Dilemmas abound for Vietnamese coffee exporters trying to compete

|

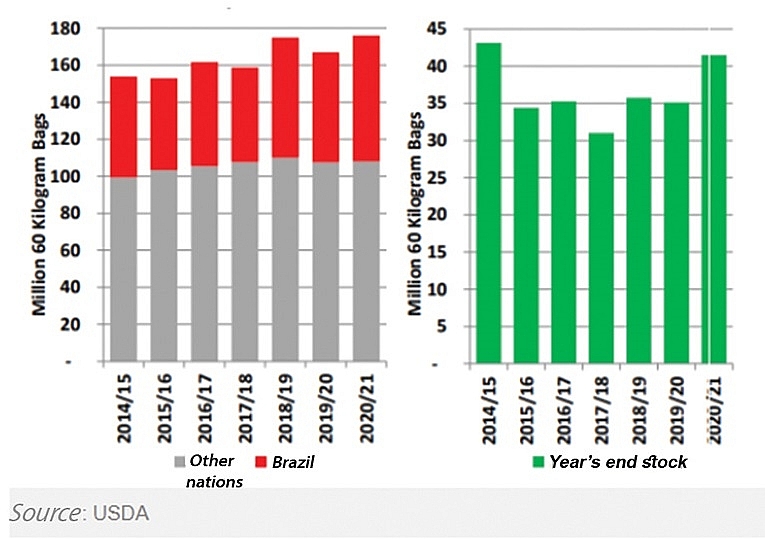

| Global output & Year’s end stock |

According to the Ministry of Agriculture and Rural Development’s Department for Agricultural Products Processing and Market Development (DAPP), coffee exports in July witnessed an on-year decrease in both price (0.1 per cent) and volume (0.6 per cent).

Since late April, the consecutive decline in export prices has significantly hurt Vietnam’s coffee exports, especially amid the resurgence of the pandemic. For example, as of late last week, the on-year price fall could be seen in the United Kingdom (24.6 per cent), and China (13.7 per cent). Vietnam’s average coffee export price hit $1,690 per tonne, down 0.9 per cent on-year.

Coffee material exporter Simexco Daklak is now suffering from a decline in export price, with the company’s promotion plans being delayed and its ambitious goal to become one of the leading suppliers of coffee materials for the world’s major coffee firms already hurt. “We produce and export coffee beans, but their prices are fixed by speculation funds in London and New York,” said Le Duc Huy, deputy general director of Simexco Daklak. “Trading with coffee means to take risks.”

Over a decade ago, Simexco Daklak changed its strategy from selling products to intermediaries to directly selling to global-scale coffee firms, in a bid to reduce risks and ensure profits.

Currently the company directly exports 50 per cent of its products to large firms like Lavazza, Nestlé, DEMB, Mondelez, and Ahold with an annual volume of over $100 million. It also still sells 40 per cent of products to intermediaries and 10 per cent to Vietnamese purchasers.

However, dilemmas persist as input prices have continuously been increasing. According to Huy, purchasing coffee materials from intermediary channels has led to a rise in transport costs, pushing up input prices and reducing enterprises’ competitiveness.

Currently, the average cost for material transportation from farmers to producers is $15 per tonne, accounting for 25 per cent of the export price, double than the average cost for exports of Simexco Daklak to the Japanese market.

