CapitaValue Homes targets 6,400 homes in Vietnam

According to the statement from CapitaLand Vietnam, Quoc Cuong Sai Gon (QCSG) owns an approximately 9,000-square metre piece of land in Binh Chanh district, Ho Chi Minh City.

QCSG has received the investment certificate from the Department of Planning and Investment of Ho Chi Minh City to develop the land. It intends to develop the land into approximately 800 value homes and CapitaValue Homes will lead the development.

This development with the total cost VND906 billion ($43.7 milllion) will be CapitaValue Homes’ fourth value homes project, bringing its pipeline to a total of over 4,200 value homes in Asia.

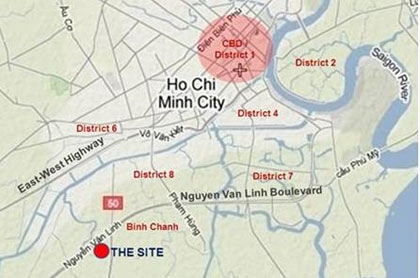

Located in Binh Chanh district, a new urban area of Ho Chi Minh City with well-established amenities and infrastructure, the land is about 10 kilometres or 45 minutes away from Ho Chi Minh City’s Central Business District. The land enjoys direct access to Nguyen Van Linh boulevard and is easily accessible to the newly urbanised district 7 as well as the National Highway 1A.

The cash consideration of VND121.2 billion ($5.8 million) for CapitaValue Homes’ acquisition of the 65 per cent stake in QCSG was arrived at on a willing-buyer willing-seller basis, taking into account.

Among other factors, the net tangible assets of QCSG of VND186.5 billion ($9 million) based on the management accounts as at 30 May 2011. The remaining stake in QCSG is held by Quoc Cuong Gia Lai JSC (30 per cent) and Gach Do Co Ltd (5 per cent).

The project is CapitaLand’s third value homes development and its seventh residential development in Vietnam. Overall in Vietnam, CapitaLand has a residential portfolio of over 6,400 units across seven residential developments in Ho Chi Minh City and Hanoi.

Chen Lian Pang, CEO of CapitaValue Homes Limited, said that given the rapid urbanisation and rising home prices in the major cities in Vietnam, CapitaLand’s value homes would be timely to meet the housing needs of the mass market homebuyers who are seeking for good value homes.

“We will build homes that are value for money and at the same time, cater to the essential needs and affordability of the Professionals, Managers, Executives and Technicians (PMETs) who aspire to live in a vibrant living community that enjoys basic communal facilities as well as good transportation connectivity and proximity to the city centres,” Pang.

Nguyen Thi Nhu Loan, chairwoman and general director of Quoc Cuong Gia Lai JSC, said: “We are pleased to partner CapitaLand, one of Asia’s largest real estate companies, and be part of this long-term endeavour which will bring in significant value for customers without compromising quality”.

“With CapitaLand’s extensive experience and excellent international track record in real estate development, project management and real estate financial services, we are certain that our first partnership will meet the needs of the mass market homebuyers whose priority is to purchase a home that has both value and functionality,” said Loan.

Vietnamis CapitaLand Group’s fourth pillar of growth in addition to its core markets of China, Singapore and Australia.

Currently, the group’s presence in Vietnam is in Ho Chi Minh City, Hanoi, Haiphong and Danang, in both the residential and serviced residence sectors. Its wholly-owned serviced residence business unit, The Ascott Limited, has over 1,300 apartment units in nine properties across the four major cities, making it the largest international serviced residence owner-operator in Vietnam.

CapitaLand said it would continue to explore opportunities in other real estate sectors such as mixed developments and shopping malls in Vietnam.

Quoc Cuong Gia Lai JSC (QCGL) was listed on Ho Chi Minh Stock Exchange in August 2010 with total owner’s equity capital of VND1.21 trillion ($62.5 million).

The company was established in 1994 as a wood processor. In 2008, it ventured into real estate development and now it derives 90 per cent of its revenue and profits from residential projects in Vietnam’s major cities. The group also has interests in hydropower and rubber plantations which have generated stable income for company since 2012.

QCGL has five subsidiaries in which it possesses over 50 per cent of the total shares, and four associate companies which QCGL holds from 20 per cent to 50 per cent of total shares. QCGL’s main catalyst is the Phuoc Kien high-end waterfront development, which has the potential to be developed into 1.1 million square metres of gross floor area.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Mobile Version

Mobile Version