border M&A in Vietnam following the introduction of the new Investment Law and Enterprise Law in 2015. However, against the backdrop of geopolitical uncertainty in the US and the EU, we do not expect 2017 to live up to 2016’s $3.4 billion,” said Chung.

“Despite the unclear situation in the west, we expect continued M&A activity from Japan, Thailand, and other Asian investors, which will keep the market vibrant—especially should the agenda of state divestment from large-sized companies remain on track,” he added.

Total IPO transactions, however, are expected to increase from $172 million in 2016 to $409.8 million in 2017.

“In 2017, we will see more equitisation of SOEs and dilution of state control in a number of major state owned enterprises. We predict domestic IPO activity will increase to $410 million in 2017 from $172 million in 2016, then continue to rise to $717 million in 2018 and peak at $948 million in 2019,” said Oanh Nguyen, head of Baker Mackenzie’s Banking & Finance and Capital Markets practices in Vietnam.

The second Global Transactions Forecast reveals that the outlook for transactions, while uncertain in the short term due to geopolitical factors, is more optimistic in the years ahead.

The forecast is based on the anticipation that EU and UK officials will make progress in forging a new relationship in 2017, and that the new US administration adopts a pragmatic stance on international trade and immigration, and sets out plans for fiscal stimulus. Also assumed is that China continues to manage its transition to a mature economy and the Eurozone continues its recovery, as well as financial markets continuing to hit new highs and investor confidence rising.

Global M&A and IPO activity slowed sharply in 2016 amid heightened economic and political uncertainty. Volatility in the US stock market, growing concerns about China's economic slowdown, and dropping oil and commodity prices caused dealmakers to be more cautious. These concerns were compounded by the UK's vote to leave the EU and the US presidential election.

"We expect this environment of uncertainty to continue at least for the first quarter of this year, so the forecast predicts deal-making to drop slightly in 2017 to $2.5 trillion from the $2.8 trillion in 2016 as global investors wait for the UK-EU relationship and the new US administration's policies on trade and investment to crystallise,” said Michael DeFranco, global head of M&A at Baker McKenzie.

Regarding IPO, the forecast predicts global IPO activity to rise modestly in 2017 from a weak 2016 and bounce back in 2018 and 2019 as companies that had postponed their listings return to the public markets.

| RELATED CONTENTS: | |

| M&A in banking sector perking up for 2017 | |

| Retail, property deals dominate M&A market in 2016 | |

| 2016’s top 5 largest M&A deals in Vietnam | |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Mobile Version

Mobile Version