European business confidence gains traction in Vietnam

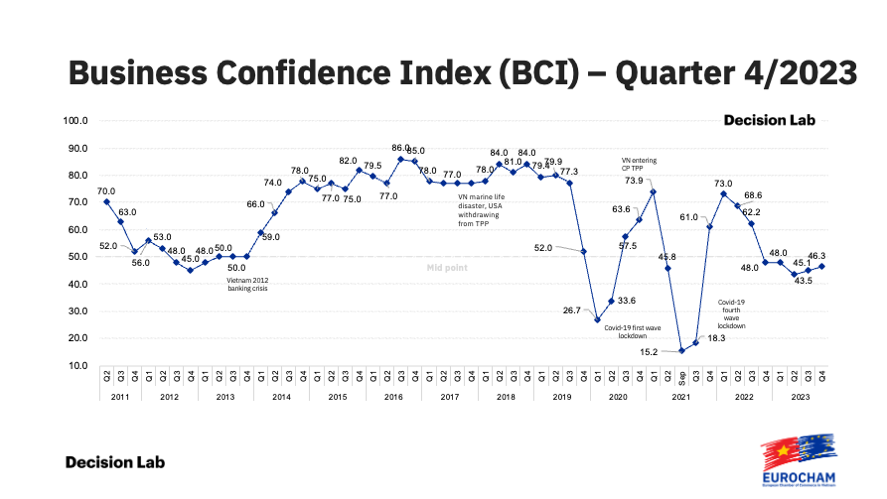

While this uptick signals gradual stabilisation, it’s vital to highlight that the BCI has remained below the midpoint since Q4 2022. Notably, over one-third of businesses anticipate underperformance, underlining a cautious outlook amid persistent market weaknesses.

EuroCham Chairman Gabor Fluit commented on this development saying, "There’s definitely a positive trend underway. While we still have a long way to go for a full recovery, businesses are feeling more hopeful.”

"The European business community is increasingly optimistic that the most challenging economic period is now behind us.'”

The quarterly BCI offers a snapshot of European investor sentiment in Vietnam. Conducted since 2011, it surveys a pool of over 1,400 EuroCham members across various sectors, delivering real-time observations into the ever-evolving dynamics of this vibrant Southeast Asian market.

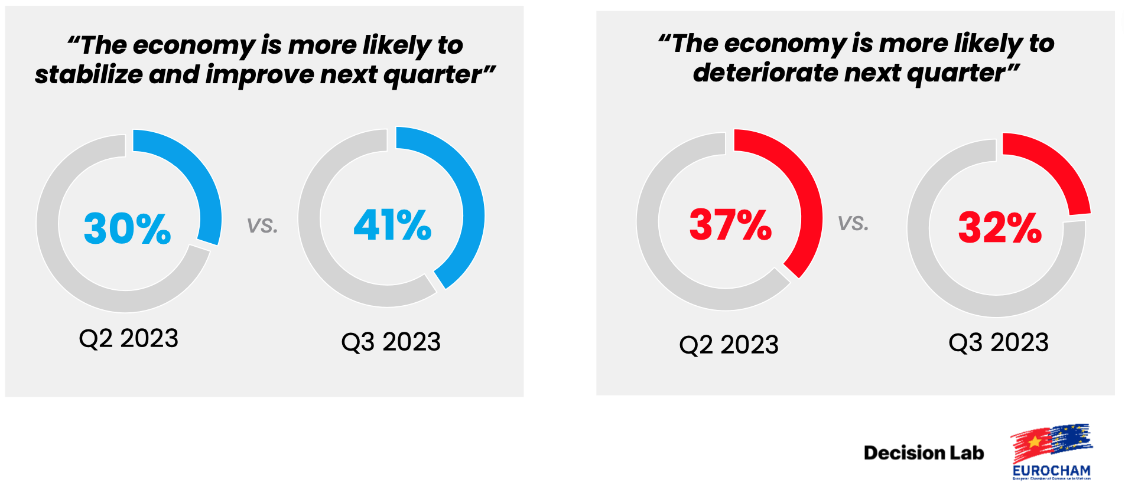

As Vietnam’s business landscape transitioned from Q3 to Q4 2023, subtle yet telling shifts in sentiment emerged. While there was a slight 2 percentage point dip in overall optimism for economic stability and growth, this was more than offset by a decline of 14 percentage points in expectations of an economic downturn.

The last quarter of 2023 saw a marked increase in satisfaction among businesses: firms confident in their current situation rose from 24 per cent in Q3 to 32 per cent in Q4. The outlook for Q1 2024 is also positive, with 29 per cent of businesses viewing their prospects as ‘excellent’ or ‘good’ – a sign of diminishing concerns, as extreme worries fell from 9 per cent to 5 per cent.

Looking ahead, Vietnam’s business sector is poised for growth. 31 per cent of companies plan to expand their workforce in Q1 2024, and 34 per cent intend to increase their investments, a clear uptick from 2023.

In Q4 2023, Vietnam’s investment hotspot status increased significantly. 62 per cent of those surveyed ranked Vietnam among their top 10 global investment destinations, with 17 per cent placing it at the very top. This endorsement is matched by 53 per cent of respondents anticipating increased foreign direct investment in Vietnam by the end of Q4.