|

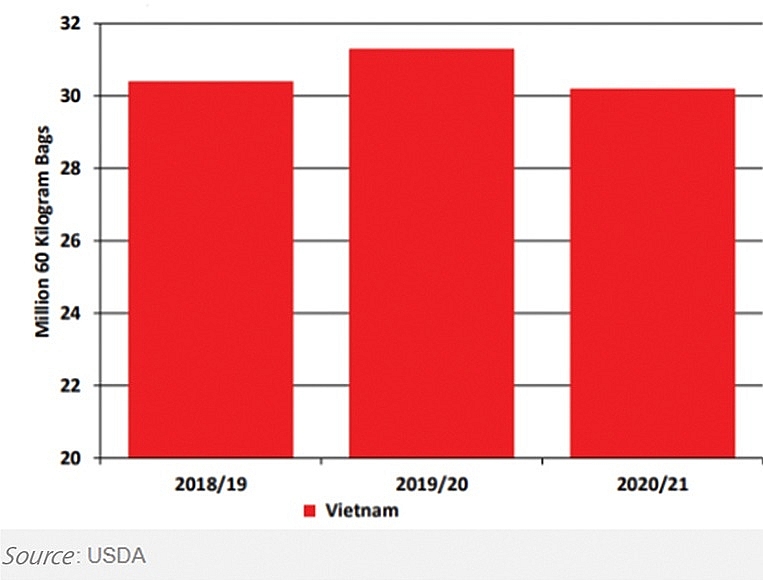

| Output of Vietnam |

The company’s 2020 revenues are expected to be negatively affected, especially when it has invested heavily into cultivating high-quality coffee trees under the standards of the US Department of Agriculture.

It installed modern processing lines in accordance with European standards, and forged cooperation with farmers to create large-scale coffee material areas in order to ensure an annual output of 30,000 tonnes of beans.

According to the DAPP, Vietnam reaped export turnover of $213 million for 120,000 tonnes in July, and $1.8 billion tonnes with 1.06 million tonnes for the first seven months of 2020 – down 0.1 per cent in volume and 0.6 per cent in export value on-year.

Amid the resurgence of COVID-19 in the country, it is expected that Vietnam may miss the set target of $3 billion in coffee export turnover this year due to an expected decline in export prices.

As per the Vietnam Coffee and Cocoa Association, the average price for exports in the 2019-2020 period has flung to a 10-year low, at times at $1,207 per tonnes of Robusta coffee, and 88 US cents per pound of Arabica.

Figures from Vietnam’s General Statistics Office showed that last year, Vietnam exported 1.61 million tonnes for $2.78 billion, down 13.9 per cent in volume and 21.2 per cent in value on-year.

In the first seven months of 2020, said the DAPP, the downtrend in coffee prices reflected a decline in global consumption caused by the pandemic and new supplies from Brazil, one of the largest coffee producers in the world.

In addition, coffee prices have also been influenced by the depreciation of the Brazilian real, which created new competition for Brazilian exporters in the global coffee market, and pressured the prices of global coffee including those of Vietnam.

Observers estimated that Vietnam’s exports in the 2019-2020 period reduced to 26.3 million 60-kg bags, lower than the previously-forecasted volume, due to price differences of Vietnamese coffee in the futures market, prompting importers to turn to buying from Brazil and Indonesia.

In addition, an increase of an extra VND600 (3 US cents) per kg of coffee domestically since late 2019 has also caused difficulties to businesses in purchasing coffee materials for exports.

Stalled export-import activities everywhere caused by the pandemic have forced many ports to close down, making it impossible for the coffee price to recover in the first seven months of this year.

In addition, COVID-19 has forced Vietnam’s key importers – the EU and the US – to slash coffee imports from the Southeast Asian nation due to feeble purchasing power caused by the governments’ policies of social distancing, with closure of a series of activities in coffee trading, cafés, and coffee firms.

Meanwhile, stockpiles remain at a high level, found at depots and warehouses of businesspeople, exporters, and farmers. Low prices mean farmers do not want to sell their products, making it difficult for businesspeople and exporters to ensure supplies.

Experts said that currently the average coffee price is hovering at $1,356 for January 2021 contracts. If stock prices – especially in the US market – reduce, speculators will shift to goods, notably coffee as it is one of the main trading floors together with gold and crude oil. With their rich budget, speculators may select floors with good liquidity, and coffee may be selected.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Themes: EVFTA & EVIPA

Related Contents

Latest News

More News

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

Mobile Version

Mobile Version