Finding the right keys to unlock the third quarter

|

| Hanoi’s 1,000 year birthday may provide a nice boost to consumer goods manufacturers’ bottom lines |

The trend implies that second quarter earnings were not surprising enough to support investors’ disbursement decisions. Usually, this is the lowest season for most companies in the year, new cash flows have yet to appear, reflecting difficulties in the expansionary monetary policies.

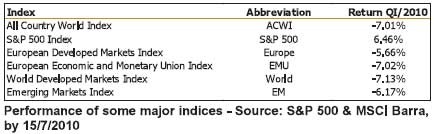

Observing the performances of the major global and Vietnamese indices, there are a number of noticeable differences.

Although there was a tight correlation between VN-Index and global indices in second quarter, there were unique characteristics in the local market.

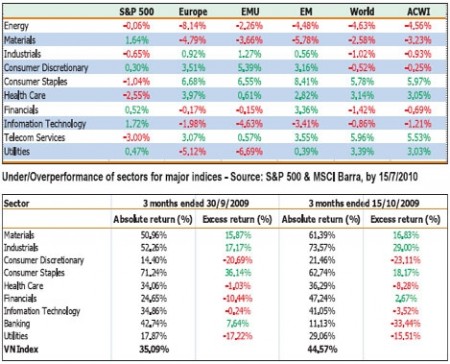

Investor seemed to not care about the cyclicality of sectors compared to global averages due to a number of reasons. This is due to the sovereign debt crisis having direct rather than psychological impacts on Vietnam’s macroeconomy and the uncertain European debt crisis. If the crisis lessened in the short term, its impact on Vietnam would not be significant. Otherwise, the local economy would not be able to avoid the recession as with other countries. From our observations, the performance in each sector was highly volatile. Under the stagnant market conditions during May and June, blue chips failed to hold leading positions, leaving penny stocks to step up. However, industry is normally not the first priority of choice when retail investors picked stocks. Based upon what is happening in the global and local economy, we might expect surprises in the third quarter. Compared to the corresponding period in 2009, a number of similarities and differences can be observed.

The third quarter will continue to be a peak business season for companies that serve the mid-autumn festival in September. Besides, the 1,000 year Thang Long anniversary will be a good opportunity for consumer goods, consumer services and tourism companies to enjoy a leap in revenue and profit performance.

The domestic macroeconomy is generally in a recovery and growth trend.

Differences

In the third quarter, we expect a loosening monetary outlook. In the first half of 2010, credit growth was only 10.5 per cent versus the 25 per cent target for the whole year. Since the fourth quarter is more sensitive to inflation pressures, the third quarter might be the centre for credit growth. Our concern is the high level interest rates, while the central bank’s effort to bring down banks’ rates since the end of July has experienced major difficulties. In order to channel money into the system, the State Bank might have to take a number of actions, such as modifying the rules for the use of open market cash and the use of other methods to bump money into the economy instead of the heavy use of the open market. The government might choose some strategic sectors that contribute strongly to the gross domestic product (GDP) growth and trade balance to allow further loan incentives and implement other administrative procedures to stimulate the money market.

Secondly, the underlying domestic and global economy in 2009 and 2010 (third quarter) is different. Why the local economic indicators have been on the right track (inflation, the exchange rate and GDP growth are all under control), the global economy is in a slow-down stage. Many developed countries such as the United States, European Union or Japan have lowered their growth prospects. The risk is that if the global economy gets worse, Vietnam sooner or later will be affected. In current market conditions, the recovery capability of the global economy will have a very strong impact on the investors’ decisions and the market performance in the third quarter. We are not as pessimistic about the global outlook as what happened in the second quarter, but do not expect a strong recovery in a short period of time as in 2009. Thirdly, the credit growth or money flows into the market in 2010 have been generally around 60-70 per cent of that in 2009 due to State Bank controls. Under stricter monetary expansion, the role of blue chips is going to reduce significantly compared to 2009. We are more confident in medium and small stocks with high growth potential. Also, sectors that have performance advantages in the third quarter are more favourable to investors. In the third quarter, we recommend that investors allocate their portfolios into sectors based on the three following criteria:

- Sectors that have seasonal characteristics in the third quarter with the capability of delivering high revenues and profits

- Sectors that enjoy the most benefits from an expansionary monetary policy. If the State Bank can works out solutions to quickly get money into the system in the third quarter, the stock market will pick up. Due to the smaller size of capital in 2010 compared to 2009, we believe that the State Bank might give priority over some specific sectors which can contribute more productively to GDP growth and balance the payment.

- Sectors that depend on the recovery speed of the world economy. Given the current situation, the globe in the third quarter does not promise a surge and still hides lots of risks. This is a key unknown that is mostly out of local investors’ hands and can change very quickly.

In the third quarter, sectors including consumer retail, consumer services and real estate are more likely to over perform in the VN-Index while industrials, materials and oil and gas’ performance will be highly correlated to the speed of the global economy’s recovery and local credit growth. On the other side, banking stocks are under the most stressful pressure due to the oversupply risk.

Investors can refer to the full report ‘Sector Allocation Strategies Quarter III’ of SME Securities for detailed information at www.smes.vn.

|

|

| Absolute and relative performance of sectors in Vietnam's market QIII/2009 - Source: SME |

By Nguyen Viet Hung - Director of Research & Investment, SME Securities

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version