The survey also highlights Vietnam’s strategic position in the ASEAN region. While only a small fraction (2 per cent) consider it an ‘industry leader’, 29 per cent rank it among the ‘top competitive countries’ in ASEAN. The total of 45 per cent view Vietnam as a competitor, albeit acknowledging certain challenges. This perspective emphasizes Vietnam’s growing influence and potential for advancement within ASEAN.

The survey sheds light on the European business community’s assessment of Vietnam’s workforce. The statistics reveal a complex picture: while 32 per cent of respondents recognise good proficiency in the workforce, this number indicates that a majority perceive room for improvement in skills and expertise. Similarly, the 24 per cent satisfaction rate regarding workforce availability suggests that while there is a pool of talent, it might not fully align with the specific requirements or scale desired by international businesses.

|

The findings also show that 40 per cent of respondents view Vietnam’s workforce as moderately proficient, indicating a blend of basic and intermediate skills. In addition, half rate the workforce’s availability as moderate, reflecting some challenges in finding qualified candidates. These results suggest that further development and training could enhance workforce proficiency and availability to better meet the demands of the global market.

Through the survey, valuable insights emerge on regulatory challenges perceived by the business community in Vietnam. Topping the list, a significant 52 per cent of respondents identify ‘administrative burdens and bureaucratic inefficiencies’ as one of the top three hurdles. Following this, 34 per cent of businesses highlight ‘unclear and variably interpreted rules and regulations’ as major challenges.

Securing necessary licences, permits, and approvals is a concern for 22 per cent of respondents. Moreover, 20 per cent cite the ‘lack of qualified local expertise in specialised fields.’ Furthermore, 19 per cent of companies find ‘visa regulations, work permits, and labour rules for foreign employees’ challenging, reflecting the complexities of managing an international workforce under the current legal system.

On the solutions front, the survey highlights key areas for improvement to boost Vietnam’s attractiveness for FDI. A notable 54 per cent of respondents call for ‘administrative and bureaucratic streamlining’, indicating that easing bureaucratic processes could significantly enhance the business environment. Additionally, 45 per cent stress the importance of ‘strengthening the legal system and regulatory environment,’ while 30 per cent see ‘infrastructure development, including roads, ports, and bridges,’ as essential for FDI attraction.

In 2023, the potential of the EU-Vietnam Free Trade Agreement (EVFTA) was increasingly realised by businesses. By Q4, a significant 27 per cent of companies reported experiencing ‘moderate’ to ‘significant’ benefits from the agreement, a marked increase from just 18 per cent in Q2. The foremost advantages of EVFTA were ‘tariff reductions or eliminations’ (42 per cent), ‘increased market access to Vietnam’ (27 per cent), and ‘improved competitiveness in Vietnam’ (25 per cent).

However, the survey also reveals challenges in fully leveraging the EVFTA’s potential. About 13 per cent of respondents cited ‘Uncertainty or lack of understanding of the agreement’ as a primary obstacle, suggesting a need for more clarity. Moreover, 9 per cent pointed to ‘Opaque and lengthy customs clearance procedures.’

“Confidence among the foreign business community in Vietnam is clearly on the rise. New data for 2023 support this. Last year, foreign direct investment reached $36.61 billion, jumping 32.1 per cent from 2022. This is a clear illustration of growing faith in Vietnam’s economy," Fluit said.

“While these figures are indeed promising, it’s crucial to maintain a cautious outlook. It’s noteworthy that the BCI still remains below the midpoint, and more than one-third of businesses still expect to underperform. Given the intense economic competition in the region, Vietnam should stay vigilant. It’s crucial for the country to keep refining its policies and strategies to draw and maintain European foreign direct investment."

| Vietnam remains attractive to European investors Vietnam remains appealing to European investors amidst the tough global situation, according to the latest report by The the European Chamber of Commerce in Vietnam. |

| Euro groups keen on smooth policy Businesses from the European Union are pinning high hopes on regulatory advances, such as with visa exemptions, so that they can unlock wide-ranging benefits through investment in Vietnam. |

| European investor-sentiment on Vietnam improves The European Chamber of Commerce Vietnam's (EuroCham) quarterly Business Confidence Index (BCI) has regained its upward trajectory in the third quarter of 2023, offering a glimmer of hope for Vietnamese businesses after a turbulent year. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Middle East conflict raises risks for global coffee market (March 10, 2026 | 15:07)

- Resilient Vietnam economy faces Middle East headwinds (March 10, 2026 | 12:16)

- Fuel import tariffs temporarily cut to zero until April 30 (March 10, 2026 | 10:53)

- TVS invests $4 million in Dat Bike (March 09, 2026 | 14:38)

- Women face growing workforce gap as AI reshapes industries (March 07, 2026 | 11:55)

- Over 64,000 businesses enter market in first two months (March 07, 2026 | 10:00)

- Honda Vietnam marks 30-year milestone (March 07, 2026 | 08:00)

- Palm oil perspectives from nutrition experts (March 06, 2026 | 09:00)

- Global surge in critical minerals stockpiling: a strategic edge for Vietnam (March 05, 2026 | 17:21)

- Iran war to modestly impact Vietnam (March 05, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version