Exporters urged to proactively deal with drop in orders

In a report titled “Asian Economics Quarterly: Retooling factory Asia” released by HSBC on December 22, the bank warned about a hibernation period for Vietnamese exports.

Thanks to the high growth rate in the first nine months of 2022, Vietnam's textile and garment industry is still forecast to achieve its export target of $43 billion this year, despite the decline in orders in the fourth quarter. However, the industry also expects 2023 to be more difficult.

Le Tien Truong, chairman of the Vietnam National Textile and Garment Group (Vinatex), forecast that the situation in Q1 of 2023 will not be brighter than the previous quarter due to global economic fluctuations, growth slowdowns, and high inflation. Some common difficulties for businesses are a decrease in orders, low unit prices, and increasing pressure on import partners' requirements for green development and sustainable development.

“Many large importers reduced orders from tens of thousands of products previously to about 1,000 products, or even only hundreds of products per order. It shows a decrease in the purchasing power of textiles and garments as people in many countries tighten spending to cope with the impact of inflation and economic downturn," Truong said.

Ty Hung Co. Ltd, a Taiwanese leather shoemaker has laid off around 1,200 workers across its three factories in Ho Chi Minh City, Ben Tre, and Dong Thap, blaming it on a drying up of orders. A representative of Ty Hung said its export orders were cut by 70-80 per cent because the purchasing power of many items in Europe dropped sharply.

The company still has orders for 2023, but the quantity is not enough to maintain the operation of three factories. The representative said the company will re-consider its production coordination strategy if the business situation is better and there are enough orders for factories to operate.

|

Many experts believe that the difficult situation is forecasted to persist, and so businesses need to soon have a plan in place to respond over a long period of time, focusing on quickly reducing production costs and expanding the market, especially toward stable markets with little risk of inflation matter.

Truong of Vinatex Group encourages its businesses to keep persistent in participating in the global supply chain as businesses with strong positions are less susceptible to fluctuations than weaker ones. "Besides that, businesses need to steadfastly implement commitments to social responsibility and green production, which are considered non-financial factors, to choose more sustainable partners and meet the new requirements of the market in sustainable production," Truong said.

In particular, the textile, garment, and footwear sectors need to take advantage of even small orders, requiring high technology and high unit prices. Exploiting niche markets is also an important solution for businesses to consider.

The Vietnam Textile and Apparel Association has proposed two scenarios for garment and textile export growth in 2023. In the first scenario, if the market recovers in the second half of the year, the sector may touch an export turnover of $47-48 billion for the whole year. Meanwhile, in the second scenario, in the event of difficulties persisting for longer, the figure may be lower slightly to reach $45-46 billion.

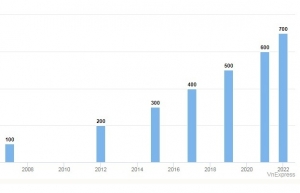

| Vietnam's export-import values reaches $700 billion The export-import turnover of Vietnam has reached $700 billion, the highest on record. |

| Vietnamese sugarcane gears up to cultivate new prospects In 2023, sugar exporters are likely to benefit from higher export prices and trade remedies imposed by Vietnam, leading to a possible renaissance of sugarcane plantation and sugar mills. |

| Increasing demand for rice points to favourable year Vietnam’s rice is in a good position to bolster its status as one of the major export goods of the nation on the back of global restrictions due to supply issues and trade tariffs, as well as changing trends in wheat-consuming countries. |

| Vietnam's global import-export ranking can be improved According to the General Department of Customs, Vietnam's import and export turnover reached 700 billion USD (As of mid-December 2022). It is notable that Vietnam surpassed developed countries in the region to rank second in ASEAN. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Spring Fair 2026 boosts domestic demand (March 02, 2026 | 16:30)

- Law on Investment takes effect (March 02, 2026 | 16:21)

- Ho Chi Minh City attracts nearly $980 million in FDI in early 2026 (March 02, 2026 | 10:57)

- Businesses bouncing back after turbulent year (February 27, 2026 | 16:42)

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

Tag:

Tag:

Mobile Version

Mobile Version