Few property marriages

But efforts by the investors to sell their 50 per cent stakes in both properties have received a tepid reception in Vietnam’s moribund real estate market.

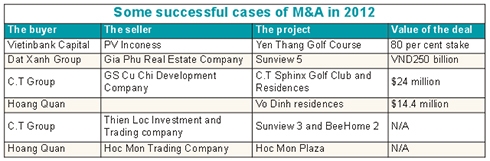

Neil MacGregor, managing director of Savills Vietnam, shares with VIR some of his thought on the merger and acquisition (M&A) activities in Vietnam during the past months and his expectations for 2013. Neil MacGregor, managing director of Savills Vietnam, shares with VIR some of his thought on the merger and acquisition (M&A) activities in Vietnam during the past months and his expectations for 2013.Has the shortage of capital investment in the real estate market prompted a wave of M&A as developers seek to overcome the difficult circumstances? The Vietnamese real estate market is critically short of capital and developers are therefore seeking new sources of finance. Whilst in the past many developers were reluctant to seek finance from the banks, projects are now leveraged at unprecedented levels. There are a number of options open to developers requiring capital to move their projects forward, none of which necessarily requires financing from banks, if the right partner can be found. These include an outright sale of the project to a third party, seeking a joint venture partner, en bloc sales of residential units, or strata sales of retail and office space. Many Vietnamese developers continue to hold large land banks and are able to sell development land to third parties in order to raise capital to finance the construction of other projects. How do you see prospects for real estate M&As next year? Given that the Vietnam real estate market is now in a downturn, caused by constrained bank financing, we can expect to see many more mergers and acquisitions in the real estate sector over the next 12 months in Vietnam. Although facing a number of challenges such as an immature legal framework, low market transparency, complicated licensing procedures and differences in price expectations; it is believed that the next few years will see the conclusion of a rising number of M&A deals. Whilst the lack of bank finance is troublesome for many in the real estate industry, it also creates an unprecedented period of opportunity for others, particularly those with cash. |

Representatives of VinaCapital, which is trying to divest its half ownership of the 365-room Sofitel Metropole and Vinaconex, which is selling its stake in the Splendora, have encountered frustration in what is clearly a buyer’s market, property experts say.

Son Nam Nguyen, managing partner from Vietnam Capital Partners, said that in the difficult financial circumstances, selling is a great way to get out – but what if there are no buyers?

“It is a buyer’s market and the buyers know that, so they are waiting for prices to fall further,” Son said. “As one of my friends put it, in general the number of sellers to buyers is 10 to 1 unless you have an excellent project. So it is not easy.”

In an recent interview with VIR, Phan Xuan Can, chairman of property consulting company SohoVietnam, said that at present, many investors are seeking to take over real estate projects, but that Sofitel Metropole and Splendora projects have too high a price tag to attract new bidders in the current difficult finance situation.

“The new investors would have to take a long time to have capital investment recovered, compared to pouring their money into smaller projects,” Can explained. Only a handful of domestic investors, perhaps numbering from three to five, would be interested in acquiring these stakes, Can said.

Apart from having enough financial resources, new investors would have to be experienced in project management and operation, and their capacity should be commensurate to the current foreign partner in the joint venture to avoid being disadvantaged. Can added that there were also few chances to take over those projects from foreign funds because they were also facing financial difficulties.

Meanwhile, Posco E&C - the foreign partner of Vinaconex in the Splendora - wants to have a domestic partner in the project, in order to be in charge of solving issues involved in Vietnam.

Some investors have been trying to pull out of the real estate market when they need money to focus on their core business.

According to Neil MacGregor, managing director of Savills Vietnam, there were unlikely to be local groups able to commit to large development projects at this time.

“However, we are seeing increased interest from private equity groups and pan Asian real estate funds who are interested to partnering with strong developers on well located projects in Hanoi and Ho Chi Minh City,” MacGregor said.

However, MacGregor added that due to current perceptions of development risk in the weak real estate market, investors are typically more interested in operating assets that are able to provide a strong cashflow.

Vinaconex’s desire to withdraw from the Splendora, Can commented, can be blamed on the difficulties during the past two years as the company scratched investment in many large projects, from cement production, construction to real estate.

“Therefore the company has to restructure its portfolio to focus more on its core construction business,” Can said.

The Splendora, Can said, compares favourably to many other projects offered in the overbuilt market, because the project has finished its land clearance and compensation, as well as the first phase of construction. The involvement of Posco E&C, a respected firm, is another advantage.

“Vinaconex for sure would not consider to withdraw from the project with the above advantages, unless it had financial difficulties,” Can commented.

Potential investors should carefully evaluate the current project’s status, Can said. “With the proportion of 50/50 divided between Vinaconex and Posco E&C it is very hard to negotiate any conflicts arising between two investors and this would be another problem Vinaconex is facing,” Can said.

He added that if Posco E&C wants to take the majority right in the joint venture, it should purchase 15 to 20 per cent from Vinaconex, or a new partner who wants to take over Vinaconex’s stakes would also need another percentage from Posco, in order to have major right in the joint venture.

“The withdrawal by a lot of investors has brought the opportunities to restructure the real estate market. This would allow capable investors to access and develop projects professionally,” he added.

VinaCapital, meanwhile, has received much benefit from the Sofitel Metropole hotel during the past year, but the company wants to divest as it restructures its portfolios. “For a fund management company, the M&A is a normal technique and it might see other better chance for investment and wants to have more capital to take new chance,” Can said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Tag:

Tag:

Mobile Version

Mobile Version