Impressive growth can be built upon

|

| Paulo Medas, division chief and mission chief for Vietnam (left), and Fei Han, senior economist at the International Monetary Fund |

Vietnam’s economic performance has been impressive in the last two decades, with economic growth averaging around 6.5 per cent per year and outpacing most peer countries in the world. Living standards have improved significantly and millions have been lifted out of poverty.

Per capita GDP rose to $4,324 in 2023 from below $500 in 2000. Extreme poverty has almost been eliminated and the poverty rate, based on the World Bank’s threshold for lower-middle-income countries, also dropped sharply to below 4 per cent from 66 per cent in 2002.

This impressive growth was largely fuelled by expanding exports and manufacturing, high foreign investment, and sound economic policies, as highlighted in the International Monetary Fund’s 2024 Vietnam Article IV Staff Report.

The export-led growth strategy, together with Vietnam’s young population and low labour costs in the last two decades, has attracted the substantial interest of foreign investors, with funding from abroad increasing ten-fold to $23 billion since 2000. These enabled Vietnam to become a global player in sectors such as electronics and textiles. Exports of goods and services soared to $380 billion in 2023, nearly 22 times the level at the turn of the century.

However, economic growth in Vietnam has become more volatile since the pandemic, reflecting the large external and domestic shocks. For example, exports as a share of GDP fell by more than 9 percentage points in 2023 and the exchange rate depreciated against the US dollar amid weakened external demand and higher global interest rates.

The external shocks, combined with disruptions in the domestic financial and real estate sectors following the failure of the fifth-largest bank and disruptions in the corporate bond market, led to a sharp economic slowdown in early 2023.

Despite such large shocks, the Vietnamese economy has shown strong resilience. A rapid economic recovery since late 2023 has gained strong momentum in 2024, thanks to a rebound in exports, resilient foreign investment, and supportive macroeconomic policies.

Increasing resilience

The large shocks of recent years highlight the importance of continuing to improve domestic institutions and policies to promote strong and stable economic growth. As the economy develops and becomes more complex and integrated in the world, economic institutions and policy frameworks need to be upgraded to increase resilience and continue to deliver high growth.

Accelerating the transition of the monetary policy framework towards an inflation targeting regime, with greater exchange rate flexibility, would be an important step forward. Modernising fiscal institutions and processes, including the budget and public investment management, is another key reform agenda. Ensuring a sound and robust banking system, as past experience in Vietnam and elsewhere shows, is another pillar for supporting the long-term economic growth.

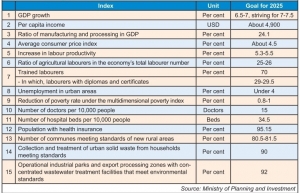

Ensuring macro-financial stability is critical to promoting economic growth, but further structural reforms will also be needed to achieve Vietnam’s development goals. The government set ambitious development goals for the next two decades, including reaching upper-middle-income status by 2035 and high-income status by 2045 - the centenary of national independence.

The latter requires sustaining annual economic growth at similar levels as in the past two decades, around 6-7 per cent per year. An ambitious climate goal of achieving net-zero emissions by 2050 was also established.

Raising productivity growth will be key for a successful growth strategy. Achieving the development goals will require further reforms, especially considering the headwinds from demographic and climate change. Vietnam has benefited from a young population, which helped keep labour costs relatively low.

However, the demographic trends are projected to reverse as the population ages and the share of workers in the total population shrinks. The implication is that demographic factors will become increasingly a drag on growth in the future. Vietnam is also among the countries most exposed to climate change, for example higher global temperatures, rising sea levels, and more frequent and intense extreme weather events, which could take a toll on growth and disproportionately impact the most vulnerable. It will be key to boost the low productivity growth of recent years.

A broader set of structural reforms are needed, especially by tackling the labour market inefficiencies, reducing the costs of doing business, and improving capital and resource allocation.

