FPT’s triple-X transformation

FPT’s turn at the age of 30

One day before its 29th birthday, FPT Corporation (coded FPT) signed an agreement with its strategic investor Synnex Technology International from the US to finalise the capital divestment plan in FPT Trading and reduce the ownership ratio to only 48 per cent.

Not long ago, the group also approved the plan to sell a 30-per-cent stake in FPT Retail to two large investment funds, VinaCapital and Dragon Capital, by the end of the year, minimising its ownership to 45 per cent.

The divestments in both companies are expected to be completed this year. Apart from bringing unexpected remarkable profit gains, the withdrawal also opened a new era for FPT: at the age of 30, FPT has dramatically transformed from a corporation with major sources of income generated by the wholesale and retail segment to a pure technology corporation with main sources of revenue being software business, technology development, and telecommunications services.

A pure technology group

Founded in 1988, the development strategy of FPT initially focused on software business, technology development, and telecommunications services.

Considering the characteristics of the group’s operation process, despite being the largest technology corporation in Vietnam, more than half of FPT’s total revenue comes from the distribution and retail segment, making it a group specialising in “wholesale-retail.”

Though recent divestments from the distribution and retail arms have reduced FPT’s revenue as it is no longer merged with FPT Trading and FPT Retail, they signify a turning point for the group: FPT returns to its roots of a pure technology company.

Accordingly, FPT’s revenue structure will change significantly, as 95 per cent of revenue now comes from the telecom and technology segments. These are also the two biggest contributors to FPT’s long-term profit. This move has met the long-held expectations of shareholders and investors. The rest primarily comes from educational businesses, which are closely linked to software and human resource exports.

Profit margins are expected to double

According to the evaluations of certain securities companies, the biggest impact on FPT is that revenue may decline considerably from 2018. Also, there are factors that cannot be ignored, particularly performance indicators. These indexes are expected to significantly increase once they effectively reflect the true nature of a technology company.

Regarding the wholesale and retail sector, despite accounting for 60-70 per cent of FPT’s total annual sales, its proportion in total profits only makes up about 20 per cent due to low profit margins. In 2016, this segment yielded a gross profit margin of about 14 per cent, less than half of the 35.5 per cent ratio for software outsourcing.

Before the divestments, the technology and telecom sector accounted for 41 per cent of the total revenue, but brought 76 per cent of FPT’s total profit.

According to the calculations of securities companies, divestments from low margin areas, for example the distribution-retail segment, will help raise a more “realistic” profit margin, reflecting the true nature of a technology company.

|

| FPT’s pre-tax profit margin in 2016 |

| Note: The profit margin excluded retail and distribution activities (DB-RT) based on the assumption that FPT will not consolidate all the revenues from these two segments, and consolidate their profits in proportion to the ownership ratio after divestments. |

Breakthrough on horizon

Shortly after the group’s decision to withdraw capital in FPT Retail and FPT Trading, a series of securities companies have published several reports analysing and assessing the prospects of FPT, unanimously coming to positive conclusions.

Ho Chi Minh City Securities Corporation (HSC), in its newly published report, has recommended investors to buy FPT shares at an expected price of VND60,000 ($2.64) in the short term and VND65,000 ($2.86) in the long term, which are in proportion with the profit margins of 25 and 35 per cent.

According to HSC, FPT’s revenue may fall by 51 per cent in 2018 to about $1 billion, but the growth of pre-tax profit will remain positive. Motivation for growth comes from revenue and profit forecasts for software outsourcing and telecom services, which promise a growth rate of more than 20 per cent.

Similarly, Viet Capital Securities (VCSC) also predicted that divestments from FPT’s distribution and retail businesses will allow the company to focus on technology development and telecommunications services, turning these two sectors into a new growth engine.

VCSC forecasts that the Japanese market will continue to be a major source of growth for FPT’s software export activities in the future. Revenue from this market is forecast to grow by 30 per cent in 2017, thanks to continuous investments in manpower and increased workload. This sector is also expected to have the highest growth rate of nearly 18 per cent.

As the group’s revenue and profit will now be generated largely by the business of technology-telecommunications and properly invested technology projects, investors and partners are looking forward to seeing a more visible image of FPT as an international technology group in the future.

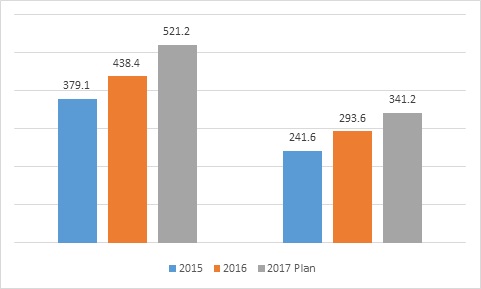

|

| FPT’s revenues in the technology and telecommunications sectors in 2015-2016 and the targets for 2017 (Unit: million USD) |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Mobile Version

Mobile Version