E-commerce names going automated

In mid-July, SPX Express and Frasers Property Vietnam held a groundbreaking ceremony for an automated sorting centre in the southern province of Binh Duong with an investment of $30 million. Covering 10.6 hectares in the Binh Duong Premium Industrial Park, the facility boasts an advanced automatic sorting system with a processing capacity of over 2.5 million parcels per day.

|

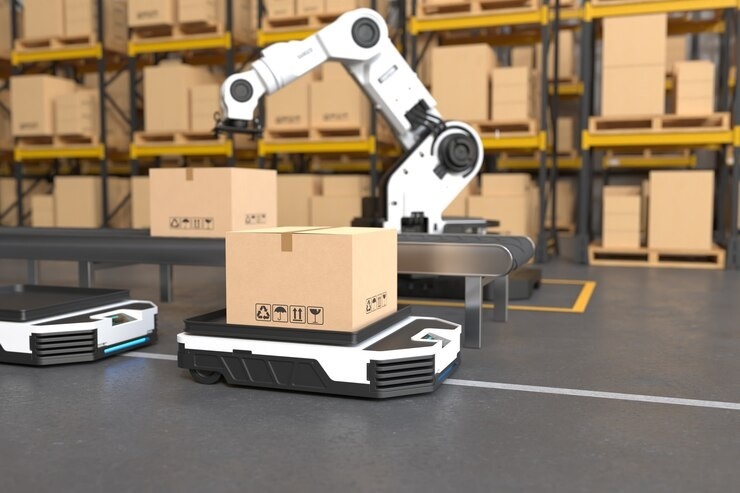

| E-commerce names going automated, illustration photo/ Source: freepik.com |

Scheduled for completion in 2025, the facility is set to be the most advanced automatic sorting centre for SPX in South Vietnam. The groundbreaking event follows the agreement signed between SPX and Frasers Property in March to strengthen the infrastructure network in the Vietnamese market.

Nguyen Kim Anh, director of SPX, highlighted the company’s key objectives for 2024. “In addition to strengthening the infrastructure network, we will continue to prioritise improving the customer experience by simplifying the process of handling customer support requests, shortening delivery times, and improving the quality and stability of services during seasonal peaks.”

A report released by Momentum Works in July revealed that Vietnam is one of the fastest-growing e-commerce markets in Southeast Asia, with gross merchandise value increases of 52.9 per cent on-year. Vietnam also overtook the Philippines as the third-largest e-commerce market in Southeast Asia in 2024.

According to Euromonitor and the Vietnam E-commerce Association, Vietnam’s e-commerce revenue is booming, with an estimated compound annual growth rate of 25 per cent to $39 billion across 2021-2026. For $1 billion of additional e-commerce sales, it would require an additional 93,000 square metres of logistic space. Following that, more than 2.2 million sq.m of additional e-commerce-dedicated logistic space is estimated to be required by 2026.

“The e-commerce warehousing sector has substantial growth potential due to the continuous rise in e-commerce. The growth rate in this sector is driven by increasing demand for fast and accurate delivery, as well as advancements in automation and robotics technology. Indeed, major industrial real estate businesses and e-commerce companies are actively investing and innovating to meet increasing demands and optimise operational efficiency,” said Cherry Tran, general manager of Pro-Invest Vietnam.

To meet the growing needs of the e-commerce sector, industrial real estate companies are actively investing in the development of warehousing projects. BW Industrial Development, a joint venture between Becamex IDC and Warburg Pincus, is an investor in the ready-built factory and warehouse market, with more than 50 projects and developing more than three million sq.m of factories/warehouses. BW Industrial plans to add 12 more projects in 2024 and build about 700,000-800,000sq.m of warehouses and factories each year.

Mapletree is also another major player in Vietnam’s warehousing market, with 922,000sq.m of net leasable area. The Singapore company has been aggressively expanding its warehouse portfolio in Vietnam, with mega logistic hubs in Bac Ninh, Hung Yen, and Binh Duong provinces. Another warehouse project with 198,000sq.m of net leasable area in Bac Ninh is slated to be completed in 2025.

In addition, industrial real estate companies are also building modern warehouses with state-of-the-art infrastructure and integrating new technologies. They offer high-tech warehouse leasing services to e-commerce companies, helping them save on investment costs and focus on their core business activities.

“E-commerce warehouses are increasingly adopting automation technology to enhance efficiency,” said Tran from Pro-Invest Vietnam. “Warehouse management systems that integrate AI and machine learning help manage inventory and optimise operational processes. Meanwhile, the use of robots for tasks such as sorting, packaging, and transporting goods within warehouses is becoming common. Robots can operate continuously without breaks, increasing order processing speed and reducing errors.”

Smart warehouses have also gained traction in Vietnam. Among them, sensors help monitor inventory status and environmental conditions in such warehouses, providing accurate information to adjust operational processes in real-time. Meanwhile, big data and predictive analytics help forecast demand and optimise inventory layout, improving efficiency and reducing costs, Tran added.

Along with industrial real estate companies, e-commerce companies like Tiki, Shopee, and Lazada have also stepped up their expansion and technology adoption amidst the e-commerce boom.

Specifically, Tiki is heavily investing in automation technology for its warehouses. The company utilises robotic systems and warehouse management software to enhance operational capabilities and quickly meet customer demands. It is also continually scaling up its warehouse network to meet growing demand and improve delivery speeds.

Similarly, Shopee has implemented automated warehouses with robotic systems to handle goods quickly and efficiently. This helps Shopee maintain a competitive edge in rapid delivery. At the same time, it is also investing in expanding its warehouse infrastructure and distribution systems to handle the increasing volume of orders.

Lazada also applies advanced technologies such as robots and AI to automate warehouse processes and optimise inventory management. By expanding its network of warehouses, Lazada strives to meet growing customer demands and enhance its delivery capabilities.

| Cainiao Vietnam to enhance supply chain with premium warehousing With the launch of premium warehouse facilities in strategic locations, Cainiao Vietnam, a subsidiary of Cainiao Network, the logistics arm of Alibaba Group, is contributing to the development of the logistics sector in Vietnam. |

| ITL Corporation commits $200 million to Vietnam's warehousing infrastructure ITL Corporation is set to invest approximately $200 million in warehousing infrastructure over the next five years, underscoring Vietnam's significance in their strategic expansion. |

| Cainiao PAT Logistics Park welcomes warehousing partner Mixue Cainiao Group, the logistics arm of Chinese e-commerce giant Alibaba Group, welcomed food and beverage company Mixue to its PAT Logistics Park in Vietnam’s southern province of Long An on March 18. |

| Foreign developers account for three-quarters of Vietnam's warehousing Foreign developers dominate the modern warehouse market in Vietnam, accounting for over 75 per cent of the market share by net leasable area (NLA) in 2023. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version