Vietnam maturing into respected capital player

February 12, 2024 | 23:29

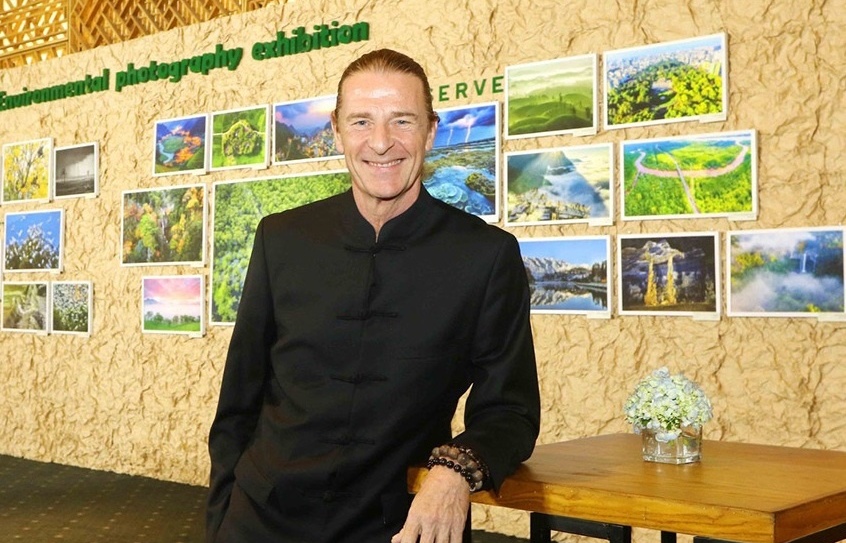

Dragon Capital is heavily investing in Vietnam and has been ever-present in the country for three decades. In an exclusive interview, chairman Dominic Scriven shared insights with VIR’s Le Luu into the evolving Vietnamese capital market.

Citi closes out the year as top equity house in Asia

January 19, 2024 | 11:48

To cap off a challenging year for all, Citigroup Inc. ended 2023 as the top equity house in Asia.

JB Securities strives to contribute to development of Vietnam's capital markets

September 22, 2023 | 08:00

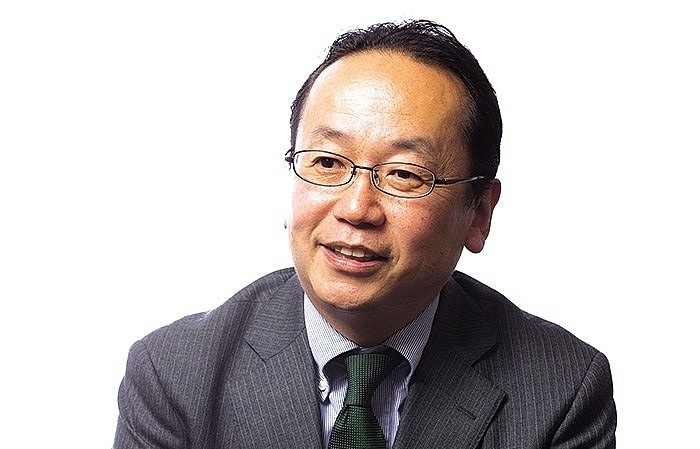

Kim Dooyoon, CEO of JBS Vietnam, spoke to VIR’s Le Luu about the newly launched JBS stockbrokerage platform Finavi, and the company's commitment to Vietnam.

Building a reliable corporate bond market

March 07, 2023 | 10:44

Many businesses will see their bonds mature in 2023, with about $6.5-8.7 billion being due.

Indonesia eyes 11 bln USD in capital market in 2023

January 04, 2023 | 11:15

Indonesia aims to raise 170 trillion rupiah (10.92 billion USD) in the capital market in 2023, including from initial public offerings and debt instruments, well below the amount raised in 2022, the country's financial regulator said on January 2.

Optimism urged for 2023 capital market prospects

November 30, 2022 | 10:28

Vietnam’s capital market has evolved at a pace that may have exceeded forecasts during the last decade, but investor education and environmental, social, and governance awareness are now pressing concerns. Dominic Scriven, chairman of Dragon Capital, discussed with VIR’s Luu Huong how to accelerate the adoption of such standards to promote sustainability and the position of Vietnam’s capital sector.

Liquidity remains under pressure despite stability

November 17, 2022 | 15:00

Information risks and liquidity pressure in the capital market have had a negative impact on the stock market, and is expected to last at least in the short term.

Legal basis for corporate bond issuance important for real estate sector

August 29, 2022 | 11:30

Building a solid and long-term legal basis for corporate bond issuance was an urgent solution to build a capital market for the real estate sector.

Deeper capital focus required for real estate arena

June 14, 2022 | 14:04

The domestic housing market is witnessing huge demand on the back of rapid urbanisation with a resounding population rate, but major difficulties remain such as legal procedures, land funds, and investment capital, leading to a mismatch between supply and demand.

PM requests developing transparent, sustainable capital market

April 22, 2022 | 20:53

How to develop a safe, transparent, effective, and sustainable capital market to ensure macro-economic stability is the focus of a conference held under the chair of Prime Minister Pham Minh Chinh on April 22.

Shinhan Securities Vietnam successfully arranges bond issuance for Gelex

June 18, 2020 | 11:43

The market has seen high volatilities from COVID-19 and financial and credit institutions are cautious in lending and investment, focusing on risk management.

Avoiding “creative destruction” to stave off future recessions

January 15, 2020 | 14:00

While some lessons have been learned from previous financial calamities, central banks are again in the spotlight as the global market attempts to fend off a repeat crisis. Steve Brice, chief investment strategist at Standard Chartered Bank, shares his view on global growth prospects for the capital market as a useful channel for investors to take as reference.

Securing the necessary funding for green growth

December 20, 2018 | 17:02

To mobilise capital for green growth, co-operation between all stakeholders need to be strengthened, with a particular view on the private sector.

Korean investors seek assurances

December 15, 2018 | 08:00

South Korean investors are seeking further funding opportunities in Vietnam’s capital market and are keen to dive in, providing the country further strengthens existing legal frameworks in order to support an efficient capital market.

Encouraging an investor-friendly framework for the capital market

December 12, 2018 | 16:21

The vibrant demand for private sector funding requires development of the capital-financial market in Vietnam. Konaka Tetsuo, the Japan International Cooperation Agency’s chief representative of the Vietnam office, talked with VIR’s Thanh Tung about the potential of this market, and how it can develop strongly.

1 2

Mobile Version

Mobile Version