Vietnam’s labour market still suffers from high skill mismatches and excessive employee churning - partly underpinned by the high informality. For example, university-level and vocational-technical skills are under-supplied, and on-the-job skill acquisition does not fill the gap, as few firms provide formal training given the high churning.

These inefficiencies have contributed to the relatively low labour productivity growth and limited the technological and productivity spillovers from foreign firms operating locally to domestic ones.

Efforts to improve the functioning of the labour market, including further investing in human capital and improving vocational training, skill upgrading, and job matching, would increase labour market dynamism and labour productivity.

Sound fiscal planning

Further reducing the cost of doing business is also critical for boosting productivity. Improving business environment and economic governance can further increase Vietnam’s attractiveness for both foreign and domestic investors and firms. It will be important to improve administrative and legal processes, including by further progress in making laws and administrative processes clearer, simpler, and more transparent to provide greater legal certainty, reducing scope for excessive discretion by public officials, and limiting red tape.

Strengthening the functioning and governance of capital markets could also help reduce borrowing costs and raise productivity and economic growth in the medium term. Well-functioning corporate bond and equity markets could facilitate the allocation of capital to the most productive firms. A modernised monetary policy framework can also help by phasing out distorted credit growth ceilings and interest rate controls.

Developing modern and efficient financial markets will also require reforming the government bond market to promote more market-determined rates and a diversified investor base. This would help attract more investors, promote a more financially sound public sector, and help reduce the borrowing cost for the private sector. Strengthening the debt enforcement and insolvency framework is also critical to a sound financial sector, including by helping banks deal efficiently with bad loans.

Boosting public infrastructure can also help increase productivity and medium-term economic growth, but will require ensuring a high quality of public investment and sound fiscal planning. There are still large infrastructure gaps in Vietnam, reflected by the high logistics costs compared to its regional peers.

Improving transport, digital, and IT infrastructure could help lower transportation costs, facilitate efficient movement of labour, goods and information, and reduce production constraints for the private sector. In this context, it will be important to have robust medium-term fiscal plans, and improve debt management, to fund the many investments over the medium term. Given the relatively low tax ratios in Vietnam, there is space to mobilise more tax revenues to help fund the many infrastructure and social needs.

Achieving ambitious climate goals will require accelerating the implementation of the government’s green agenda, including introducing a carbon market and boosting investment in resilient infrastructure. Scaling up investment in renewable energy will also be crucial to achieve both high and green growth.

With most of the investment envisaged to be funded by international partners and the private sector, including through green bonds, improving the business environment, and strengthening financial market regulations will be key.

| Economic growth surpassing targets Backed by a recovery in production and trade this year, Vietnam’s domestic economy is set to experience higher growth in 2024, driven by continued support for enterprises and individuals. |

| ADB revises Vietnam’s growth forecast upward for 2024 and 2025 Vietnam’s growth forecast for 2024 has been revised upward to 6.4 per cent from 6 per cent and from 6.6 per cent from 6.2 per cent for 2025, according to the Asian Development Bank (ADB). |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Citi economists project robust Vietnam economic growth in 2026 (February 14, 2026 | 18:00)

- Sustaining high growth must be balanced in stable manner (February 14, 2026 | 09:00)

- From 5G to 6G: how AI is shaping Vietnam’s path to digital leadership (February 13, 2026 | 10:59)

- Cooperation must align with Vietnam’s long-term ambitions (February 13, 2026 | 09:00)

- Need-to-know aspects ahead of AI law (February 13, 2026 | 08:00)

- Legalities to early operations for Vietnam’s IFC (February 11, 2026 | 12:17)

- Foreign-language trademarks gain traction in Vietnam (February 06, 2026 | 09:26)

- Offshore structuring and the Singapore holding route (February 02, 2026 | 10:39)

- Vietnam enters new development era: Russian scholar (January 25, 2026 | 10:08)

- 14th National Party Congress marks new era, expands Vietnam’s global role: Australian scholar (January 25, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version