Building a reliable corporate bond market

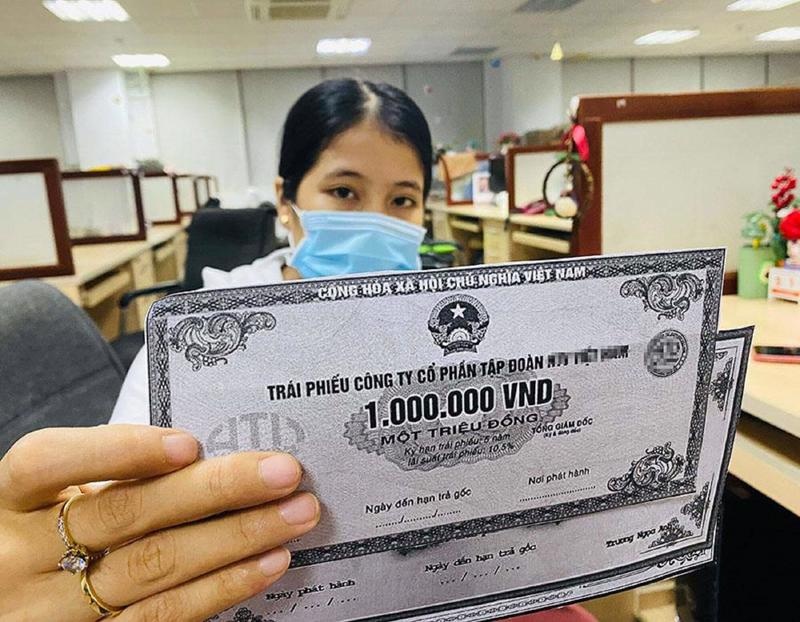

Since its establishment, Vietnam's capital market – including the corporate bond market – has grown rapidly in terms of scale and the range of available products, with quick liquidity contributing to the mobilisation of financial resources.

|

However, the size of Vietnam's corporate bond market is still quite modest. Currently, the outstanding debt of the corporate bond market stands at about 15 per cent of GDP, but the country's financial strategy aims for this to reach 20 per cent by 2025 and at least 25 per cent by 2030.

The capital market at the end of the first quarter of 2022, including the bond and stock market, had a capitalisation rate of 134.5 per cent of GDP. Stocks alone reached 94 per cent, corporate bonds hit 16.4 per cent, and the government bond market was 23 per cent. Thus, the capital market is taking up the same proportion as outstanding bank credit (almost $490 billion and equivalent to 132 per cent of GDP).

At the time of reaching 16.4 per cent of GDP, many experts and investors expected the corporate bond market to gradually replace and reduce the burden on the bank credit market – which is still the country's largest source of funding.

However, over the past two years, the bond market has faltered as it has been pressured by a number of market fluctuations and drops in investor confidence due to legal incidents and inaccurate media reports on some bond issuers. At the same time, the inspection and supervision focused on the purpose of bond issuance also led to concerns from both issuers and service providers.

This has had a significant impact on the market, even causing investors to lose confidence in corporate bonds, which are inherently transparent and safe. If this problem continues for a long time, it will be a burden on the financial resources that are vital to support the economy. The decline in capital mobilisation through the corporate bond market is increasing the pressure on the liquidity of many businesses.

Within the framework of the 5th Vietnam Economic Forum co-chaired by the Central Economic Commission and the government, Nguyen Quang Thuan, chairman of FiinRatings said that improving the transparency of corporate bond issuers is the key to restoring confidence and gradually opening up this important capital channel.

"The corporate bond channel needs to be restored to meet the capital needs of businesses, thereby supporting the target of high economic growth in 2023 and over the coming years," Thuan said.

When assessing the reliability of corporate bonds, it is important to consider the reputation of the issuer, which should be verified by international financial institutions. For example, in November 2022, Masan Group successfully raised a $600 million syndicated loan, despite the market fluctuations. It was underwritten and attracted 37 international financial institutions to oversubscribe.

|

As a leading retail consumer group in Vietnam, Masan has constantly attracted investment from prestigious international funds and credit institutions such as TPG, the Abu Dhabi National Investment Fund, and SeaTown Holdings ($350 million).

SK Group has continuously poured capital into Masan's retail segment ($750 million) to realise its online-offline integration strategy with the point-of-life platform.

Another notable investor is the group from Alibaba and Baring Private Equity Asia – one of the largest alternative investment funds in Asia ($400 million).

With solid financial capacity and strong cash flows, the total principal and interest paid by Masan in 2022 was $475 million. Of this, the total value of long-term loans paid early was $200 million. In November 2022, Masan successfully issued $72 million in bonds for professional investors that mature in August 2023.

| Masan posts net revenue of $3.25 billion in 2022 Masan Group Corporation posted net revenue of $3.25 billion in 2022, according to its unaudited management accounts for the fourth quarter and the financial year 2022. |

| Masan pumps $105 million into tech software group The Sherpa Co., Ltd., a subsidiary of Masan Group, has received an offshore registration certificate to carry out investment activities in Singapore. |

| Restoring confidence at centre of bond provisions The newly introduced alternatives to a corporate bond decree are envisaged to lay a foundation for issuers to address their difficulties, relieve liquidity strains, and gradually restore investor confidence. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version