Franchising landscape in Vietnam transformed by global pandemic

|

| Sean T. Ngo CEO and co-founder VF Franchise Consulting |

The ADB anticipates that if the pandemic is contained successfully within the next two or three months, Vietnam’s economic growth should rebound to 6.8 per cent in 2020 and remain strong in the years thereafter.

Every industry has been affected and the virus has significantly damaged industries in hospitality and tourism, transportation, food and beverages (F&B), retail, cinemas, and other entertainment.

According to the Vietnam Tourism Advisory Council, the pandemic will result in an estimated loss of between $5.9 and $7 billion for the country’s tourism sector in the next three months. The total losses for the country is no doubt a multitude of this figure and remains to be seen.

Nascent franchise industry

According to Vietnam’s Ministry of Industry and Trade, 235 foreign brands have registered their trademarks as of April 12. In fact, there has not been one additional foreign brand that has been registered in 2020 as of this date. Still, this does not mean that there have not been additional franchises entering Vietnam, and it is more likely that the registrations are currently being reviewed and have not yet been granted.

For the last five years, Vietnam has experienced a 15-20 per cent growth in terms of new foreign and Vietnamese franchises entering the market. While we expect Vietnam to continue to grow and to recover in the latter half of this year, we estimate that this growth will slow to 8-12 per cent in 2020 and revert back to its normal 15-20 per cent growth in 2021 and beyond.

Many international franchisors continue to seek entry in Vietnam as the country is considered one of the most attractive markets in the ASEAN due to rising incomes and a rather young population. Since many businesses plan for long-term growth, reviewing new business opportunities like franchises is prudent even in these challenging times since the actual franchise partnership may be formalised months from when the discussions first start.

There continues to be no shortage of franchises, including F&B, education, services, and even hospitality chains wishing to enter Vietnam. They include Little Caesars Pizza, Delifrance, Mango Tree, Scholastic World of English, Helen Doron Kindergarten, Sureclean, and many others. Even hotel chains such as Marriott, Accor, Hilton, and others continue their search for the right franchise partner.

Our company, VF Franchise Consulting, continues to get many requests from franchisors who wish to enter Vietnam and many of the countries in the ASEAN. Our recent franchise webinars promoting franchises like those mentioned above, and upcoming webinars for Helen Doron Education Group and Little Caesars have been resounding successes and with 100 or more registrations for each of these webinars – with some attracting hundreds of registrations.

