Fund required to lower GMT impact

While the Ministry of Planning and Investment is urgently building the draft decree for establishing new investment support, aiming to issue it in the first half of the year, numerous foreign-invested enterprise (FIEs) associations have been contributing comments on the draft.

|

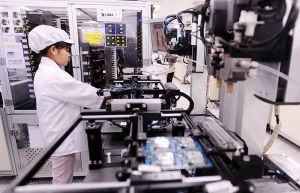

| Regulations are strict when it comes to high-tech areas of operation, photo Le Toan |

Hong Sun, chairman of the Korean Chamber of Commerce in Vietnam, said that criticism was largely based on the ambiguity of the support criteria, making it insufficient to draw in the interest of investors.

“Concerns are rising due to limitations on the eligibility for support, restricting it to investment amounts exceeding $500 million. This restriction may lead to a very limited number of eligible companies, and there is a significant concern that many FIEs may not benefit,” Sun said. “If the investment of these companies is deterred by these measures, it could have a negative impact on the business of all vendor companies that have entered Vietnam.”

Other FIEs also worried that with requirements of very high capital or turnover, only a few enterprises in the high-tech sector will be satisfied.

According to regulations, companies in high-tech parks must meet strict conditions, one of which is that their project’s areas of operation must fit very specific high-tech fields in which investment is encouraged. Anything produced in the parks must be listed as high-tech products, a representative of the Singaporean Chamber of Commerce Vietnam said. “Thus, these businesses should also be targeted for support in the high-tech sector,” he added.

Moreover, regarding scale of investment, the current draft decree looks at the enterprise-level or project-level scale. Research and development outputs are often applied to manufacturing of small but critical spare parts and components in terms of new technology or materials. Due to in-depth applications of each technology, tech companies often carry out investment activities under individual projects or subsidiaries, for each type of product with specific technologies.

“In fact, high-tech companies and projects are often small in scale. If we only look at the scale of each project or subsidiary, which is actually supervised by a larger corporation/investor, we will miss important strategic investors in technology,” said Nakajima Takeo, chief representative of the Japan External Trade Organization in Hanoi.

Currently, there are big names in technology implementing investment activities and long-term commitments in Vietnam, with many subsidiaries and ventures. The scale of investment of an entire corporation might reach over $500 million in total, which would be difficult to realise for a single project. It is suggested that support policies for investors in high technology should target large corporations in terms of their total scale of investment in Vietnam as a single entity.

“For example, if a corporation’s investment capital in Vietnam is from about $1 billion or higher, its high-tech projects will be eligible for investment support policies,” Takeo said. “This is important to draw in large and reputable corporations and encourages corporations to choose Vietnam as a destination of their direct projects in the high-tech sector.”

Gabor Fluit, former chairman of the European Chamber of Commerce in Vietnam, said that if expenditure-based incentives were to be introduced instead of income-based, such as tax holidays, there would be less impact from global minimum tax adoption on foreign investment.

“Examples that could be considered with reference to international practice include accelerated depreciation for machinery and equipment of the projects, and a double tax deduction of labour cost or research and development costs for encouraged ventures,” Fluit said. “Such incentives may increase the likelihood of generating additional investment as they directly target expenses.”

Several countries in the region have already issued and applied some new policies to cope with the global minimum tax and enhance competitiveness in calling foreign investment.

In February, to encourage companies to make sizable investments that bring substantive economic activities to Singapore, the city-state’s finance minister proposed refundable investment credit aimed at providing support to applicable entities, including all businesses with initiatives in key economic sectors and new growth areas.

The US government also recently allocated hundreds of billions of US dollars for sustainability programmes and climate financing, in addition to semiconductor manufacturing, through the enactment of three new laws.

According to the current draft decree on the investment support fund, the scope of target support recipients is narrow, targeting enterprises with investments in high technology whose investment is more than $500 million or whose revenue is over $830 million per year.

| New fund a solution to GMT concerns The Ministry of Planning and Investment has created a draft decree for a brand new investment support fund, but the scale of the projects and investors under the draft’s purview is the subject of intense debate and discussion. |

| Preferential support on cards for GMT alignment Green production and business, a favourable digital environment, high-quality human resources, and a suitable living environment are necessary factors for Vietnam in implementing the global minimum tax. |

| Big foreign groups await GMT direction Foreign enterprises are expecting the early implementation of the government’s new investment support fund so that they can boost investment in Vietnam amid the entry into force of the global minimum tax. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version