|

Going digital

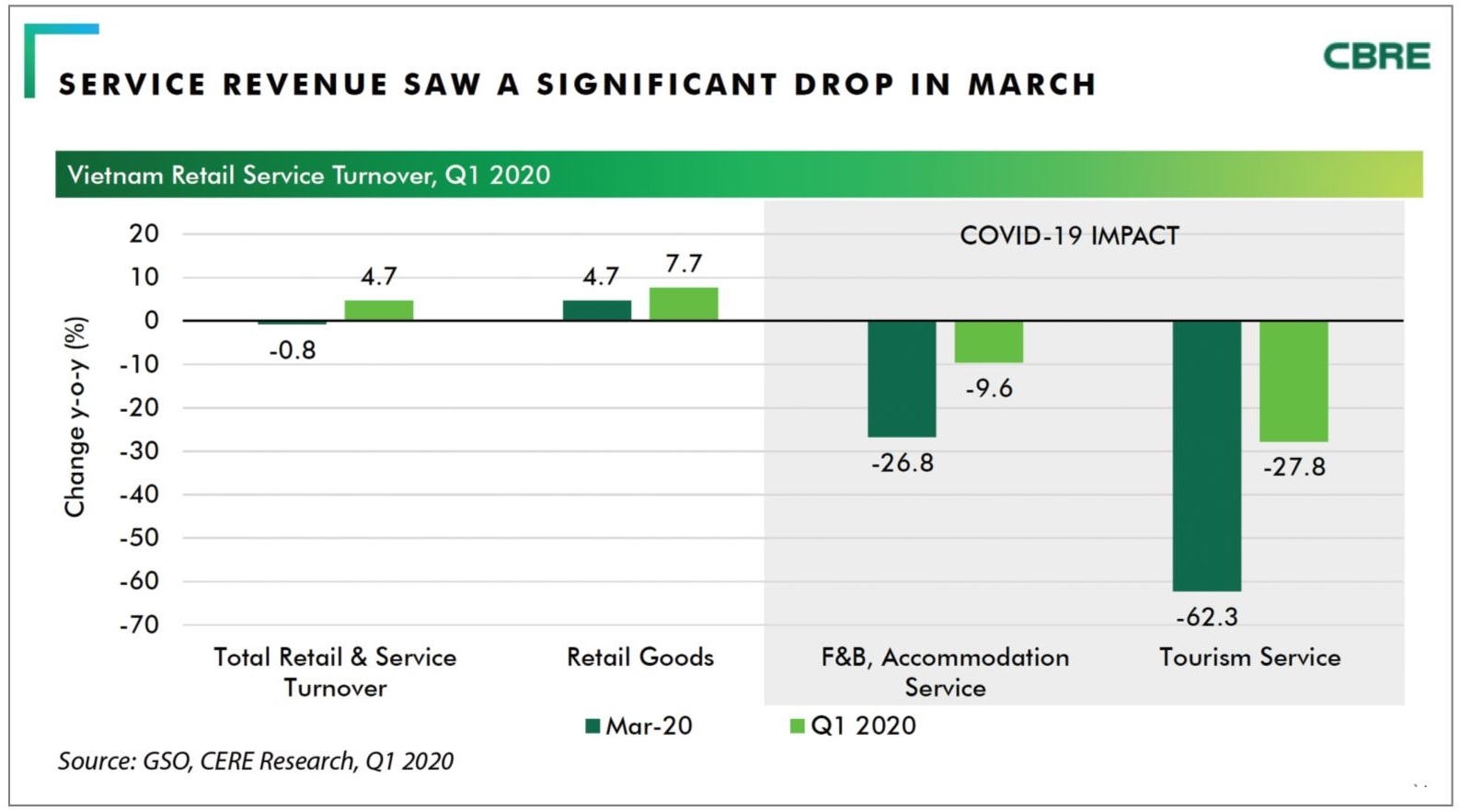

According to CBRE Research’s first-quarter 2020 report, the impact to F&B and tourism businesses have been significant. While the figures (see chart) are not surprising, we believe the impact will be worse in the coming months as local laws and social distancing practices take an even greater hold.

Some franchises have already begun to adapt to the new environment by shifting their efforts online and expediting their plans to move at least a part of their businesses online. F&B franchises have adapted particularly well thus far with a heavy focus on online deliveries. Even hotels and catering companies have taken their businesses online to mitigate the impact to their normal business operations.

Though online deliveries will not make up for the significant losses due to stores being closed, it has boomed in recent weeks as consumers stay put in their homes due to local laws and for fear of catching the deadly virus.

Major chains such as KFC, Pizza Hut, Texas Chicken, Lotteria, Highlands Coffee, Starbucks, and many others have closed their stores and now only offer delivery and takeaways. In fact, pizza deliveries have risen significantly as it has a very high acceptance rate in Vietnam and Asia.

Demand for food delivery drivers and workers have also increased as restaurants, cafés, and even food stalls are now crowded – not with customers but delivery drivers from GrabFood, Vietnammm, Eat.vn, and many others. Online deliveries are now more important than ever as the F&B industry’s sales have fallen across the board and can be anywhere from a drop of 50 to 100 per cent, depending on the business. Unfortunately, some will close doors permanently.

Force majeure event

By definition, a force majeure event refers to the occurrence of an event which is outside the reasonable control of a party and which prevents that party from performing its obligations under a contract. In the world of franchising, this would apply to both franchisees and franchisors.

There are a growing number of franchisees and franchisors that have been exploring possible ways to renegotiate existing franchise agreements due to the pandemic.

While the threshold to prove force majeure is high and lies with the claimant, some franchisors around the world have proactively responded without resorting to the courts, including reducing, deferring, or removing franchise royalties, ad funds, and other items – at least for a limited time.

In early March, Subway CEO John Chidsey told the chain’s 23,500 locations in the US that it will cut its royalty fees by 50 per cent for a limited time, down to 4 per cent. It also agreed to cancel the 4.5 per cent of revenue payments it collects from franchisees for the advertising budget for a limited time. McDonald’s, which temporarily closed its 13,850 US restaurants, is reportedly considering financial aid for franchisees in the form of rent deferrals.

Many landlords are now having to make the difficult decision to either lower, defer, or remove rent completely over the short-term in order to help their tenants survive this pandemic. Without tenants, landlords ultimately fail as well.

Closer to home, Vincom Retail JSC in March announced reserving VND300 billion ($13 million) to support tenants in its 79 retail centres throughout Vietnam. The funds are to be used to market to consumers more aggressively via attractive discounts and vouchers. This will still be challenging given current conditions.

Return to normalcy

While there have been and continue to be many difficulties that individuals and companies face, those that are able to weather this storm will likely recover well due to pent-up demand and possibly less competition, at least in the short-term.

Governments continue to do what they are already doing in Vietnam and globally – a combination of fiscal stimulus programmes for businesses and individuals as well as a vigilant policy of social distancing and better hygiene for all.

Individuals and companies must do their part and honour the social distancing laws and behave responsibly.

According to a recent report from VinaCapital, the Vietnamese government has proposed some additional fiscal stimulus measures, including direct payments to some individuals and subsidising electricity prices, which would bring the total amount of stimulus up to about 2.3 per cent of Vietnam’s GDP.

The fiscal response is expected to increase in the coming weeks and possibly months as the full impact of COVID-19 remains unclear. This is in line with what has happened in the past when the government spent over 5 per cent of GDP to boost the economy during the global financial crisis.

Finally, the impact of COVID-19 to businesses and franchises might be that it accelerates certain franchise trends that we have already seen in recent years.

One is e-commerce, capturing a fast-growing online delivery market while at the same time minimising the risk of other future pandemics. It is interesting to note that the health emergency has pushed companies to not only develop but implement their digital strategy nearly overnight - not senior management.

Another change is the increased awareness of health and hygiene - franchises and businesses that can alleviate these customer concerns will benefit greatly.

Finally, modern retail will continue to grow faster as traditional wet markets are seen as less safe, and the number of supermarkets and convenience stores continue to grow at an even faster pace to meet demand.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Mobile Version

Mobile Version